Nordstrom 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

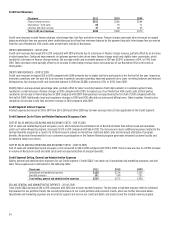

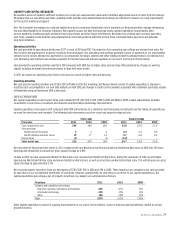

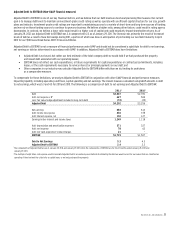

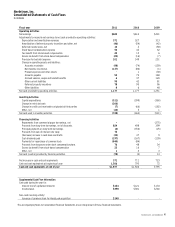

Contractual Obligations

The following table summarizes our contractual obligations and the expected effect on our liquidity and cash flows as of January 28, 2012. We expect

to fund these commitments primarily with operating cash flows generated in the normal course of business and credit available to us under existing

and potential future facilities.

Total

Less than

1 year 1–3 years 3–5 years

More than

5 years

Long–term debt $5,303 $674 $729 $614 $3,286

Capital lease obligations 13 2 4 4 3

Operating leases 1,063 122 229 206 506

Purchase obligations 1,443 1,273 141 28 1

Other long–term liabilities 261 - 45 29 187

Total $8,083 $2,071 $1,148 $881 $3,983

Included in the required debt repayments disclosed above are estimated total interest payments of $1,725 as of January 28, 2012, payable over the

remaining life of the debts.

The capital and operating lease obligations in the table above do not include payments for operating expenses that are required by most of our

lease agreements. Such expenses, which include common area charges, real estate taxes and other executory costs, totaled $69 in 2011, $65 in 2010

and $60 in 2009. In addition, some of our leases require additional rental payments based on a percentage of our sales, referred to as “percentage

rent.” Percentage rent, which is also excluded from the obligations in the table above, was $12 in 2011 and $9 in each of 2010 and 2009.

Purchase obligations primarily consist of purchase orders for unreceived goods or services and capital expenditure commitments.

Other long-term liabilities consist of workers’ compensation and general liability insurance reserves and postretirement benefits. The payment

amounts presented above were estimated based on historical payment trends. Other long-term liabilities not requiring cash payments, such as

deferred property incentives and deferred revenue, were excluded from the table above. Also excluded from the table above are unrecognized tax

benefits of $18, as we are unable to reasonably estimate the timing of future cash payments, if any, for these liabilities.

Off-Balance Sheet Arrangements

We enter into commitments to extend credit to customers for use at third parties through our Nordstrom VISA credit cards. The unused credit card

capacity available to our customers represents an off-balance sheet commitment. As of January 28, 2012, this unfunded commitment was $14,284.

We had no other off-balance sheet arrangements, other than operating leases entered into in the normal course of business, during 2011.

CRITICAL ACCOUNTING ESTIMATES

The preparation of our financial statements requires that we make estimates and judgments that affect the reported amounts of assets, liabilities,

revenues and expenses, and disclosure of contingent assets and liabilities. We base our estimates on historical experience and other assumptions

that we believe to be reasonable under the circumstances. Actual results may differ from these estimates. The following discussion highlights the

estimates we believe are critical and should be read in conjunction with the Notes to Consolidated Financial Statements in Item 8. Our management

has discussed the development and selection of these critical accounting estimates with the Audit Committee of our Board of Directors and the Audit

Committee has reviewed our disclosures that follow.

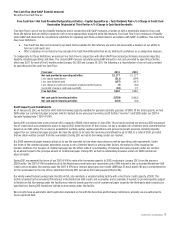

Allowance for Credit Losses

The allowance for credit losses reflects our best estimate of the losses inherent in our credit card receivables as of the balance sheet date, including

uncollectible finance charges and fees. We estimate such credit losses based on several factors, including historical aging and delinquency trends,

write-off experience, concentration and risk metrics, and general economic conditions.

We believe the allowance for credit losses is adequate to cover anticipated losses in our credit card receivables under current conditions; however,

significant deterioration in any of the factors mentioned above could materially change these expectations. During 2011, our delinquency and net

write-off results continued the improvements began in 2010. As a result of these improvements, we reduced our allowance for credit losses by $30

during 2011, from $145 to $115, and by $45 during 2010, from $190 to $145. A 10% change in our allowance for credit losses would have affected net

earnings by $7 for the fiscal year ended January 28, 2012.