Nordstrom 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 27 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

Notes to Consolidated Financial Statements

NORDSTROM INC. AND SUBSIDIARIES 2 7

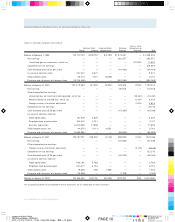

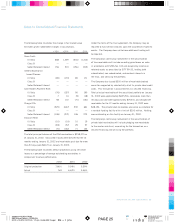

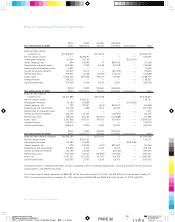

Note 12 : Long-Term Debt

A summary of long-term debt is as follows:

January 31, 2 0 0 2 2001

Receivable-backed PL Term, 4.82%,

due 2006 $ 3 0 0 ,0 0 0 —

Senior debentures, 6.95%,

due 2028 300,000 $300,000

Senior notes, 5.625%, due 2009 250,000 250,000

Senior notes, 8.950%, due 2005 300,000 300,000

Medium-term notes, 7.25%, due 2002 7 6 ,7 5 0 87,750

Notes payable, 6.7%, due 2005 100,000 100,000

Other 10 2 , 5 21 74,546

Total long-term debt 1,4 2 9 ,2 71 1,112,296

Less current portion (7 8 ,2 2 7 ) (12,586)

Total due beyond one year $ 1,3 51,0 4 4 $1,099,710

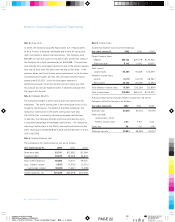

The Company entered into a variable interest rate swap agreement

in the third quarter of 2001. The swap has a $300 million notional

amount and a four-year term. Under the agreement, the Company

receives a fixed rate of 8.95% and pays a variable rate based on

LIBOR plus a margin of 4.44% set at six-month intervals (6.85%

at January 31, 2002). Any differences between the amounts paid

and received on interest rate swap agreements are recognized as

adjustments to interest expense over the life of the swap. The swap

agreement qualifies as a fair value hedge and is recorded at fair

value in other liabilities.

In November 2001, the Company issued $300 million of Class A

notes backed by Nordstrom Private Label Receivables (“ PL Term” ).

The PL Term bears a fixed interest rate of 4.82% and has a

maturity of five years. The Company will use the proceeds for

general corporate purposes and capital expansion.

The Company owns a 49% interest in a limited partnership that

completed construction on a new corporate office building in

which the Company is the primary occupant. Land, buildings

and equipment includes capitalized costs related to this building

of $92,952 and $57,270 as of January 31, 2002 and 2001

which includes noncash amounts of $78,003 and $41,883 as of

January 31, 2002 and 2001. The corresponding finance obligation

of $89,180 and $53,060 is included in other long-term debt.

This finance obligation will be amortized as rental payments are

made by the Company to the limited partnership over the life of

the permanent financing. The Company is a guarantor of a

$93,000 credit facility of the limited partnership. The credit

facility provides for interest at either the LIBOR rate plus 0.75%,

or the greater of the Federal Funds rate plus 0.5% and the prime

rate, and matures in August 2002 (2.63% and 6.36% at

January 31, 2002 and 2001).

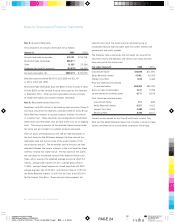

The limited partnership is currently refinancing the $93,000 credit

facility and has signed a commitment agreement for an $85,000

mortgage secured by the property. The obligation will have a

fixed interest rate of 7.68% and a term of 18 years. The Company

expects the agreement to close in April 2002 subject to various

requirements. The dif ference between the amount outstanding

under the original credit facility and the new mortgage will be

funded by the Company.

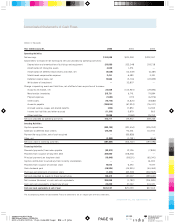

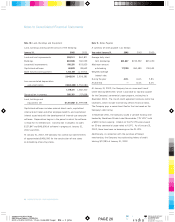

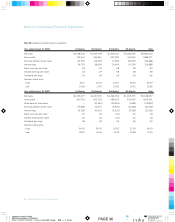

Required principal payments on long-term debt, excluding capital

lease obligations and construction loan obligations, are as follows:

Year ended January 31,

2003 $77,730

2004 1,535

2005 1,463

2006 400,410

2007 300,188

Thereafter 549,332