Nordstrom 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

NORDSTROM INC. AND SUBSIDIARIES 3 1

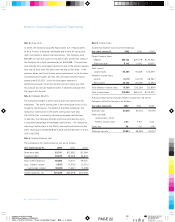

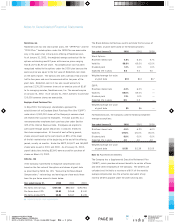

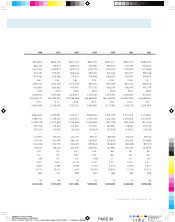

The following provides a reconciliation of benefit obligations,

funded status of the SERP, as well as a summary of significant

assumptions:

January 31, 2 0 0 2 2001

Change in benefit obligation:

Benefit obligation at beginning of year $23,543 $23,645

Service cost 1,0 9 2 630

Interest cost 2 ,6 6 8 2,044

Amortization of adjustments 1 , 8 2 1 688

Change in additional minimum liability 7,3 0 8 (1,519)

Distributions (2 ,0 2 1 ) (1,945)

Benefit obligations at end of year $ 3 4 , 4 1 1 $23,543

Funded status of plan:

Under funded status $ ( 3 9,5 4 7 ) $(28,964)

Unrecognized transitional obligation 324 648

Unrecognized prior service cost 6 ,3 9 6 240

Unrecognized loss 6 ,9 8 3 5,792

Accrued pension cost $(25,844) $(22,284)

Balance sheet amounts:

Additional minimum liability $ ( 8 ,5 6 7 ) $(1,259)

Intangible asset 6 ,7 2 0 888

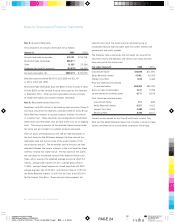

The components of SERP expense are as follows:

January 31, 2 0 0 2 2001 2000

Service cost $ 1,0 9 2 $630 $906

Interest cost 2 ,6 6 8 2,044 1,952

Amortization of adjustments 1 , 8 2 1 688 1,013

Total SERP expense $ 5 ,5 81 $3,362 $3,871

Assumption percentages:

Discount rate 7.2 5 % 7.50% 6.50%

Rate of compensation increase 5.00% 5.00% 5.00%

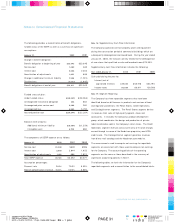

Note 16 : Supplementary Cash Flow Information

The Company capitalizes certain property, plant and equipment

during the construction period of commercial buildings which are

subsequently derecognized and leased back. During the year ended

January 31, 2002, the noncash activity related to the derecognition

of new stores that qualified as sale and leaseback were $75,555.

Supplementary cash f low information includes the following:

Year ended January 31, 2 0 0 2 2001 2000

Cash paid during the year for:

Interest (net of

capitalized interest) $ 7 7,0 2 5 $58,190 $54,195

Income taxes 8 0 ,6 8 9 88,911 129,566

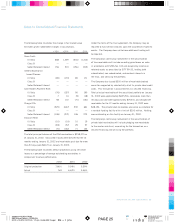

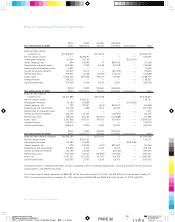

Note 17 : Segment Reporting

The Company has three reportable segments that have been

identified based on differences in products and services offered

and regulatory conditions: the Retail Stores, Credit Operations,

and Catalog/Internet segments. The Retail Stores segment derives

its revenues from sales of high-quality apparel, shoes and

accessories. It includes the Company’s product development

group, which coordinates the design and production of private

label merchandise sold in the Company’s retail stores. The Credit

Operations segment revenues consist primarily of finance charges

earned through issuance of the Nordstrom proprietary and VISA

credit cards. The Catalog/Internet segment generates revenues

from direct mail catalogs and the Nordstrom.com website.

The measurements used to compute net earnings for reportable

segments are consistent with those used to compute net earnings

for the Company. The accounting policies of the operating

segments are the same as those described in the summary of

significant accounting policies in Note 1.

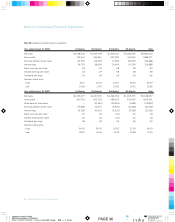

The following tables set forth the information for the Company’s

reportable segments and a reconciliation to the consolidated totals:

Blk + 1 pms PAGE 31 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar