Nordstrom 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 2 pms PAGE 11 pms

8002

pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

NORDSTROM INC. AND SUBSIDIARIES 11

Management’s Discussion and Analysis

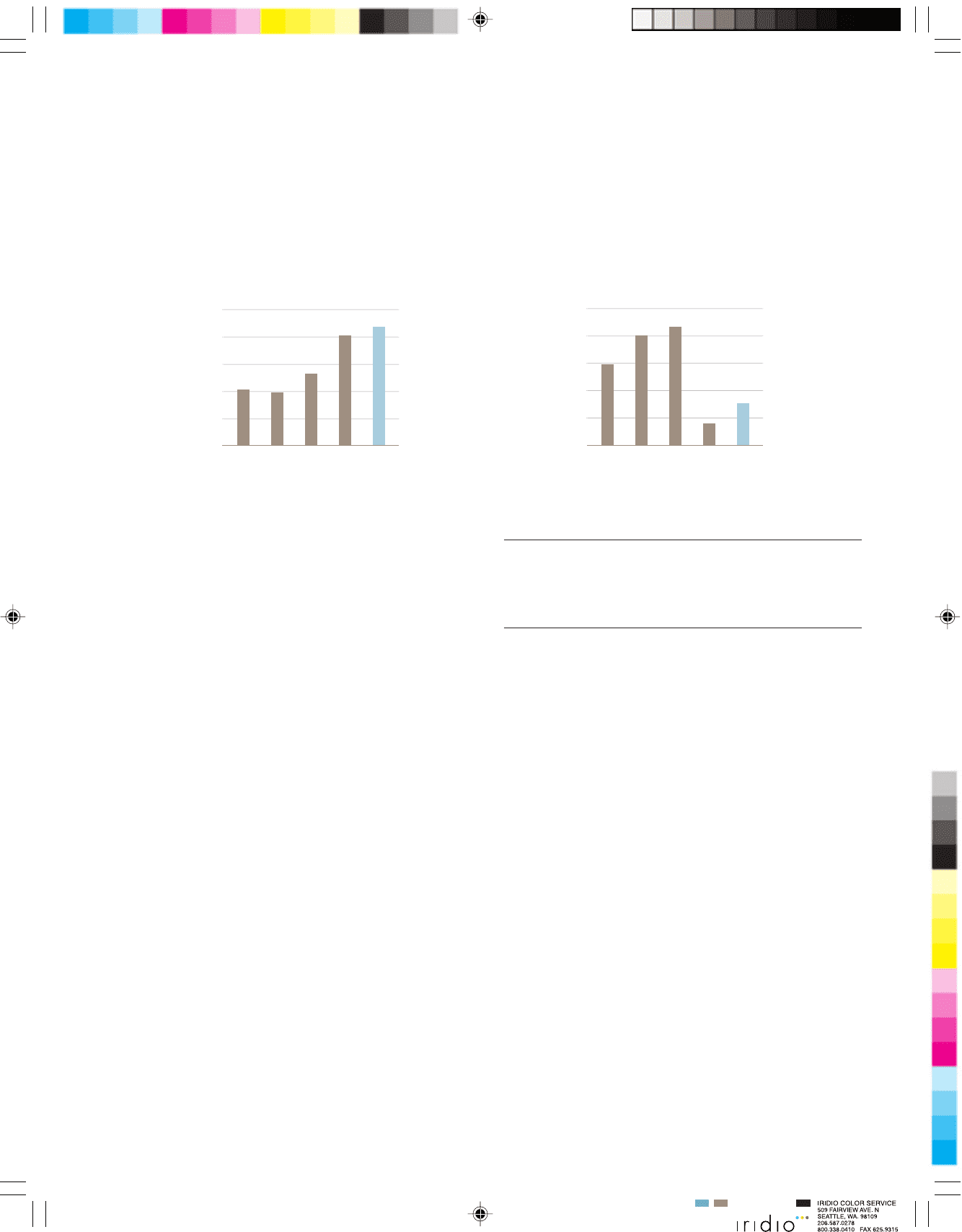

Service Charge Income and Other, Net (in millions)

Service charge income and other, net primarily represents income

from the Company’s credit card operations. Service charge income

declined slightly in 2001 due to lower interest rates, flat credit

sales and a steady number of credit accounts. This decline was

offset by lower miscellaneous charges compared to the prior year.

In 2000, service charge income increased due to higher credit sales

and increases in the number of credit accounts. Credit sales and

the number of credit accounts increased as a result of a targeted

marketing effort toward inactive accounts and the introduction of

a rewards program.

In 2002, service charge income is planned to be higher due to a

small increase in credit sales and credit accounts, and adjustments

to interest rates charged.

Write-off of Investment

The Company held common shares in Streamline, Inc., an

Internet grocery and consumer goods delivery company, at

a cost of approximately $33 million. Streamline ceased its

operations effective November 2000. During 2000, the

Company wrote off its entire investment in Streamline.

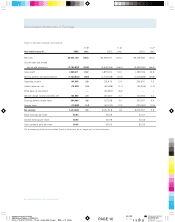

Earnings per Share (Diluted)

Diluted earnings per share are as follows:

Fiscal Year 2001 2000 1999

Diluted earnings per share $.93 $.78 $1.46

Nonrecurring charges —.26 .04

Diluted earnings per share

before nonrecurring charges $.93 $1.04 $1.50

Excluding nonrecurring charges, earnings per share for 2001 were

10.6% worse than 2000 primarily driven by a decline in comparable

store sales and a decline in gross profit percent offset by decreases

in selling, general and administrative expenses as a percent of sales.

Excluding nonrecurring charges, earnings per share for 2000 were

30.7% lower than 1999 primarily due to the decline in gross profit

percent and higher selling, general and administrative expenses,

partially offset by higher service charge income.

Fourth Quarter Results

Fourth quarter 2001 earnings per share were $.38 compared with

$.20 in 2000. The prior year included a $.01 nonrecurring charge

related to the write-off of the remaining Streamline investment.

Total sales for the quarter declined by 1.5% versus the same quarter

in the prior year and comparable store sales declined by 3.4%.

The decline in sales was primarily due to the overall slowdown in

the economy. Gross profit increased compared to the same quarter

in the prior year due to lower markdowns. Selling, general and

administrative expenses improved in the quarter compared to the

1997 1998 1999 2000 2001

$140

$130

$120

$110

$100

$111

$110

$117

$131

$134

1997 1998 1999 2000 2001

$1.60

$1.40

$1.20

$1.00

$0.80

$1.20

$1.41

$1.46

$0.78

$0.93