Nordstrom 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 43

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

Rent

We recognize minimum rent expense, net of landlord reimbursements, on a straight-line basis over the minimum lease term from the time that we

control the leased property. For leases that contain predetermined, fixed escalations of the minimum rent, we recognize the rent expense on a

straight-line basis and record the difference between the rent expense and the rent payable as a deferred credit. Contingent rental payments,

typically based on a percentage of sales, are recognized in rent expense when payment of the contingent rent is probable.

We receive incentives from landlords to construct stores in certain developments. These property incentives are recorded as a deferred credit and

recognized as a reduction of rent expense on a straight-line basis over the lease term. At the end of 2011 and 2010, the deferred credit balance was $556

and $553.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of compensation and benefit costs (other than those included in buying and

occupancy costs), advertising, shipping and handling costs, bad debt expense related to our credit card operations and other miscellaneous

expenses.

Advertising

Advertising production costs for Internet, magazines, store events and other media are expensed the first time the advertisement is run. Total

advertising expenses, net of vendor allowances, of $128, $114 and $85 in 2011, 2010 and 2009 were included in selling, general and administrative

expenses.

Vendor Allowances

We receive allowances from merchandise vendors for cosmetic selling expenses, purchase price adjustments, cooperative advertising programs and

various other expenses. Allowances for cosmetic selling expenses are recorded in selling, general and administrative expenses as a reduction of the

related costs when incurred. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been earned and the

related merchandise has been sold. Allowances for cooperative advertising and promotion programs and other expenses are recorded in selling,

general and administrative expenses as a reduction of the related costs when incurred. Any allowances in excess of actual costs incurred that are

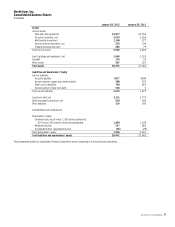

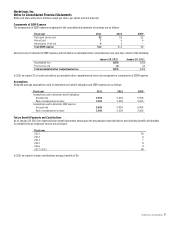

included in selling, general and administrative expenses are recorded as a reduction of cost of sales. Vendor allowances earned are as follows:

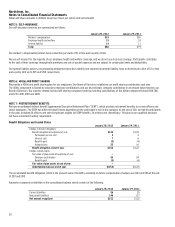

Fiscal year 2011 2010 2009

Cosmetic selling expenses $128 $118 $106

Purchase price adjustments 108 96 91

Cooperative advertising and promotion 78 67 63

Other 2 2 2

Total vendor allowances $316 $283 $262

Shipping and Handling Costs

Our shipping and handling costs include payments to third-party shippers and costs to hold, move and prepare merchandise for shipment. These

costs do not include in-bound freight to our distribution centers, which we include in the cost of our inventory. Shipping and handling costs of $178,

$133 and $103 in 2011, 2010 and 2009 were included in selling, general and administrative expenses.

Loyalty Program

Customers who use our Nordstrom private label credit or debit card or our Nordstrom VISA credit cards can participate in the Nordstrom Fashion

Rewards® program through which customers accumulate points based on their level of spending. Upon reaching a certain threshold, customers

receive Nordstrom Notes®, which can be redeemed for goods or services in our stores and online. Starting in January 2012, all Fashion Rewards

customers receive a credit for complimentary alterations and a personal triple points day, in addition to early access to sales events. As part of

these changes, Nordstrom Rack is also now included with all bonus points events and the spend requirements for customers to achieve our two

highest benefit levels have been lowered. With increased spending, they can receive additional amounts of these benefits as well as access to

exclusive fashion and shopping events.

We estimate the net cost of Nordstrom Notes that will be issued and redeemed, and record this cost as rewards points are accumulated. These costs,

as well as complimentary alterations, are recorded in cost of sales given that we provide customers with products and services for these rewards.

Other costs of the loyalty program, including shipping and fashion events, are recorded in selling, general and administrative expenses.

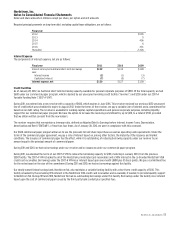

Stock-Based Compensation

We recognize stock-based compensation expense related to stock options at their estimated grant date fair value, recorded on a straight-line basis over

the requisite service period. The total compensation expense is reduced by estimated forfeitures expected to occur over the vesting period of the award.

We estimate the grant date fair value of stock options using the Binomial Lattice option valuation model. Stock-based compensation expense also

includes amounts related to HauteLook stock compensation, performance share units and our Employee Stock Purchase Plan, based on their fair values

as of the end of each reporting period.