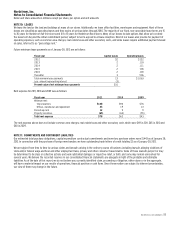

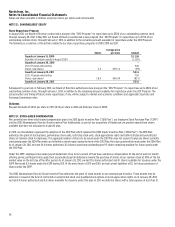

Nordstrom 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 61

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

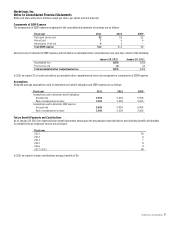

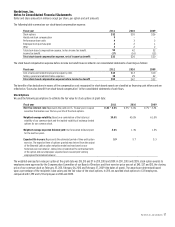

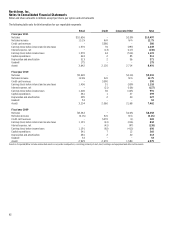

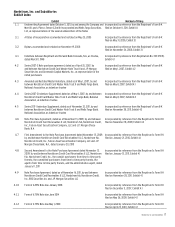

NOTE 15: EARNINGS PER SHARE

Earnings per basic share is computed using the weighted-average number of common shares outstanding during the year. Earnings per diluted share

uses the weighted-average number of common shares outstanding during the year plus dilutive common stock equivalents, primarily stock options.

The computation of earnings per share is as follows:

Options and other equity instruments totaling 3.9 shares in 2011, 6.1 shares in 2010 and 7.2 shares in 2009 were excluded from earnings per diluted

share because their impact was anti-dilutive.

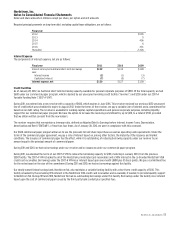

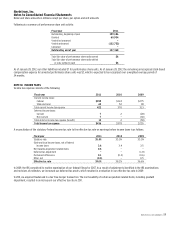

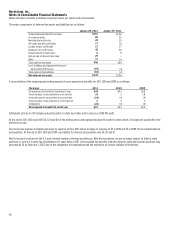

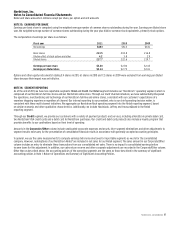

NOTE 16: SEGMENT REPORTING

As of the end of 2011, we have two reportable segments: Retail and Credit. Our Retail segment includes our “Nordstrom” operating segment, which is

composed of our Nordstrom full-line stores and our Nordstrom online store. Through our multi-channel initiatives, we have substantially integrated

the operations, merchandising and technology of our Nordstrom full-line and online stores, consistent with our customers’ expectations of a

seamless shopping experience regardless of channel. Our internal reporting to our president, who is our chief operating decision maker, is

consistent with these multi-channel initiatives. We aggregate our Nordstrom Rack operating segment into the Retail reporting segment, based

on similar economic and other qualitative characteristics. Additionally, we include HauteLook, Jeffrey and treasure&bond in the Retail

reporting segment.

Through our Credit segment, we provide our customers with a variety of payment products and services, including a Nordstrom private label card,

two Nordstrom VISA credit cards and a debit card for Nordstrom purchases. Our credit and debit card products also include a loyalty program that

provides benefits to our cardholders based on their level of spending.

Amounts in the Corporate/Other column include unallocated corporate expenses and assets, inter-segment eliminations and other adjustments to

segment results necessary for the presentation of consolidated financial results in accordance with generally accepted accounting principles.

In general, we use the same measurements to compute earnings before income taxes for reportable segments as we do for the consolidated

company. However, redemptions of our Nordstrom Notes® are included in net sales for our Retail segment. The sales amount in our Corporate/Other

column includes an entry to eliminate these transactions from our consolidated net sales. There is no impact to consolidated earnings before

income taxes for this adjustment. In addition, our sales return reserve and other corporate adjustments are recorded in the Corporate/Other column.

Other than as described above, the accounting policies of the operating segments are the same as those described in the summary of significant

accounting policies in Note 1: Nature of Operations and Summary of Significant Accounting Policies.

Fiscal year 2011 2010 2009

Net earnings $683 $613 $441

Basic shares 213.5 218.8 216.8

Dilutive effect of stock options and other 4.2 3.8 2.9

Diluted shares 217.7 222.6 219.7

Earnings per basic share $3.20 $2.80 $2.03

Earnings per diluted share $3.14 $2.75 $2.01