Oracle 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

particular agreement. Historically, payments made by us under these agreements have not had a material

effect on our results of operations, financial position, or cash flows.

Our software license agreements also generally include a warranty that our software products will

substantially operate as described in the applicable program documentation for a period of one year after

delivery. We also warrant that services we perform will be provided in a manner consistent with industry

standards for a period of 90 days from performance of the service. Warranty expense was not significant in

fiscal 2009, fiscal 2008 or fiscal 2007.

We occasionally are required, for various reasons, to enter into agreements with financial institutions that

provide letters of credit on our behalf to parties we conduct business with in ordinary course. Such

agreements have not had a material effect on our results of operations, financial position or cash flows.

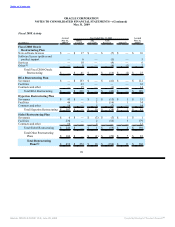

12. STOCKHOLDERS’ EQUITY

Stock Repurchases

Our Board of Directors has approved a program for us to repurchase shares of our common stock. On

October 20, 2008, we announced that our Board of Directors approved the expansion of our repurchase

program by $8.0 billion and as of May 31, 2009, approximately $6.3 billion was available for share

repurchases pursuant to our stock repurchase program. We repurchased 225.6 million shares for $4.0 billion

(including 0.6 million shares for $12 million that were repurchased but not settled), 97.3 million shares for

$2.0 billion and 233.5 million shares for $4.0 billion in fiscal 2009, 2008 and 2007, respectively.

Our stock repurchase authorization does not have an expiration date and the pace of our repurchase activity

will depend on factors such as our working capital needs, our cash requirements for acquisitions and dividend

payments, our debt repayment obligations (as described above) or repurchases of our debt, our stock price,

and economic and market conditions. Our stock repurchases may be effected from time to time through open

market purchases or pursuant to a Rule 10b5-1 plan. Our stock repurchase program may be accelerated,

suspended, delayed or discontinued at any time.

Dividends on Common Stock

In June 2009, our Board of Directors declared a quarterly cash dividend of $0.05 per share of outstanding

common stock payable on August 13, 2009 to stockholders of record as of the close of business on July 15,

2009. Future declarations of dividends and the establishment of future record and payment dates are subject to

the final determination of our Board of Directors.

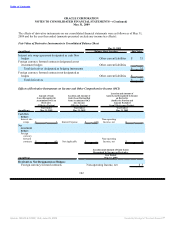

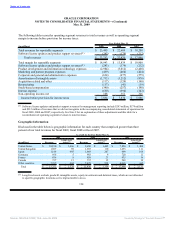

Accumulated Other Comprehensive Income

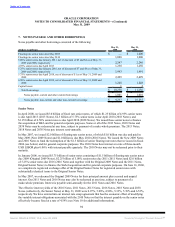

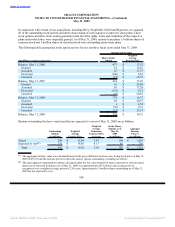

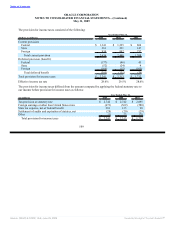

The following table summarizes, as of each balance sheet date, the components of our accumulated other

comprehensive income, net of income taxes (income tax effects were insignificant for all periods presented):

May 31,

(in millions) 2009 2008

Foreign currency translation gains, net $ 340 $ 690

Unrealized losses on derivative financial instruments, net (125) (86)

Unrealized gains on marketable securities, net 4 3

Unrealized (losses) gains on defined benefit plan, net (3) 11

Total accumulated other comprehensive income $ 216 $ 618

104

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠