Nordstrom 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 34 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

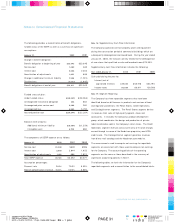

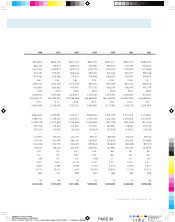

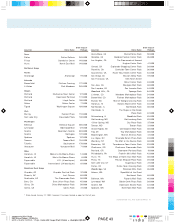

Notes to Consolidated Financial Statements

34 NORDSTROM INC. AND SUBSIDIARIES

Note 20: Nordstrom.com Put Agreement

The holders of the minority interest of Nordstrom.com LLC,

through their ownership interests in its managing member,

Nordstrom.com, Inc., have the right to sell their shares of

Nordstrom.com, Inc. to the Company for effectively $80 million

in the event that certain events do not occur. This right would

terminate if the Company provides at least $100 million in

additional funding to Nordstrom.com, Inc. prior to July 1, 2002

or if Nordstrom.com, Inc. completes an initial public offering of its

common stock prior to September 1, 2002. It is possible that the

Company will choose not to provide the $100 million in additional

funding and that Nordstrom.com, Inc. will not complete an initial

public offering on or before September 1, 2002. If and when

the Company determines that neither of those events is likely to

occur and that the purchase of the minority interest shares is

probable, the Company will begin to accrete, over the period

remaining prior to the purchase, the difference between that $80

million and the fair value of the shares. Based on current values

for similar businesses, management of the Company believes

that the amount of that difference could range from $55,000

to $65,000.

Note 21: Contingent Liabilities

The Company has been named in various lawsuits and intends to

vigorously defend itself in those cases. The Company is not in

a position at this time to quantify the amount or range of any

possible losses related to those claims. While no assurance can

be given as to the ultimate outcome of these lawsuits, based on

preliminary investigations, management currently believes that

resolving these matters will not have a material adverse effect

on the Company's financial position, results of operations or

cash flows.

Cosmetics. The Company was originally named as a defendant along

with other department store and specialty retailers in nine separate

but virtually identical class action lawsuits filed in various Superior

Courts of the State of California in May, June and July 1998 that

have now been consolidated in Marin County state court. In May

2000, plaintiffs filed an amended complaint naming a number of

manufacturers of cosmetics and fragrances and two other retailers

as additional defendants. Plaintiffs' amended complaint alleges

that the retail price of the "prestige" cosmetics sold in department

and specialty stores was collusively controlled by the retailer and

manufacturer defendants in violation of the Cartwright Act and

the California Unfair Competition Act.

Plaintiffs seek treble damages and restitution in an unspecified

amount, attorneys' fees and prejudgment interest, on behalf of

a class of all California residents who purchased cosmetics and

fragrances for personal use from any of the defendants during

the period four years prior to the filing of the amended complaint.

Defendants, including the Company, have answered the amended

complaint denying the allegations. The Company and the other

retail defendants have produced documents and responded to

plaintiffs' other discovery requests, including providing witnesses

for depositions. Plaintiffs have not yet moved for class

certification. Pursuant to an order of the court, plaintiffs

and defendants participated in mediation sessions in May

and September 2001.