Nordstrom 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 2 pms PAGE 12 pms

8002

pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

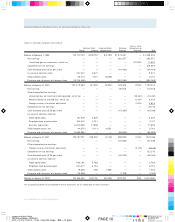

Management’s Discussion and Analysis

12 NORDSTROM INC. AND SUBSIDIARIES

prior year due to lower costs in selling and sales promotion,

partially offset by higher bad debt. The lower selling, general

and administrative costs were the result of a focused effort

to control costs.

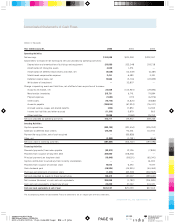

LIQUIDITY AND CAPITAL RESOURCES

The Company finances its working capital needs, capital

expenditures, acquisitions, and share repurchase activity with

a combination of cash flows from operations and borrowings.

Management believes that the Company’s operating cash flows,

existing cash and available credit facilities are sufficient to

finance the Company’s operations and planned growth for the

foreseeable future.

Cash Flows from Operations

Net cash provided by operating activities increased approximately

$238 million in 2001 compared to 2000 primarily due to decreases

in merchandise inventories and accounts receivable.

Net cash provided by operating activities decreased approximately

$193 million in 2000 compared to 1999 largely due to lower

net earnings and increases in credit card accounts receivable

and merchandise inventories.

In 2002, cash flows provided by operating activities are expected

to decrease due to increases in accounts receivable related to

increases in credit sales and inventory increases related to the

opening of new stores.

Capital Expenditures

The Company’s capital expenditures aggregated approximately $683

million over the last three years, net of developer reimbursements,

principally to add stores, improve existing facilities and purchase

or develop new information systems. Over 3.5 million square feet

of retail store space was added during this period, representing

an increase of 25% since January 31, 1999.

The Company plans to spend approximately $875 million, net of

developer reimbursements, on capital projects during the next

three years, including new stores, the remodeling of existing

stores, new systems and technology, and other items.

At January 31, 2002, approximately $456 million has been

contractually committed for the construction of new stores

or remodel of existing stores. Although the Company has made

commitments for stores opening in 2002 and beyond, it is possible

that some stores may not be opened as scheduled because of delays

inherent in the development process, or because of the termination

of store site negotiations.

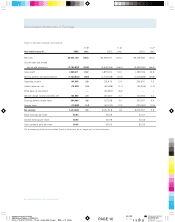

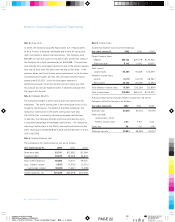

Total Square Footage (thousands)

Share Repurchase

In May 1995, the Board of Directors authorized $1.1 billion of share

repurchases. As of January 31, 2002, the Company has purchased

39 million shares of its common stock for $1 billion, with remaining

share repurchase authority of $82 million. The share repurchase

represents 24% of the shares outstanding as of May 1995 after

adjusting for the 1998 stock split, at an average price per share

of $25.93. Share repurchases have been partially financed through

additional borrowings, resulting in an increase in the Company’s

debt to capital ratio.

Dividend Policy

In 2001, the Company paid $.36 per share of common stock

in cash dividends, the fifth consecutive annual dividend increase.

The Company paid $.35 and $.32 per share of common stock

in fiscal 2000 and 1999.

1997 1998 1999 2000 2001

18,000

16,000

14,000

12,000

10,000

12,614

13,593

14,487

16,056

17,048