Oracle 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

acquisition of PeopleSoft and represented a pre-acquisition contingency that we identified and assumed in

connection with our acquisition of PeopleSoft. We settled this lawsuit in October 2006, which was subsequent

to the purchase price allocation period, for approximately $98 million. Accordingly, we included the

difference between the amount accrued as of the end of the purchase price allocation period and the

settlement amount as a benefit to our consolidated statement of operations in fiscal 2007.

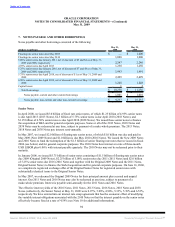

Non-Operating Income, net

Non-operating income, net consists primarily of interest income, net foreign currency exchange gains (losses),

the minority owners’ shares in the net profits of our majority-owned subsidiaries (Oracle Financial Services

Software Limited, formerly i-flex solutions limited, and Oracle Japan), and other income, net, including net

realized gains and losses related to all of our investments and net unrealized gains and losses related to the

small portion of our investment portfolio that we classify as trading.

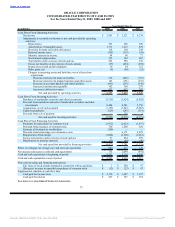

Year Ended May 31,

(in millions) 2009 2008 2007

Interest income $ 279 $ 337 $ 295

Foreign currency (losses) gains, net (55) 40 45

Minority interests in income (84) (60) (71)

Other income, net 3 67 86

Total non-operating income, net $ 143 $ 384 $ 355

Income Taxes

We account for income taxes in accordance with FASB Statement No. 109, Accounting for Income Taxes.

Deferred income taxes are recorded for the expected tax consequences of temporary differences between the

tax bases of assets and liabilities for financial reporting purposes and amounts recognized for income tax

purposes. We record a valuation allowance to reduce our deferred tax assets to the amount of future tax

benefit that is more likely than not to be realized.

On June 1, 2007, we adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes

(FIN 48), to account for our uncertain tax positions. FIN 48 contains a two-step approach to recognizing and

measuring uncertain tax positions taken or expected to be taken in a tax return. The first step is to determine if

the weight of available evidence indicates that it is more likely than not that the tax position will be sustained

in an audit, including resolution of any related appeals or litigation processes. The second step is to measure

the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. We

recognize interest and penalties related to uncertain tax positions in our provision for income taxes line of our

consolidated statements of operations.

Recent Accounting Pronouncements

Transfers of Financial Assets: In June 2009, the FASB issued Statement No. 166, Accounting for Transfers

of Financial Assets, an amendment of FASB Statement No. 140. Statement 166 eliminates the concept of a

“qualifying special-purpose entity” from Statement 140 and changes the requirements for derecognizing

financial assets. We will adopt Statement 166 in fiscal 2011 and are currently evaluating the impact of its

pending adoption on our consolidated financial statements.

Variable Interest Entities: In June 2009, the FASB issued Statement No. 167, Amendments to FASB

Interpretation No. 46(R). Statement 167 amends the evaluation criteria to identify the primary beneficiary of a

variable interest entity provided by FASB Interpretation No. 46(R), Consolidation of Variable Interest

Entities—An Interpretation of ARB No. 51. Additionally, Statement 167 requires ongoing reassessments of

whether an enterprise

85

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠