Nordstrom 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 10 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

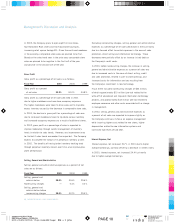

Management’s Discussion and Analysis

10 NORDSTROM INC. AND SUBSIDIARIES

In 2002, the Company plans to open eight full-line stores,

four Nordstrom Rack stores and two Façonnable boutiques,

increasing retail square footage 8%. Given the continued weakness

in the economy, comparable store sales are planned to be flat.

Based on the sales trend seen in the prior year, comparable store

sales are planned to be negative in the first half of the year

and positive in the second half of the year.

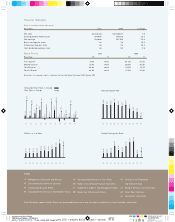

Gross Profit

Gross profit as a percentage of net sales is as follows:

Fiscal Year 2001 2000 1999

Gross profit as a percent

of net sales 33.2% 34.0% 34.8%

Gross profit as a percentage of net sales declined in 2001

due to higher markdowns and new store occupancy expenses.

The higher markdowns were taken to drive sales and to liquidate

excess inventory caused by the decrease in comparable store sales.

In 2000, the decline in gross profit as a percentage of sales was

due to increased markdowns taken to liquidate excess inventory

and increased occupancy expenses as a result of additional stores.

In 2002, gross profit as a percentage of sales is expected to

improve moderately through careful management of inventory

levels in relation to sales trends. However, any improvement may

be limited if sales trends are weaker than expected. The Company

expects to complete the rollout of its perpetual inventory system

in 2002. The benefits of having better inventory tracking tools

through perpetual inventory should, over time, also improve gross

profit performance.

Selling, General and Administrative

Selling, general and administrative expenses as a percent of net

sales are as follows:

Fiscal Year 2001 2000 1999

Selling, general and

administrative 30.6% 31.6% 29.6%

Nonrecurring charges —0.4% 0.2%

Selling, general and

administrative before

nonrecurring charges 30.6% 31.2% 29.4%

Excluding nonrecurring charges, selling, general and administrative

expenses as a percentage of net sales decreased in 2001 primarily

due to a focused effort to control expenses in the areas of sales

promotion, direct selling and information technology. These

decreases were partially offset by an increase in bad debt on

the Company’s credit cards.

In 2000, before nonrecurring charges, the increase in selling,

general and administrative expenses as a percent of sales was

due to increased costs in the areas of direct selling, credit

and sales promotion, related in part to store openings, and

increased costs for information services resulting from

the Company’s investment in new technology.

Fiscal 2000 included nonrecurring charges of $23 million,

of which approximately $10 million (pre-tax) related to the

write-off of abandoned and impaired information technology

projects, and approximately $13 million (pre-tax) related to

employee severance and other costs associated with a change

in management.

In 2002, selling, general and administrative expenses as

a percent of net sales are expected to improve slightly as

the Company continues its focus on expense management

while incurring higher costs related to new stores, higher

depreciation related to new information systems and

continued high levels of bad debt.

Interest Expense, Net

Interest expense, net increased 19.7% in 2001 due to higher

average borrowings, partially offset by a decrease in interest rates.

In 2000, interest expense, net increased 24.4% primarily

due to higher average borrowings.