Nordstrom 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 20 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

20 NORDSTROM INC. AND SUBSIDIARIES

Dollars in thousands except per share amounts

Note 1: Summary of Significant Accounting Policies

The Company: Nordstrom, Inc. is a fashion specialty retailer

offering a wide selection of high-quality apparel, shoes and

accessories for women, men and children, in the United States

through 80 Nordstrom full-line stores, 46 Nordstrom Rack and

clearance stores, 4 Façonnable boutiques and 2 free-standing

shoe stores. The Company also operates 24 Façonnable boutiques

located primarily in Europe. Additionally, the Company generates

catalog and Internet sales through Nordstrom.com LLC and service

charge income through Nordstrom Credit, Inc.

Basis of Presentation: The consolidated financial statements

include the balances of Nordstrom, Inc. and its subsidiaries for

the entire fiscal year. All significant intercompany transactions

and balances are eliminated in consolidation.

Use of Estimates: Management makes estimates and assumptions

that affect the reported amounts in the financial statements and

accompanying notes. Actual results could differ from those

estimates.

Reclassifications: Certain reclassifications of prior year balances

have been made for consistent presentation with the current year.

Revenue Recognition: Revenues are recorded net of estimated

returns and exclude sales tax. Revenue is recorded at the point

of sale for retail stores. Catalog and e-commerce sales include

shipping revenue and are recorded upon shipment to the customer.

Buying and Occupancy Costs: Buying costs consist primarily

of salaries and expenses incurred by the Company’s merchandise

managers, buyers and private label product development group.

Occupancy costs include rent, depreciation, property taxes and

operating costs related to the Company’s retail and distribution

facilities.

Shipping and Handling Costs: The Company's costs for shipping

and handling to customers include payments to third-party shippers

and costs incurred to store, move and prepare merchandise for

shipment. Shipping and handling costs of $30,868, $38,062

and $29,085 in 2001, 2000 and 1999 were included in selling,

general and administrative expenses.

Advertising: Costs for newspaper, television, radio and other media

are generally expensed as incurred. Direct response advertising

costs, consisting primarily of catalog book production and printing

costs, are deferred and recognized over the expected life of the

catalog, not to exceed six months. Total advertising expenses were

$145,341, $190,991 and $160,957 in 2001, 2000 and 1999.

Store Preopening Costs: Store opening and preopening costs

are charged to expense when incurred.

Cash Equivalents: Cash equivalents represent short-term investments

with a maturity of three months or less from the time of purchase.

Cash Management: The Company’s cash management system

provides for the reimbursement of all major bank disbursement

accounts on a daily basis. Accounts payable at January 31, 2002

includes $31,817 of checks not yet presented for payment drawn

in excess of cash balances.

Customer Accounts Receivable: In accordance with industry

practices, installments maturing in more than one year and deferred

payment accounts receivable are included in current assets.

Merchandise Inventories: Merchandise inventories are stated

at the lower of cost (first-in, first-out basis) or market, using

the retail method.

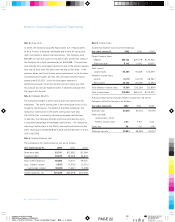

Land, Buildings and Equipment: Depreciation is computed using

a combination of accelerated and straight-line methods. Estimated

useful lives by major asset category are as follows:

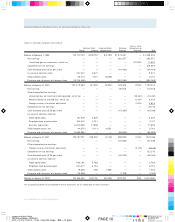

Asset Life (in years)

Buildings 5-40

Store fixtures and equipment 3-15

Leasehold improvements Shorter of life of lease or asset life

Software 3-7

Asset Impairment: The Company reviews its intangibles and

other long-lived assets for impairment when events or changes

in circumstances indicate the carrying value of these assets may

not be recoverable.

Notes to Consolidated Financial Statements