Nordstrom 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

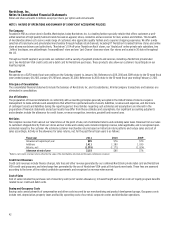

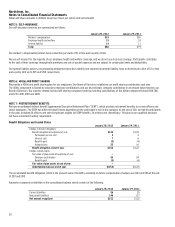

Derivatives

During 2011, we held interest rate swap agreements (collectively, the “swap”), which were intended to hedge our exposure to changes in the fair

value of our fixed-rate senior notes due in 2018 from interest rate risk. The swap was designated as a fully effective fair value hedge. As such, the

interest rate swap fair value was included in other assets or other liabilities on our consolidated balance sheet, with an offsetting adjustment to

the carrying value of our long-term debt (included in other unsecured debt). In the fourth quarter of 2011, we sold our swap. The accumulated

adjustments to the associated debt of $72 are being amortized as a reduction of interest expense over the remaining life of the debt. The cash flows

from the sale of our swap are treated as a financing activity within our consolidated statement of cash flows. See Note 8: Debt and Credit Facilities

and Note 9: Fair Value Measurements for additional information related to our swap.

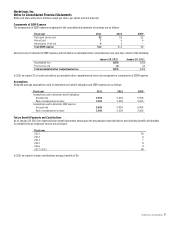

Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-04,

Amendments to Achieve

Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs

. This ASU clarifies existing fair value measurement and

disclosure requirements, amends certain fair value measurement principles and requires additional disclosures about fair value measurements.

We do not expect the provisions of this ASU, which are effective for us beginning with the first quarter of 2012, to have a material impact on our

consolidated financial statements.

In June 2011, the FASB issued ASU No. 2011-05,

Presentation of Comprehensive Income,

which was subsequently modified in December 2011 by ASU No.

2011-12,

Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive

Income in Accounting Standards Update No. 2011-05

. This ASU amends existing presentation and disclosure requirements concerning comprehensive

income, most significantly by requiring that comprehensive income be presented with net income in a continuous financial statement, or in a

separate but consecutive financial statement. The provisions of this ASU (as modified) are currently effective for us beginning with the first quarter

of 2012 and will result in changes to the presentation of comprehensive net earnings in our consolidated financial statements, but will have no effect

on the calculation of net earnings, comprehensive net earnings or earnings per share.

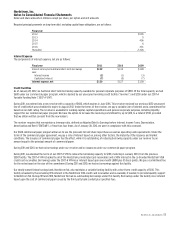

In September 2011, the FASB issued ASU No. 2011-08,

Testing for Goodwill Impairment

. This ASU amends existing guidance by permitting an entity to

first assess qualitative factors before calculating the fair value of a reporting unit in the two-step goodwill impairment test described in Accounting

Standards Codification Topic 350,

Intangibles – Goodwill and Other.

If it is determined that it is more likely than not that the fair value of a reporting

unit is not less than its carrying value, further testing is not needed. We do not expect the provisions of this ASU, which are effective for us beginning

with the first quarter of 2012, to have a material impact on our consolidated financial statements.

In December 2011, the FASB issued ASU No. 2011-11,

Disclosures about Offsetting Assets and Liabilities

. This ASU requires disclosures about offsetting

and related arrangements for financial instruments and derivative instruments, including gross and net information and evaluation of the effect of

netting arrangements on the statement of financial position. We do not expect the provisions of this ASU, which are effective for us beginning with

the first quarter of 2013, to have a material impact on our consolidated financial statements, as its requirements are disclosure-only in nature.

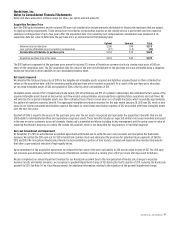

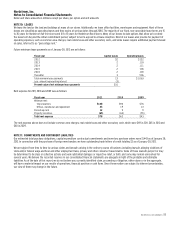

NOTE 2: HAUTELOOK

On March 23, 2011, we acquired 100% of the outstanding equity of HauteLook, Inc., an online private sale retailer offering limited-time sale events

on fashion and lifestyle brands. We believe the acquisition will enable us to participate in the fast-growing private sale marketplace and provide

a platform to increase innovation and speed in the way we serve customers across all channels. The terms of this acquisition included upfront

consideration of $180 in Nordstrom stock and an “earn-out” provision originally for up to $90 of additional consideration payable in Nordstrom stock

over a three-year period, subject to HauteLook’s performance in meeting certain targets for sales and earnings before interest, taxes, depreciation

and amortization (“EBITDA”). Subsequent to the acquisition, we amended the earn-out agreement and settled the 2011 earn-out for $30 in Nordstrom

common stock and eliminated the potential future payments of $60 for 2012 and 2013.

HauteLook’s results of operations are included in our consolidated results from the acquisition date, and were not material to our consolidated

results as of January 28, 2012. We have not presented pro forma results of operations for periods prior to the acquisition because HauteLook’s

results of operations were not material to our consolidated results for any previous period.