Nordstrom 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 13 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

NORDSTROM INC. AND SUBSIDIARIES 1 3

Management’s Discussion and Analysis

Acquisition

In 2000, the Company acquired Façonnable, S.A. ("Façonnable"),

of Nice, France, a designer, wholesaler and retailer of high quality

men’s and women’s apparel and accessories. The Company paid

$88 million in cash and issued 5,074,000 shares of common

stock of the Company for a total consideration of $169 million.

The purchase also provides for a contingent payment to one

of the previous owners that may be paid after five years from

the acquisition date. If the previous owner continues to have

active involvement in the business and performance targets

are met, the contingent payment would approximate $10 million.

Since the contingent payment is performance based, the actual

amount paid will likely vary from this amount and will be

expensed when it becomes probable that the targets will be met.

Debt, Available Credit and Debt Ratings

In October 2000, the Company issued $300 million of 8.95%

Senior Notes due in 2005. These proceeds were used to reduce

short-term indebtedness, to fund the acquisition of Façonnable,

and for general corporate purposes.

The Company entered into a variable interest rate swap agreement

in the third quarter of 2001. The swap has a $300 million notional

amount and a four-year term. Under the agreement, the Company

receives a fixed rate of 8.95% and pays a variable rate based on

LIBOR plus a margin of 4.44% set at six-month intervals (6.85%

at January 31, 2002). Any differences between the amounts paid

and received on interest rate swap agreements are recognized as

adjustments to interest expense over the life of the swap.

In November 2001, the Company issued $300 million of Class A

notes backed by Nordstrom Private Label Receivables (“ PL Term” ).

The PL Term bears a fixed interest rate of 4.82% and has a maturity

of five years. Both the debt and related assets of the PL Term are

included in the Company’s consolidated balance sheet. The

Company will use the proceeds for general corporate purposes

and capital expansion.

The Company has an outstanding $200 million variable funding

note backed by Nordstrom VISA credit card receivables(“ Visa VFN”).

In accordance with SFAS No. 140 "Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of Liabilities"

this debt and the related assets are not reflected in the Company’s

consolidated balance sheets. The Visa VFN is scheduled to expire

in April 2002. The Company is in the process of renewing this

credit facility.

The Company owns a 49% interest in a limited partnership which

constructed a new corporate of fice building in which the Company

is the primary occupant. Land, building and equipment includes

capitalized costs related to this building of $93 million and $57

million as of January 31, 2002 and 2001. The Company is a

guarantor of a $93 million credit facility of the limited partnership

of which $89 million and $53 million is outstanding as of January

31, 2002 and 2001 and is included in other long-term debt.

The limited partnership is currently refinancing the $93 million

credit facility and has signed a commitment agreement for an

$85 million mortgage secured by the property. The obligation

will have a fixed interest rate of 7.68% and a term of 18 years.

The Company expects the agreement to close in April 2002 subject

to various requirements. The difference between the amount

outstanding under the original credit facility and the new mortgage

will be funded by the Company.

In November 2001, the Company entered into a $300 million

unsecured revolving credit facility that expires in November 2004.

This credit facility replaced an existing $500 million line of credit,

that was scheduled to expire in July 2002. As of January 31, 2002,

no borrowings have been made against this revolving credit facility.

In November 2001, the Company issued a variable funding note

backed by Nordstrom Private Label Receivables (“ PL VFN” ) with

a $200 million capacity. As of January 31, 2002, no borrowings

have been made against this note.

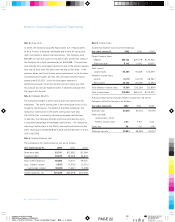

The Company has the following credit ratings as of the date of

this report.

Standard

Credit Ratings Moody’s* and Poor’s*

Senior unsecured debt Baa1 A-

Commercial paper P-2 A-2

*negative outlook

These ratings are subject to change depending on the Company’s

performance. A significant ratings drop could result in the

termination of the $200 million PL VFN and the $200 million

Visa VFN, and a change in interest rates on the $300 million

8.95% Senior Notes and the $300 million revolving credit facility.