Nordstrom 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 33 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

Notes to Consolidated Financial Statements

NORDSTROM INC. AND SUBSIDIARIES 33

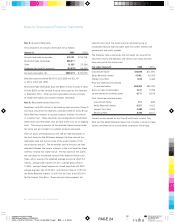

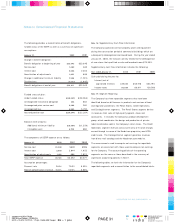

Note 18: Restructurings, Impairments, and Other One-Time Charges

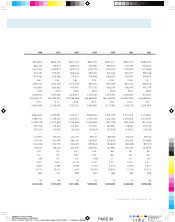

The following table provides a summary of restructuring,

impairments and other charges:

Year ended January 31, 2002 2001 2000

Employee severance $1,791 — $2,685

Other expenses —— 1,206

Restructuring subtotal 1,791 — 3,891

Management severance —$13,000 —

Asset impairment —10,227 4,053

Litigation settlement costs —— 2,056

Total charges $1,791 $23,227 $10,000

During the year ended January 31, 2002, the Company

streamlined its operations through a reduction in workforce

of approximately 2,600 employees. As a result, the Company

recorded a restructuring charge of $1,791 in selling, general

and administrative expenses relating to severance for

approximately 195 employees. Personnel affected were

primarily located in the corporate center and in full-line stores.

During the year ended January 31, 2001, the Company

recorded an impairment charge of $10,227, consisting of

$9,627 recorded in selling, general and administrative

expenses and $600 in interest expense. Due to changes

in business strategy, the Company determined that several

software projects under development were either impaired or

obsolete. The charges consisted of $6,542 primarily related

to the disposition of transportation management software.

Additionally, merchandise software was written down $3,685

to its estimated fair value. During the same year, the Company

accrued and paid $13,000 for certain severance and other

costs related to a change in management.

During the year ended January 31, 2000, the Company recorded

a charge of $10,000 in selling, general and administrative expenses

primarily associated with the restructuring of the Company’s

information technology services area. The charge consisted of

$4,053 in the disposition of several software projects under

development, $2,685 in employee severance and $1,206 in other

miscellaneous costs. Additionally, the Company recorded $2,056

related to settlement costs for two lawsuits. The restructuring

included the termination of 50 employees in the information

technology department.

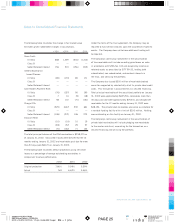

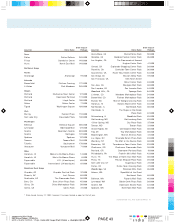

The following table presents the activity and balances of the

reserves established in connection with the restructuring charges:

Year ended January 31, 2002 2001 2000

Beginning balance $178 $1,452 —

Additions 1,7 91 — $3,891

Payments (1,890) (1,220) (2,122)

Adjustments (79) (54) (317)

Ending balance $— $178 $1,452

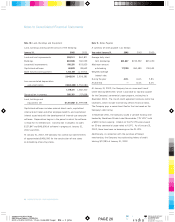

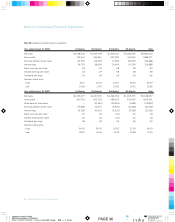

Note 19: Vulnerability Due to Certain Concentrations

Approximately 31% of the Company’s retail square footage is

located in the state of California. At January 31, 2002, the net

book value of property located in California was approximately

$276,000. Accordingly, the Company carries earthquake insurance

in California with a $50,000 deductible and a $50,000 coverage

limit per occurrence.

At January 31, 2002 and 2001, approximately 40% and 41% of

the Company’s receivables were obligations of customers residing

in California. Concentration of the remaining receivables is

considered to be limited due to their geographical dispersion.