Nordstrom 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nordstrom, Inc. and subsidiaries 19

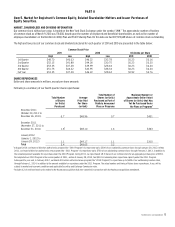

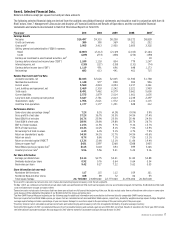

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts

OVERVIEW

Nordstrom is a fashion specialty retailer offering high-quality apparel, shoes, cosmetics and accessories for women, men and children. We offer a

wide selection of brand name and private label merchandise through various channels: our ‘Nordstrom’ branded full-line stores and website, our

off-price ‘Nordstrom Rack’ stores, our online private sale subsidiary ‘HauteLook,’ our ‘Jeffrey’ boutiques and our philanthropic ‘treasure&bond’ store.

Our stores are located in 30 states throughout the United States. In addition, we offer our customers a variety of payment products and services,

including credit and debit cards with an associated loyalty program.

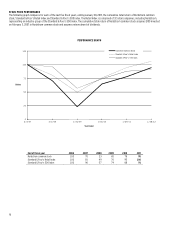

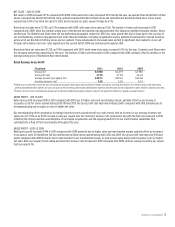

In 2011, we achieved record total net sales of $10,497, an increase of 12.7%, while growing earnings before interest and taxes (“EBIT”) by 11.7%. This

reflects our ongoing efforts to improve the customer experience across all channels, combined with consistent execution and various growth

initiatives. As customers’ expectations of service evolve, the consistency of the customer experience across all channels becomes more important,

including factors such as expanded selection, multi-channel capabilities, personalization, speed, convenience and price.

To enhance the customer experience online, we have accelerated our investments in e-commerce. We acquired HauteLook, a leader in the online

private sale marketplace. We believe this acquisition will help us further develop our mobile and e-commerce capabilities and enable us to

participate in the fast-growing private sales channel. In the third quarter, we began offering free standard shipping and free returns for online

purchases and did limited testing of same-day delivery. We also made enhancements to our website and mobile website. We believe these changes

make it easier and more convenient to shop with us. Our combined efforts to enhance the online experience led to a meaningful sales increase in the

online channel, which is where we expect to have the strongest percentage growth in the future.

Our strong financial position enables us to continue to make investments in the customer experience to improve our store and online business while

also growing through new stores, remodels and other initiatives. During 2011, we opened three Nordstrom full-line stores, eighteen Nordstrom Rack

stores and remodeled six Nordstrom full-line stores. We also opened a philanthropic store in New York called treasure&bond. In 2012, we plan to open

one Nordstrom full-line store and have announced twelve new Nordstrom Rack stores. In addition, we have announced plans to relocate two existing

Nordstrom Rack stores and remodel eight Nordstrom full-line stores.

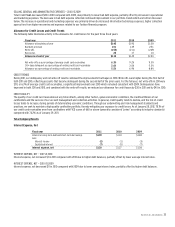

Our overall goals are to achieve high single-digit total sales growth and mid-teens Return on Invested Capital (“ROIC”). We believe that top-line

growth and ROIC correlate strongly with shareholders’ return. As we continue to invest in new stores and remodels, we also want to enhance the

customer experience through increased spending on e-commerce and technology. These investments flow through our expenses at a faster pace

than other investments in previous years. We believe they will increase our ROIC through high growth in sales dollars and EBIT, as opposed to EBIT

margin, with an incrementally productive capital base.

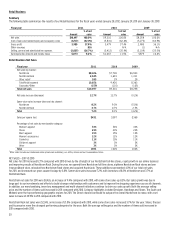

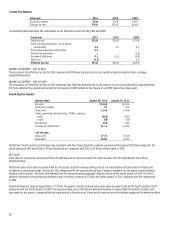

Fashion Rewards plays an important part in building customer loyalty, and our Fashion Rewards members shop more frequently and spend more

with us on average than non-members. Approximately one-third of our sales are from Fashion Rewards customers and the program continues to

grow as more members use our tender as a convenient way to shop and earn rewards. During the year, customer payment rates continued to

improve, resulting in decreasing delinquency and write-off trends, while our credit and debit card volumes increased. In January 2012, we enhanced

our Fashion Rewards program, giving customers more control over how and when they can earn rewards and extending more benefits to

our cardholders.

As we look forward to 2012, we remain focused on improving customer service and providing a superior shopping experience. We have a

customer-driven strategy, allowing us to execute our current operating plans across all channels while targeting investments in e-commerce and

technology to enhance our platform for sustainable, profitable growth.

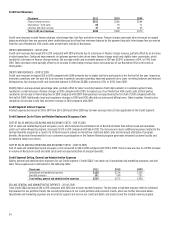

RESULTS OF OPERATIONS

Our reportable segments are Retail and Credit. Our Retail segment includes our Nordstrom branded full-line stores and website, our Nordstrom Rack

stores, and our other retail channels including HauteLook, our Jeffrey stores and our treasure&bond store. For purposes of discussion and analysis

of our results of operations, we combine our Retail segment results with revenues and expenses in the “Corporate/Other” column of our segment

reporting footnote (collectively, the “Retail Business”). We analyze our results of operations through earnings before interest and income taxes for

our Retail Business and earnings before income taxes for Credit, while interest expense and income taxes are discussed on a total company basis.