Nordstrom 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

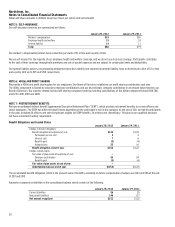

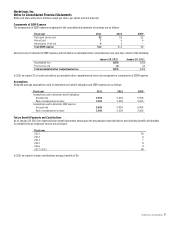

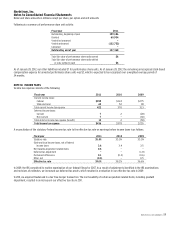

NOTE 8: DEBT AND CREDIT FACILITIES

Debt

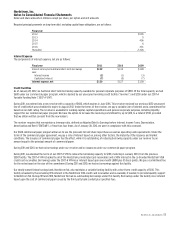

A summary of our long-term debt is as follows:

January 28, 2012 January 29, 2011

Secured

Series 2007–2 Class A Notes, one–month LIBOR plus 0.06%

per year, due April 2012 $454 $454

Series 2007–2 Class B Notes, one–month LIBOR plus 0.18%

per year, due April 2012 46 46

Series 2011–1 Class A Notes, 2.28%, due October 2016 325 –

Mortgage payable, 7.68%, due April 2020 51 55

Other 12 14

888 569

Unsecured

Senior notes, 6.75%, due June 2014, net of unamortized discount 399 399

Senior notes, 6.25%, due January 2018, net of unamortized discount 648 647

Senior notes, 4.75%, due May 2020, net of unamortized discount 498 498

Senior notes, 4.00%, due October 2021, net of unamortized discount 499 –

Senior debentures, 6.95%, due March 2028 300 300

Senior notes, 7.00%, due January 2038, net of unamortized discount 343 343

Other 72 25

2,759 2,212

Total long-term debt 3,647 2,781

Less: current portion (506) (6)

Total due beyond one year $3,141 $2,775

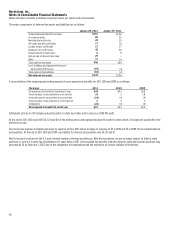

All of our Nordstrom private label card receivables and a 90% interest in our Nordstrom VISA credit card receivables serve as collateral for various

borrowings and credit facilities, including our Series 2007-2 Class A & B Notes, our Series 2011-1 Class A Notes and our Variable Funding Note facility

(“2007-A VFN”). Our mortgage payable is secured by an office building which had a net book value of $73 at the end of 2011.

During 2011, we issued $500 of senior unsecured notes at 4.00%, due October 2021. After deducting the original issue discount of $1, net proceeds

from the offering were $499. Additionally, we issued $325 of securitized Series 2011-1 Class A Notes at 2.28%, due October 2016.

In connection with the April 2012 maturity of our securitized Series 2007-2 Class A & B Notes totaling $500, we began making monthly cash deposits

into a restricted account in December 2011. As of January 28, 2012, we had accumulated $200, which is included in our consolidated balance sheet in

prepaid expense and other. In the first quarter of 2012, we expect to retire the Series 2007-2 Class A & B Notes with the accumulated restricted cash

upon maturity.

During 2011, we received proceeds of $72 from the sale of our interest rate swap agreements (collectively, the “swap”) with a $650 notional amount

maturing in 2018. Under the swap, we received a fixed rate of 6.25% and paid a variable rate based on one-month LIBOR plus a margin of 2.9%. As of

the sale date of the swap, the accumulated adjustment to our long-term debt was $72, which will be amortized as a reduction of interest expense

over the remaining life of the related debt. See Note 1: Nature of Operations and Summary of Significant Accounting Policies and Note 9: Fair Value

Measurements for additional information related to our swap.

Other secured debt as of January 28, 2012 consisted primarily of capital lease obligations. Other unsecured debt consisted primarily of the

adjustment to the long-term debt carrying value associated with our fair value hedge.