Nordstrom 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 28 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

Notes to Consolidated Financial Statements

28 NORDSTROM INC. AND SUBSIDIARIES

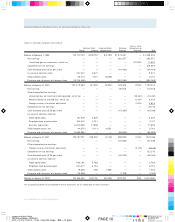

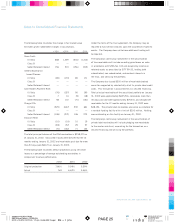

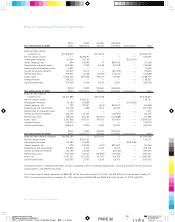

Note 13: Leases

The Company leases land, buildings and equipment under

noncancelable lease agreements with expiration dates ranging

from 2002 to 2080. Certain leases include renewal provisions

at the Company’s option. Most of the leases provide for additional

rent payments based upon specific percentages of sales and

require the Company to pay for certain common area maintenance

and other costs.

Year ended January 31, 2002 2001 2000

Minimum rent:

Store locations $26,951 $16,907 $18,794

Offices, warehouses

and equipment 20,144 21,070 19,926

Percentage rent:

Store locations 8,047 9,241 7,441

Total rent expense $55,142 $47,218 $46,161

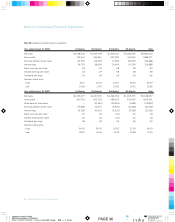

Future minimum lease payments as of January 31, 2002 are as

follows:

Capital Operating

Year ended January 31, Leases Leases

2003 $1,335 $66,940

2004 1,120 64,480

2005 1,120 60,680

2006 1,120 56,191

2007 1,120 52,285

Thereafter 11,470373,517

Total minimum lease payments 17,285 $674,093

Less amount representing interest 7,851

Present value of net minimum

lease payments $9,434

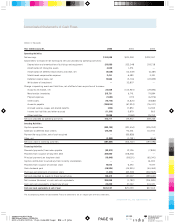

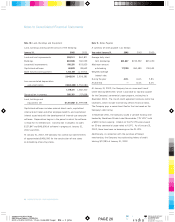

Note 14: Stock-Based Compensation

Stock Option Plan

The Company has a stock option plan (“the Plan”) under which

stock options, performance share units and restricted stock may

be granted to key employees. Stock options are issued at the fair

market value of the stock at the date of grant. Options vest over

periods ranging from four to eight years, and expire ten years after

the date of grant.

In addition to option grants, the Company granted 273,864,

355,072 and 272,970 performance share units in 2001, 2000

and 1999, which will vest over three years if certain financial goals

are attained. Employees may elect to receive common stock or cash

upon vesting of these performance shares. At January 31, 2002

and 2001, $4,713 and $2,741 was recorded in accrued salaries,

wages and related benefits for these performance shares.

Employees who receive performance share units pay no monetary

consideration. No amounts have been paid and no common stock

has been issued in connection with this program. As of January 31,

2002, 518,189 units were outstanding.

The Company also granted 30,069 and 180,000 shares of

restricted stock in 1999 and 1998, with a weighted average fair

value of $32.09 and $27.75. In September 2000, the Company

accelerated the vesting of 144,000 shares of restricted stock

resulting in compensation expense of $3,039, and also cancelled

14,175 shares of restricted stock as a result of management

changes. In January 2002, the Company accelerated the vesting

on the remaining 9,536 unvested shares of restricted stock,

resulting in compensation expense of $193. At January 31, 2002,

there are no shares of unvested restricted stock.

At January 31, 2002, approximately 7,856,298 shares are

reserved for future stock option grants pursuant to the Plan.

The Company applies Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” in measuring

compensation costs under its stock-based compensation programs.

Accordingly, no compensation cost has been recognized for stock

options issued under the Plan. Performance share compensation

expense is recorded over the performance period at the fair value

of the stock at the date when probable that such shares have been

earned. Restricted stock compensation expense is based on the

market price on the date of grant and is recorded over the vesting

period. Stock-based compensation expense for 2001, 2000 and

1999 was $3,414, $6,480 and $3,331.