Oracle 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

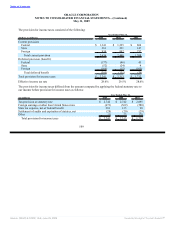

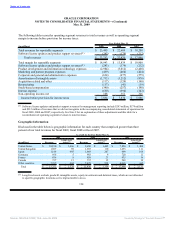

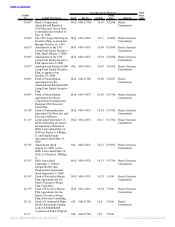

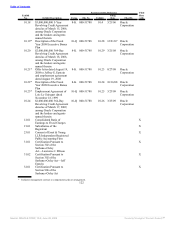

16. EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income for the period by the weighted average number

of common shares outstanding during the period. Diluted earnings per share is computed by dividing net

income for the period by the weighted average number of common shares outstanding during the period, plus

the dilutive effect of outstanding stock awards and shares issuable under the employee stock purchase plan

using the treasury stock method. The following table sets forth the computation of basic and diluted earnings

per share:

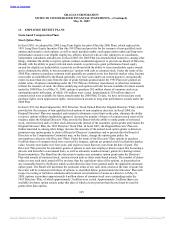

Year Ended May 31,

(in millions, except per share data) 2009 2008 2007

Net income $ 5,593 $ 5,521 $ 4,274

Weighted average common shares outstanding 5,070 5,133 5,170

Dilutive effect of employee stock plans 60 96 99

Dilutive weighted average common shares outstanding 5,130 5,229 5,269

Basic earnings per share $ 1.10 $ 1.08 $ 0.83

Diluted earnings per share $ 1.09 $ 1.06 $ 0.81

Shares subject to anti-dilutive stock options excluded from

calculation(1) 173 98 76

(1) These weighted shares relate to anti-dilutive stock options as calculated using the treasury stock method (described

above) and could be dilutive in the future. See Note 13 for information regarding the prices of our outstanding,

unexercised options.

17. LEGAL PROCEEDINGS

Securities Class Action

Stockholder class actions were filed in the United States District Court for the Northern District of California

against us and our Chief Executive Officer on and after March 9, 2001. Between March 2002 and March

2003, the court dismissed plaintiffs’ consolidated complaint, first amended complaint and a revised second

amended complaint. The last dismissal was with prejudice. On September 1, 2004, the United States Court of

Appeals for the Ninth Circuit reversed the dismissal order and remanded the case for further proceedings. The

revised second amended complaint named our Chief Executive Officer, our then Chief Financial Officer (who

currently is Chairman of our Board of Directors) and a former Executive Vice President as defendants. This

complaint was brought on behalf of purchasers of our stock during the period from December 14, 2000

through March 1, 2001. Plaintiffs alleged that the defendants made false and misleading statements about our

actual and expected financial performance and the performance of certain of our applications products, while

certain individual defendants were selling Oracle stock in violation of federal securities laws. Plaintiffs

further alleged that certain individual defendants sold Oracle stock while in possession of material non-public

information. Plaintiffs also allege that the defendants engaged in accounting violations. On July 26, 2007,

defendants filed a motion for summary judgment, and plaintiffs filed a motion for partial summary judgment

against all defendants and a motion for summary judgment against our Chief Executive Officer. On August 7,

2007, plaintiffs filed amended versions of these motions. On October 5, 2007, plaintiffs filed a motion

seeking a default judgment against defendants or various other sanctions because of defendants’ alleged

destruction of evidence. A hearing on all these motions was held on December 20, 2007. On April 7, 2008,

the case was reassigned to a new judge. On June 27, 2008, the court ordered supplemental briefing on

plaintiffs’ sanctions motion. On September 2, 2008, the court issued an order denying plaintiffs’ motion for

partial summary judgment against all defendants. The order also denied in part and granted in part plaintiffs’

motion for sanctions. The court denied plaintiffs’ request that judgment be entered in plaintiffs’ favor due to

the alleged destruction of evidence, and the court found that no sanctions were appropriate for several

categories of evidence. The court found that sanctions in the form of adverse inferences were appropriate for

two categories of evidence: e-mails from our Chief Executive Officer’s account, and materials that had been

115

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠