Nordstrom 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

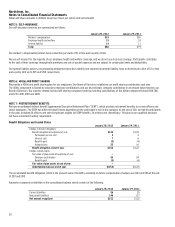

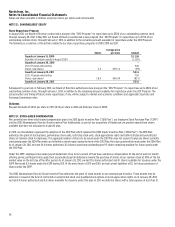

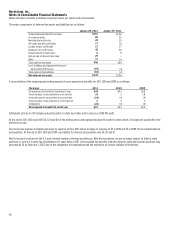

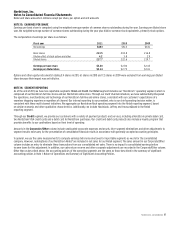

The major components of deferred tax assets and liabilities are as follows:

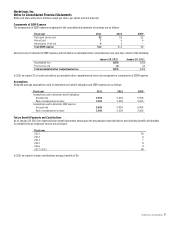

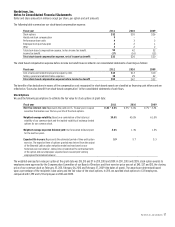

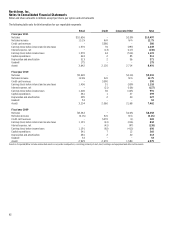

A reconciliation of the beginning and ending amount of unrecognized tax benefits for 2011, 2010 and 2009 is as follows:

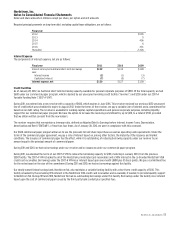

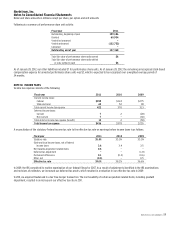

Settlement activity in 2011 includes amounts paid for a state tax matter and to close our 2008 IRS audit.

At the end of 2011, 2010 and 2009, $11, $21 and $18 of the ending gross unrecognized tax benefit relates to items which, if recognized, would affect the

effective tax rate.

Our income tax expense included a decrease to expense of $4 in 2011 and an increase to expense of $5 in 2010 and $2 in 2009 for tax-related interest

and penalties. At the end of 2011, 2010 and 2009, our liability for interest and penalties was $5, $11 and $7.

We file income tax returns in the U.S. and a limited number of foreign jurisdictions. With few exceptions, we are no longer subject to federal, state

and local, or non-U.S. income tax examinations for years before 2007. Unrecognized tax benefits related to federal, state and local tax positions may

decrease by $3 by February 2, 2013, due to the completion of examinations and the expiration of various statutes of limitations.

January 28, 2012 January 29, 2011

Compensation and benefits accruals $167

$146

Accrued expenses 86

75

Merchandise inventories 22

25

Gift cards and gift certificates 17

18

Loyalty reward certificates 17

17

Allowance for credit losses 45

56

Federal benefit of state taxes 6

9

Gain on sale of interest rate swap 29

-

Other 17

14

Total deferred tax assets 406

360

Land, buildings and equipment basis and

depreciation differences (63)

(4)

Total deferred tax liabilities (63)

(4)

Net deferred tax assets $343

$356

Fiscal year 2011 2010 2009

Unrecognized tax benefit at beginning of year $43 $43 $28

Gross increase to tax positions in prior periods 14 3 18

Gross decrease to tax positions in prior periods (14) (3) (3)

Gross increase to tax positions in current period 2 3 3

Settlements (24) (3) (3)

Unrecognized tax benefit at end of year $21 $43 $43