Oracle 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of total revenues increased during fiscal 2009 as the growth rate of our total revenues exceeded the growth

rate of our total operating expenses. The growth rate in our total operating expenses was significantly

impacted by the growth rate in our intangible asset amortization, which was primarily due to intangible assets

acquired as a part of the BEA transaction at the end of fiscal 2008, and to a lesser extent, our restructuring

expenses growth.

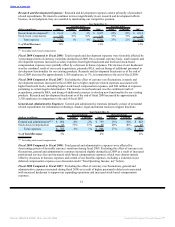

Fiscal 2008 Compared to Fiscal 2007: Total revenues increased in fiscal 2008 due to increased demand for

our products and services offerings and incremental revenues from our acquisitions. The growth in our total

revenues was positively affected by foreign currency rate fluctuations of 6 percentage points in fiscal 2008

due to the weakening of the U.S. Dollar relative to other major international currencies. Excluding the effect

of currency rate fluctuations, new software license revenues contributed 38% to the growth in total revenues,

software license updates and product support revenues contributed 45% and services revenues contributed

17%. Excluding the effect of currency rate fluctuations, the Americas contributed 50% to the increase in total

revenues, EMEA contributed 37% and Asia Pacific contributed 13%.

Total operating expenses were adversely affected by foreign currency rate fluctuations of 4 percentage points.

Excluding the effect of currency rate fluctuations, the increase in operating expenses was primarily due to

higher salary and employee benefits associated with increased headcount levels (primarily resulting from our

fiscal 2007 acquisitions, our acquisition of Agile Software Corporation in the first quarter of fiscal 2008 and,

to a lesser extent, our acquisition of BEA in the fourth quarter of fiscal 2008), as well as higher commissions

and bonuses associated with increased revenues, earnings and headcount levels. In addition, operating

expenses also increased in fiscal 2008 due to higher amortization of intangible assets and additional

stock-based compensation resulting from a higher fair value of grants (caused primarily by our higher stock

price) issued in fiscal 2008 and the acceleration of vesting of certain acquired stock awards upon employee

terminations pursuant to the original terms of those awards. Total operating expenses in fiscal 2007 were also

reduced by a $52 million benefit as a result of a settlement of an acquired legal contingency from PeopleSoft

for less than the amount accrued as of the end of the purchase price allocation period. The increases in

operating expenses during fiscal 2008 were partially offset by a $57 million gain on property sale and a

$127 million reduction of in-process research and development.

Total operating margin as a percentage of total revenues increased during fiscal 2008. The growth in our

operating margin in fiscal 2008 was the result of our revenue growth, both organic and from acquisitions,

which generally exceeded the growth rate of the majority of our expenses. In addition, our reported operating

margin growth was favorably affected by foreign currency rate fluctuations of 9 percentage points.

Supplemental Disclosure Related to Certain Charges and Gains

To supplement our consolidated financial information we believe the following information is helpful to an

overall understanding of our past financial performance and prospects for the future. You should review the

introduction under “Impact of Acquisitions” (above) for a discussion of the inherent limitations in comparing

pre- and post-acquisition information.

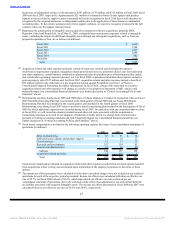

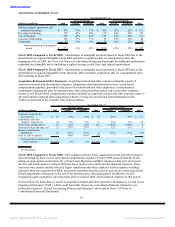

Our operating results include the following business combination accounting adjustments and expenses

related to acquisitions as well as certain other significant expense and income items:

Year Ended May 31,

(in millions) 2009 2008 2007

Support deferred revenues(1) $ 243 $ 179 $ 212

Amortization of intangible assets(2) 1,713 1,212 878

Acquisition related and other(3)(5) 117 124 140

Restructuring(4) 117 41 19

Stock-based compensation(5) 340 257 198

Income tax effect(6) (730) (535) (414)

$ 1,800 $ 1,278 $ 1,033

(1) In connection with purchase price allocations related to our acquisitions, we have estimated the fair values of the

support obligations assumed. Due to our application of business combination accounting rules, we did not recognize

software license updates and product support revenues related to support contracts that would have otherwise been

recorded by the acquired

42

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠