Nordstrom 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

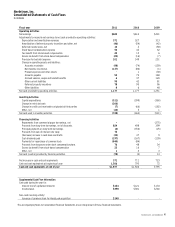

New Store Opening Costs

Non-capital expenditures associated with opening new stores, including marketing expenses, relocation expenses and temporary occupancy costs,

are charged to expense as incurred. These costs are included in both buying and occupancy costs and selling, general and administrative expenses

according to their nature as disclosed above.

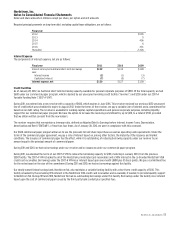

Gift Cards

We recognize revenue from the sale of gift cards when the gift card is redeemed by the customer, or we recognize breakage income when the

likelihood of redemption, based on historical experience, is deemed to be remote. Based on an analysis of our program since its inception in 1999,

we determined that balances remaining on cards issued beyond five years are unlikely to be redeemed and therefore may be recognized as income.

Breakage income was $9, $9 and $8 in 2011, 2010 and 2009. To date, our breakage rate is approximately 3.0% of the amount initially issued as gift cards.

Gift card breakage income is included in selling, general and administrative expenses in our consolidated statement of earnings. We had outstanding gift

card liabilities of $209 and $188 at the end of 2011 and 2010, which are included in other current liabilities.

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded based on

differences between the financial reporting and tax basis of assets and liabilities. The deferred tax assets and liabilities are calculated using the

enacted tax rates and laws that are expected to be in effect when the differences are expected to reverse. We routinely evaluate the likelihood of

realizing the benefit of our deferred tax assets and may record a valuation allowance if, based on all available evidence, it is determined that some

portion of the tax benefit will not be realized.

We regularly evaluate the likelihood of realizing the benefit for income tax positions that we have taken in various federal, state and foreign filings

by considering all relevant facts, circumstances and information available. If we believe it is more likely than not that our position will be sustained,

we recognize a benefit at the largest amount which we believe is cumulatively greater than 50% likely to be realized.

Interest and penalties related to income tax matters are classified as a component of income tax expense.

Comprehensive Net Earnings

Comprehensive net earnings include net earnings and other comprehensive earnings and losses. Other comprehensive earnings and losses in 2011,

2010 and 2009 consisted of adjustments, net of tax, related to our postretirement benefit obligations. Accumulated other comprehensive losses at

the end of 2011 and 2010 consisted of unrecognized losses on postretirement benefit obligations.

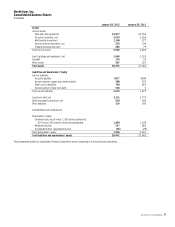

Cash Equivalents

Cash equivalents are short-term investments with a maturity of three months or less from the date of purchase and are carried at amortized cost,

which approximates fair value. Our cash management system provides for the reimbursement of all major bank disbursement accounts on a daily

basis. Accounts payable at the end of 2011 and 2010 included $81 and $111 of checks not yet presented for payment drawn in excess of our bank

deposit balances.

Accounts Receivable

Accounts receivable includes credit card receivables from our Nordstrom private label and VISA credit cards, as well as credit and debit card

receivables due from third party financial institutions. We record credit card receivables on our consolidated balance sheets at the outstanding

balance, net of an allowance for credit losses. The allowance for credit losses reflects our best estimate of the losses inherent in our receivables

as of the balance sheet date, including uncollectible finance charges and fees. We estimate such credit losses based on several factors, including

historical aging and delinquency trends, write-off experience, concentration and risk metrics and general economic conditions. Credit card

receivables constitute unsecured consumer loans, for which the risk of cardholder default and associated credit losses tend to increase as

general economic conditions deteriorate.

We consider a credit card account delinquent if the minimum payment is not received by the payment due date. Our aging method is based on the

number of completed billing cycles during which the customer has failed to make a minimum payment. Delinquent accounts, including accrued

finance charges and fees, are written off when they are determined to be uncollectible, usually after they become 150 days past due. Accounts are

written off sooner in the event of customer bankruptcy or other circumstances that make further collection unlikely.

We recognize finance charges and fees on delinquent accounts until they become 120 days past due, after which we place accounts on non-accrual

status. Payments received for accounts on non-accrual status are applied to accrued finance charges, fees and principal balances consistent with

other accounts, with subsequent finance charge income recognized only when actually received. Non-accrual accounts may return to accrual status

when we receive three consecutive minimum payments or the equivalent lump sum.