Nordstrom 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2012

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from____________ to ____________

Commission file number 001-15059

NORDSTROM, INC.

(Exact name of registrant as specified in its charter)

Washington 91-0515058

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

1617 Sixth Avenue, Seattle, Washington

98101

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code 206-628-2111

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common stock, without par value New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. YES NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). YES NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to

the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer

Non-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES NO

As of July 29, 2011 the aggregate market value of the Registrant’s voting and non-voting stock held by non-affiliates of the Registrant was

approximately $8.9 billion using the closing sales price on that day of $50.16. On March 9, 2012, 207,923,668 shares of common stock were

outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2012 Annual Meeting of Shareholders scheduled to be held on May 9, 2012 are incorporated into Part III.

Table of contents

-

Page 1

...As of July 29, 2011 the aggregate market value of the Registrant's voting and non-voting stock held by non-affiliates of the Registrant was approximately $8.9 billion using the closing sales price on that day of $50.16. On March 9, 2012, 207,923,668 shares of common stock were outstanding. DOCUMENTS... -

Page 2

[This page intentionally left blank.] 2 -

Page 3

... Disclosures About Market Risk. Financial Statements and Supplementary Data. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. Controls and Procedures. Other Information. Directors, Executive Officers and Corporate Governance. Executive Compensation. Security... -

Page 4

... in New York. Our Credit segment includes our wholly owned federal savings bank, Nordstrom fsb, through which we provide a private label credit card, two Nordstrom VISA credit cards and a debit card. The credit and debit cards feature a shopping-based loyalty program designed to increase customer... -

Page 5

...-store sales results, credit card revenues, gross profit rate, selling, general and administrative expenses, net interest expense, effective tax rate, diluted shares outstanding, earnings per diluted share, 53rd week impact to net sales and diluted earnings per share, operating cash flows, dividend... -

Page 6

...in the key areas of customer service, the shopping experience across all channels, fashion newness, quality of products, depth of selection, store environment and location, we may lose market share to our competitors and our sales and profitability could suffer. We believe owning our credit business... -

Page 7

... are risks associated with opening new stores. The availability and cost of suitable locations for our stores depends on a number of factors, including competition from other retailers and businesses, local land use and other regulations, new shopping center construction and developers' financial... -

Page 8

... acquisitions, manage our debt levels and return value to our shareholders through dividends and share repurchases. Our ability to obtain capital and the cost of the capital depend on company performance, financial market conditions and independent rating agencies' short- and long-term debt ratings... -

Page 9

... and generate additional revenues from extending credit. Our credit card revenues and profitability are subject in large part to economic and market conditions that are beyond our control, including, but not limited to, interest rates, consumer credit availability, consumer debt levels, unemployment... -

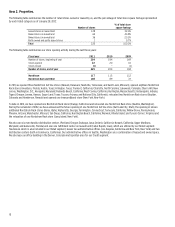

Page 10

...National City, California), relocated two Nordstrom Rack stores (Boulder, Colorado and Henderson, Nevada) and opened one treasure&bond store (New York, New York). To date in 2012, we have opened one Nordstrom Rack store (Orange, California) and relocated one Nordstrom Rack store (Seattle, Washington... -

Page 11

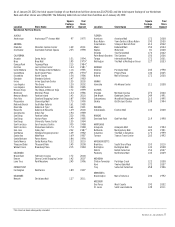

... 2012: Square Footage (000's) Year Store Opened Square Footage (000's) Year Store Opened Location Store Name Nordstrom Full-Line Stores ALASKA Anchorage ARIZONA Chandler Scottsdale CALIFORNIA Arcadia Brea Canoga Park Cerritos Corte Madera Costa Mesa Escondido Glendale Irvine Los Angeles Los Angeles... -

Page 12

... Town Center Downtown Portland Lloyd Center Salem Center Washington Square King of Prussia Ross Park Providence Place The Mall at Green Hills Barton Creek Square Galleria Dallas NorthPark Center Stonebriar Centre Houston Galleria North East Mall The Shops at La Cantera Fashion Place University Mall... -

Page 13

...'s) Year Store Opened 35 36 33 35 36 27 45 39 12 44 34 39 42 37 40 42 35 45 35 35 2011 2010 2010 2010 2009 2003 2010 2010 2007 2000 2000 2010 2003 2008 1996 2000 2009 1994 2011 2011 Towne Place at Garden State Park Rack Bergen Town Center Rack Jeffrey Union Square Rack treasure&bond The Mall at... -

Page 14

... statements are adequate in light of the probable and estimable liabilities. As of the date of this report, we do not believe any currently identified claim, proceeding or litigation, either alone or in the aggregate, will have a material impact on our results of operations, financial position... -

Page 15

..., as well as the number of employee shareholders in the Nordstrom 401(k) Plan and Profit Sharing Plan. On this date we had 207,923,668 shares of common stock outstanding. The high and low prices of our common stock and dividends declared for each quarter of 2011 and 2010 are presented in the table... -

Page 16

STOCK PRICE PERFORMANCE The following graph compares for each of the last five fiscal years, ending January 28, 2012, the cumulative total return of Nordstrom common stock, Standard & Poor's Retail Index and Standard & Poor's 500 Index. The Retail Index is comprised of 32 retail companies, including... -

Page 17

... and income taxes ("EBIT") Interest expense, net Earnings before income taxes ("EBT") Net earnings Balance Sheet and Cash Flow Data Accounts receivable, net Merchandise inventories Current assets Land, buildings and equipment, net Total assets Current liabilities Long-term debt, including current... -

Page 18

... Profit After Taxes Average Invested Capital We believe that ROIC is a useful financial measure for investors in evaluating our operating performance. When analyzed in conjunction with our net earnings and total assets and compared with return on assets (net earnings divided by average total assets... -

Page 19

...located in 30 states throughout the United States. In addition, we offer our customers a variety of payment products and services, including credit and debit cards with an associated loyalty program. In 2011, we achieved record total net sales of $10,497, an increase of 12.7%, while growing earnings... -

Page 20

..., our Jeffrey stores and our treasure&bond store. NET SALES - 2011 VS 2010 Net sales for 2011 increased 12.7% compared with 2010 driven by the strength of our Nordstrom full-line stores, rapid growth in our online business and improving results at Nordstrom Rack. During the year, we opened three... -

Page 21

...Our gross profit rate improved 54 basis points compared with 2010 primarily due to leveraging buying and occupancy costs on higher net sales. Our merchandising efforts enabled us to manage inventory levels consistent with our sales trends, with an increase in our average inventory per square foot of... -

Page 22

... business. These include HauteLook operating and purchase accounting expenses, planned increases in marketing and technology spending and increased fulfillment expenses associated with the introduction of free standard shipping and free returns for online purchases in the third quarter of 2011... -

Page 23

... can be redeemed for goods or services in our stores or online. Starting in January 2012, all Fashion Rewards customers receive a credit for complimentary alterations and personal triple points days, in addition to early access to sales events. As part of these changes, Nordstrom Rack is also now... -

Page 24

... on Nordstrom credit and debit cards and increased utilization of program benefits. We provide these benefits to our customers as participation in the Fashion Rewards program generates enhanced customer loyalty and incremental sales in our stores. COST OF SALES AND RELATED BUYING AND OCCUPANCY COSTS... -

Page 25

... 28, 2012, 78.1% of our credit card receivables were from cardholders with FICO scores of 660 or above (generally considered "prime" according to industry standards) compared with 76.2% as of January 29, 2011. Total Company Results Interest Expense, Net Fiscal year Interest on long-term debt and... -

Page 26

... of our 2007 federal tax return audit. Fourth Quarter Results Quarter ended Net sales Credit card revenues Gross profit Selling, general and administrative ("SG&A") expenses: Retail Credit Net earnings Earnings per diluted share % of net sales: Gross profit Retail SG&A January 28, 2012 $3,169 97... -

Page 27

... Financial Statements in Item 8. 2012 Outlook Our expectations for 2012 are as follows: Same-store sales Credit card revenues Gross profit rate1 Selling, general and administrative expenses: Retail Credit Interest expense, net Effective tax rate Earnings per diluted share Diluted shares outstanding... -

Page 28

... Profit After Taxes Average Invested Capital We believe that ROIC is a useful financial measure for investors in evaluating our operating performance. When analyzed in conjunction with our net earnings and total assets and compared with return on assets (net earnings divided by average total assets... -

Page 29

... taxes and interest payments on our short- and long-term borrowings. Cash provided by operating activities was flat in 2011 compared with 2010 due to higher sales and earnings offset primarily by changes in working capital, including increased inventory purchases to align with sales trends. In 2012... -

Page 30

... stock for an aggregate purchase price of $851. We completed our 2010 Program in the second quarter of 2011, and as of January 28, 2012, had $310 in remaining share repurchase capacity under the 2011 Program. Subsequent to year-end, in February 2012, our Board of Directors authorized a new program... -

Page 31

...Free Cash Flow: Fiscal year Net cash provided by operating activities Less: capital expenditures Less: cash dividends paid Less: change in credit card receivables originated at third parties (Less) Add: change in cash book overdrafts Free Cash Flow Net cash used in investing activities Net cash used... -

Page 32

...ratings assigned to our long-term unsecured debt worsen, the applicable margin associated with our borrowings may increase, resulting in a slightly higher cost of capital under this facility. Debt Covenants The revolver requires that we maintain a leverage ratio, defined as Adjusted Debt to Earnings... -

Page 33

... financial measure) Adjusted Debt to EBITDAR is one of our key financial metrics, and we believe that our debt levels are best analyzed using this measure. Our current goal is to manage debt levels to maintain an investment-grade credit rating as well as operate with an efficient capital structure... -

Page 34

... tax benefits of $18, as we are unable to reasonably estimate the timing of future cash payments, if any, for these liabilities. Off-Balance Sheet Arrangements We enter into commitments to extend credit to customers for use at third parties through our Nordstrom VISA credit cards. The unused credit... -

Page 35

... earnings by approximately $15 for the fiscal year ended January 28, 2012. Income Taxes We regularly evaluate the likelihood of realizing the benefit for income tax positions we have taken in various federal, state and foreign filings by considering all relevant facts, circumstances and information... -

Page 36

... points over the year, due to the fact that current interest rates are at or near historically low levels. Other key parameters and assumptions in our sensitivity analyses include the average cash and cash equivalents balance, average credit card receivables balance and no new floating rate debt... -

Page 37

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Nordstrom, Inc. Seattle, Washington We have audited the accompanying consolidated balance sheets of Nordstrom, Inc. and subsidiaries (the "Company") as of January 28, 2012 and January 29, 2011, and the... -

Page 38

... year Net sales Credit card revenues Total revenues Cost of sales and related buying and occupancy costs Selling, general and administrative expenses: Retail Credit Earnings before interest and income taxes Interest expense, net Earnings before income taxes Income tax expense Net earnings Earnings... -

Page 39

...current assets Land, buildings and equipment, net Goodwill Other assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued salaries, wages and related benefits Other current liabilities Current portion of long-term debt Total current liabilities Long-term... -

Page 40

...stock compensation plans Stock-based compensation Repurchase of common stock Balance at January 29, 2011 Net earnings Other comprehensive loss: Postretirement plan adjustments, net of tax of $10 Comprehensive net earnings Dividends ($0.92 per share) Issuance of common stock for HauteLook acquisition... -

Page 41

... assets Accounts payable Accrued salaries, wages and related benefits Other current liabilities Deferred property incentives Other liabilities Net cash provided by operating activities Investing Activities Capital expenditures Change in restricted cash Change in credit card receivables originated... -

Page 42

... POLICIES The Company Founded in 1901 as a shoe store in Seattle, Washington, today Nordstrom, Inc. is a leading fashion specialty retailer that offers customers a welledited selection of high-quality fashion brands focused on apparel, shoes, cosmetics and accessories for men, women and children... -

Page 43

... can be redeemed for goods or services in our stores and online. Starting in January 2012, all Fashion Rewards customers receive a credit for complimentary alterations and a personal triple points day, in addition to early access to sales events. As part of these changes, Nordstrom Rack is also now... -

Page 44

... statement of earnings. We had outstanding gift card liabilities of $209 and $188 at the end of 2011 and 2010, which are included in other current liabilities. Income Taxes We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities... -

Page 45

... VISA cards outside of our stores are treated as an investing activity within the consolidated statements of cash flows, as they represent loans made to our customers for purchases at third parties. Merchandise Inventories Merchandise inventories are valued at the lower of cost or market, using... -

Page 46

..., we acquired 100% of the outstanding equity of HauteLook, Inc., an online private sale retailer offering limited-time sale events on fashion and lifestyle brands. We believe the acquisition will enable us to participate in the fast-growing private sale marketplace and provide a platform to increase... -

Page 47

... of high-quality shoes. Upon amendment of the acquisition agreement, we reduced the fair value of the earn-out liability to $30 and recorded income of $12. The 2011 earnout provision was ultimately settled for 0.6 shares of Nordstrom common stock at a closing price of $47 per share after taxes and... -

Page 48

... owned federal savings bank, Nordstrom fsb. As of January 28, 2012 and January 29, 2011, our restricted credit card receivables included more receivables than necessary to collateralize our outstanding secured debt and variable funding facilities, and as such can be utilized to increase the current... -

Page 49

Nordstrom, Inc. Notes to Consolidated Financial Statements Dollar and share amounts in millions except per share, per option and unit amounts Credit Quality The primary indicators of the credit quality of our credit card receivables are aging and delinquency, particularly the levels of account ... -

Page 50

...28, 2012 Change in benefit obligation: Benefit obligation at beginning of year Participant service cost Interest cost Benefits paid Actuarial loss Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Employer contribution Benefits paid Fair value of... -

Page 51

...and SERP expense are as follows: Fiscal year Assumptions used to determine benefit obligation: Discount rate Rate of compensation increase Assumptions used to determine SERP expense: Discount rate Rate of compensation increase 2011 4.50% 3.00% 5.60% 3.00% 2010 5.60% 3.00% 5.95% 3.00% 2009 5.95% 3.00... -

Page 52

... 46 - 55 14 569 399 647 498 - 300 343 25 2,212 2,781 (6) $2,775 Total long-term debt Less: current portion Total due beyond one year All of our Nordstrom private label card receivables and a 90% interest in our Nordstrom VISA credit card receivables serve as collateral for various borrowings and... -

Page 53

...: Fiscal year Interest on long-term debt and short-term borrowings Less: Interest income Capitalized interest Interest expense, net 2011 $139 (2) (7) $130 2010 $133 (1) (5) $127 2009 $148 (3) (7) $138 Credit Facilities As of January 28, 2012, we had total short-term borrowing capacity available for... -

Page 54

... in Retail selling, general and administrative expenses in the consolidated statement of earnings. We estimated the fair value of our HauteLook goodwill using an income approach and a market approach based on comparable public companies and acquisitions. These valuation approaches are based on Level... -

Page 55

... merchandise, we have outstanding trade letters of credit totaling $2 as of January 28, 2012. We are subject from time to time to various claims and lawsuits arising in the ordinary course of business including lawsuits alleging violations of state and/or federal wage and hour and other employment... -

Page 56

...stock, through February 1, 2014, in addition to the remaining amount available for repurchase under the 2011 Program. The actual number and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities and Exchange Commission rules. Dividends... -

Page 57

...: Fiscal year Stock options HauteLook stock compensation Performance share units Employee stock purchase plan Other Total stock-based compensation expense, before income tax benefit Income tax benefit Total stock-based compensation expense, net of income tax benefit 2011 $32 9 4 2 3 50 (17) $33 2010... -

Page 58

...performance share unit liability is remeasured using the estimated percentage of units earned multiplied by the closing market price of our common stock on the current period-end date and is pro-rated based on the amount of time passed in the vesting period. The price used to issue stock or cash for... -

Page 59

... (benefit) Total income tax expense 2011 $359 63 422 7 7 14 $436 2010 $324 52 376 2 2 $378 2009 $275 38 313 (28) (30) (58) $255 A reconciliation of the statutory Federal income tax rate to the effective tax rate on earnings before income taxes is as follows: Fiscal year Statutory rate State and... -

Page 60

... Gift cards and gift certificates Loyalty reward certificates Allowance for credit losses Federal benefit of state taxes Gain on sale of interest rate swap Other Total deferred tax assets Land, buildings and equipment basis and depreciation differences Total deferred tax liabilities Net deferred tax... -

Page 61

... of payment products and services, including a Nordstrom private label card, two Nordstrom VISA credit cards and a debit card for Nordstrom purchases. Our credit and debit card products also include a loyalty program that provides benefits to our cardholders based on their level of spending. Amounts... -

Page 62

Nordstrom, Inc. Notes to Consolidated Financial Statements Dollar and share amounts in millions except per share, per option and unit amounts The following table sets forth information for our reportable segments: Retail Fiscal year 2011 Net sales Net sales increase Credit card revenues Earnings (... -

Page 63

... our HauteLook online private sale subsidiary, our Jeffrey stores and our treasure&bond store. The following table summarizes net sales by merchandise category: Fiscal year Women's apparel Shoes Men's apparel Women's accessories Cosmetics Children's apparel Other Total net sales 2011 % of total Net... -

Page 64

[This page intentionally left blank.] 64 -

Page 65

... ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our President and Chief Financial Officer, to allow timely decisions regarding required disclosure. CHANGES IN INTERNAL CONTROL... -

Page 66

... Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended January 28, 2012 of the Company and our report dated March 16, 2012 expressed an unqualified opinion on those financial statements. /s/ Deloitte & Touche LLP Seattle, Washington... -

Page 67

... our Proxy Statement for our 2012 Annual Meeting of Shareholders, which sections are incorporated by reference herein and will be filed within 120 days after the end of our fiscal year: Executive Officers Director Elections Board Committees and Charters Director Nominating Process Website Access to... -

Page 68

...within 120 days after the end of our fiscal year: Election of Directors Certain Relationships and Related Transactions Item 14. Principal Accounting Fees and Services. The information required under this item is included in the following section of our Proxy Statement for our 2012 Annual Meeting of... -

Page 69

... has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. NORDSTROM, INC. (Registrant) Michael G. Koppel Michael G. Koppel Executive Vice President and Chief Financial Officer (Principal Financial Officer) Date: March 16, 2012 Pursuant to the requirements... -

Page 70

... statements of Nordstrom Inc. and subsidiaries, and the effectiveness of Nordstrom, Inc.'s internal control over financial reporting, appearing in the Annual Report on Form 10-K of Nordstrom Inc. for the year ended January 28, 2012. /s/ Deloitte & Touche LLP Seattle, Washington March 16, 2012... -

Page 71

... by and between Nordstrom Credit Card Receivables II LLC, Nordstrom fsb, filed on January 21, 2010, Exhibit 4.1 Nordstrom Credit, Inc., Falcon Asset Securitization Company, LLC and J.P. Morgan Chase Bank, N.A., dated January 20, 2010 Second Amendment to the Note Purchase Agreement dated November 13... -

Page 72

... Inc. Employee Stock Purchase Plan (2011 Restatement) 1997 Nordstrom Stock Option Plan, amended and restated on February 16, 2000 Incorporated by reference from the Registrant's Form 8-K filed on December 23, 2010, Exhibit 10.1 Incorporated by reference from the Registrant's Quarterly Report on Form... -

Page 73

.... 2010 Equity Incentive Plan Form of 2011 Stock Option Award Agreement Form of 2012 Nonqualified Stock Option Grant Agreement Nordstrom, Inc. Leadership Separation Plan (Effective March 1, 2005) Method of Filing Incorporated by reference from the Registrant's Annual Report on Form 10-K for the year... -

Page 74

...Nonemployee Director Stock Incentive Plan Form of 2012 Restricted Stock Unit Agreement 10.52 10.53 Promissory Note dated April 18, 2002 between 1700 Seventh, L.P. and New Incorporated by reference from the Registrant's Quarterly York Life Insurance Company Report on Form 10-Q for the quarter ended... -

Page 75

..., New York Incorporated by reference from the Registrant's Quarterly Life Insurance Company and Life Investors Insurance Company of America Report on Form 10-Q for the quarter ended April 30, 2002, Exhibit 10.4 Investment Agreement dated October 8, 1984 between the Registrant and Nordstrom Credit... -

Page 76

... Bank N.A. and Nordstrom Incorporated by reference from the Registrant's Form 8-K filed on December 23, 2009, Exhibit 10.2 Inc., dated as of December 22, 2009 Press release dated August 19, 2010 announcing that its Board of Directors authorized a $500 million share repurchase program Press release... -

Page 77

... Public Accounting Firm Certification of President required by Section 302(a) of the SarbanesOxley Act of 2002 Certification of Chief Financial Officer required by Section 302(a) of the Sarbanes-Oxley Act of 2002 Method of Filing Filed herewith electronically Filed as page 70 of this report Filed...