Nordstrom 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

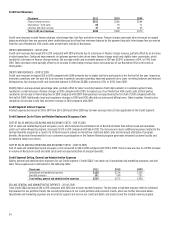

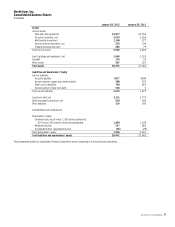

Our next debt maturity is in April 2012 for our $500 securitized Series 2007-2 Class A & B Notes. In connection with this debt maturity, we began

making monthly cash deposits into a restricted account in December 2011. As of January 28, 2012, we had accumulated $200, which is included in our

consolidated balance sheet in prepaid expense and other. After evaluating credit markets and our financing needs as we approached this maturity,

we issued $500 of senior unsecured notes and $325 of securitized Series 2011-1 Class A Notes, in the second half of 2011. This will allow us to maintain

an Adjusted Debt to Earnings before Interest, Income Taxes, Depreciation, Amortization and Rent ratio within our targeted range. We continue to

monitor credit markets and our potential future financing needs in order to ensure we have adequate cash on hand. In the first quarter of 2012, we

expect to retire the Series 2007-2 Class A & B Notes with the accumulated restricted cash upon maturity.

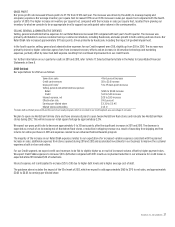

We maintain trade and standby letters of credit to facilitate international payments. As of January 28, 2012, we have $10 available under a trade

letter of credit, with $2 outstanding. We additionally hold a $15 standby letter of credit, with $1 outstanding under this facility at the end of the year.

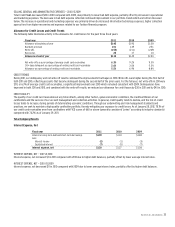

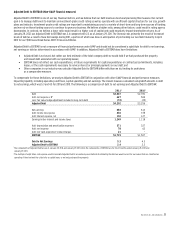

Impact of Credit Ratings

Under the terms of our $600 revolver, any borrowings we may enter into will accrue interest at a floating base rate tied to LIBOR in the case of Euro-

Dollar Rate Loans and to the highest of: (i) the Euro-Dollar rate plus 100 basis points, (ii) the federal funds rate plus 50 basis points and (iii) the prime

rate in the case of Base Rate Loans.

The rate depends upon the type of borrowing incurred, plus in each case an applicable margin. This applicable margin varies depending upon the

credit ratings assigned to our long-term unsecured debt. At the time of this report, our long-term unsecured debt ratings, outlook and resulting

applicable margin were as follows:

Credit Ratings Outlook

Moody’s Baa1 Stable

Standard & Poor’s A- Stable

Base Interest

Rate

Applicable

Margin

Euro–Dollar Rate Loan LIBOR 1.125%

Base Rate Loan various 0.125%

Should the ratings assigned to our long-term unsecured debt improve, the applicable margin associated with any such borrowings may decrease,

resulting in a slightly lower cost of capital under this facility. Should the ratings assigned to our long-term unsecured debt worsen, the applicable

margin associated with our borrowings may increase, resulting in a slightly higher cost of capital under this facility.

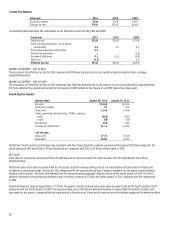

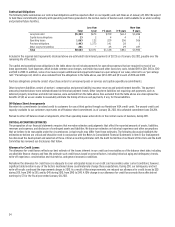

Debt Covenants

The revolver requires that we maintain a leverage ratio, defined as Adjusted Debt to Earnings before Interest, Income Taxes, Depreciation,

Amortization and Rent (“EBITDAR”), of less than four times (see the following additional discussion of Adjusted Debt to EBITDAR).

As of January 28, 2012 and January 29, 2011, we were in compliance with this covenant. We will continue to monitor this covenant to ensure that we

make any necessary adjustments to our plans, and we believe that we will remain in compliance with this covenant during 2012.