Nordstrom 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 15 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

NORDSTROM INC. AND SUBSIDIARIES 1 5

Management’s Discussion and Analysis

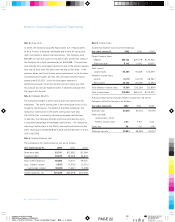

RECENT ACCOUNTING PRONOUNCEMENTS

In February 2001, the Company adopted SFAS No. 133,

“ Accounting for Derivative Instruments and Hedging Activities,”

as amended by SFAS No. 137 and No. 138. It requires the fair

value of all derivatives to be recognized as assets or liabilities,

and specifies accounting for changes in their fair value. Adoption

of this standard did not have a material impact on the Company’s

financial statements.

In March 2001, the Company adopted SFAS No. 140 “ Accounting

for Transfers and Servicing of Financial Assets and Extinguishments

of Liabilities,” a replacement of SFAS No. 125 with the same title.

It revises the standards for securitizations and other transfers of

financial assets and collateral and requires certain additional

disclosures, but otherwise retains most of SFAS No. 125’s

provisions. Adoption of this standard did not have a material

impact on the Company’s financial statements.

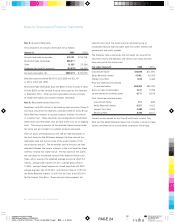

The Emerging Issues Task Force reached a consensus on Issue

No. 99-20, “ Recognition of Interest Income and Impairment

on Purchased and Retained Beneficial Interests in Securitized

Financial Assets,” which provides guidance on how a transferor

that retains an interest in securitized financial assets, or an

enterprise that purchases a beneficial interest in securitized

financial assets, should account for related interest income

and impairment. Adoption of this accounting issue for the

quarter ended July 31, 2001, did not have a material impact

on the Company’s financial statements.

In February 2002, the Company adopted SFAS No. 141 “ Business

Combinations” and No. 142 “ Goodwill and Other Intangible Assets.”

SFAS No. 141 requires that the purchase method of accounting

be used for all business combinations initiated after June 30, 2001,

and establishes specific criteria for the recognition of goodwill

separate from other intangible assets. Adoption of the accounting

provisions of SFAS No. 141 did not have a material impact on the

Company’s financial statements. Under SFAS No. 142, goodwill

and intangible assets having indefinite lives will no longer be

amortized but will be subject to annual impairment tests.

Other intangible assets will continue to be amortized over their

estimated useful lives. The Company is currently evaluating the

impact of SFAS No. 142 on its earnings and financial position.

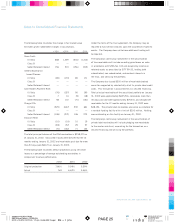

In February 2002, the Company adopted SFAS No. 144,

“ Accounting for the Impairment or Disposal of Long-Lived Assets.”

SFAS No. 144 retains the fundamental provisions of SFAS No. 121,

but establishes new criteria for asset classification and broadens

the scope of qualifying discontinued operations. The adoption of

this statement did not have a material impact on the Company’s

financial statements.

FORWARD-LOOKING INFORMATION CAUTIONARY STATEMENT

Certain statements made in this annual report include forward-

looking statements regarding the Company’s performance, liquidity

and adequacy of capital resources. These statements are based

on the Company’s current assumptions and expectations and are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those projected. Forward-looking

statements are qualified by the risks and challenges posed by

increased competition, shifting consumer demand, changing

consumer credit markets, changing capital markets and general

economic conditions, hiring and retaining effective team members,

sourcing merchandise from domestic and international vendors,

investing in new business strategies, achieving growth objectives,

and other risks and uncertainties, including the uncertain economic

and political environment arising from the terrorist acts of

September 11th and subsequent terrorist activities. As a result,

while the Company believes there is a reasonable basis for the

forward-looking statements, one should not place undue reliance

on those statements.