Nordstrom 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

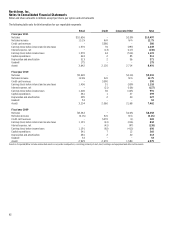

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

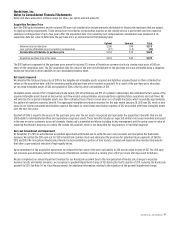

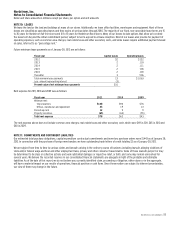

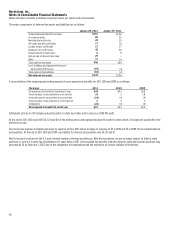

NOTE 9: FAIR VALUE MEASUREMENTS

We disclose our financial assets that are measured at fair value in our consolidated balance sheets on a recurring basis, by level within the fair value

hierarchy as defined by applicable accounting standards:

Level 1: Quoted market prices in active markets for identical assets or liabilities

Level 2: Other observable market-based inputs or unobservable inputs that are corroborated by market data

Level 3: Unobservable inputs that cannot be corroborated by market data that reflect the reporting entity’s own assumptions

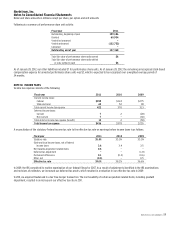

Interest Rate Swap

The estimated fair value of our interest rate swap was a $25 asset as of January 29, 2011. In January 2012, we sold our interest rate swap. During 2011,

before the sale of our swap, we estimated the fair value of our interest rate swap based upon observable market-based inputs for identical or

comparable arrangements from reputable third-party brokers, adjusted for credit risk. As such, these were considered Level 2 measurements. For

more information regarding the sale of the swap, see Note 1: Nature of Operations and Summary of Significant Accounting Policies and Note 8: Debt

and Credit Facilities.

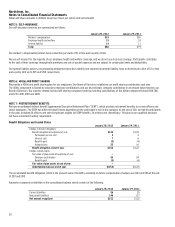

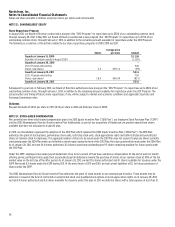

HauteLook Earn-out

During 2011, we recorded a liability for the fair value of our HauteLook earn-out. We estimated the fair value of the HauteLook earn-out liability using

a valuation model based on our expectations of HauteLook’s future performance, estimates of volatility around those expectations and the risk-

adjusted discount rate. As such, this was considered a Level 3 fair value measurement. On November 23, 2011, we settled the earn-out provisions

as part of our acquisition agreement amendment with HauteLook. For more information regarding the amendment and provisions, see Note 2:

HauteLook. As of January 28, 2012, there is no remaining liability related to the earn-out. Prior to the acquisition of HauteLook in March 2011,

we did not have any Level 3 fair value measurements.

The following table provides a reconciliation between the beginning and ending balances of our HauteLook earn-out liability for the year ended

January 28, 2012:

January 28, 2012

Balance at beginning of year -

Acquisition of HauteLook $42

Change in fair value of HauteLook earn–out liability1 (12)

Settlement (30)

Balance at end of year -

1Included in Retail selling, general and administrative expenses in the consolidated statement of earnings.

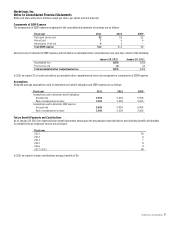

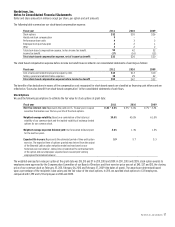

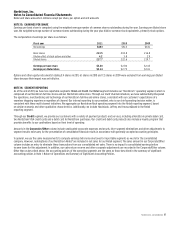

HauteLook Goodwill

As part of our annual impairment analysis for goodwill related to HauteLook, we wrote down the carrying value of $146 as of the acquisition date to

its implied fair value of $121, resulting in an impairment charge of $25 during the fourth quarter of 2011. The impairment charge is included in Retail

selling, general and administrative expenses in the consolidated statement of earnings. We estimated the fair value of our HauteLook goodwill using

an income approach and a market approach based on comparable public companies and acquisitions. These valuation approaches are based on

Level 3 inputs in the fair value hierarchy.

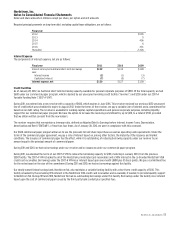

Non-Recurring

Financial instruments not measured at fair value on a recurring basis include cash and cash equivalents, accounts receivable, accounts payable and

debt. The carrying value of cash and cash equivalents, accounts receivable, net and accounts payable approximate fair value due to their short-term

nature. The estimated fair value of our long-term debt, including current maturities and the fair value adjustment from our effective fair value

hedge, was $4,152 as of January 28, 2012, compared with a carrying value of $3,647. We estimated the fair value of long-term debt using quoted

market prices of the same or similar issues.

We also measure certain non-financial assets at fair value on a nonrecurring basis, primarily long-lived tangible and intangible assets in connection

with periodic evaluations for potential impairment. See Note 1: Nature of Operations and Summary of Significant Accounting Policies.