Nordstrom 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 26 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

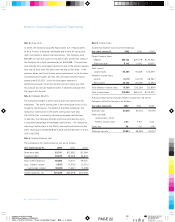

Notes to Consolidated Financial Statements

26 NORDSTROM INC. AND SUBSIDIARIES

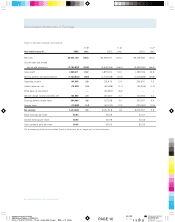

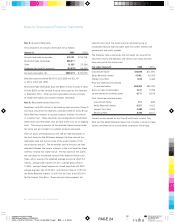

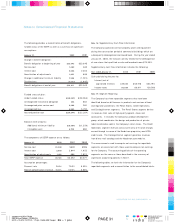

Note 10: Land, Buildings and Equipment

Land, buildings and equipment consist of the following:

January 31, 2002 2001

Land and land improvements $59,141 $60,871

Buildings 683,926 760,029

Leasehold improvements 910,291 903,925

Capitalized software 46,603 38,642

Store fixtures and equipment 1,142,169 1,1 72, 914

2,842,130 2,936,381

Less accumulated depreciation

and amortization (1,663,409) (1,554,081)

1,178,721 1,382,300

Construction in progress 582,361 217,638

Land, buildings and

equipment, net $1,761,082 $1,599,938

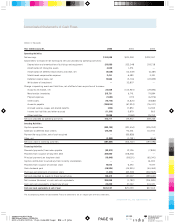

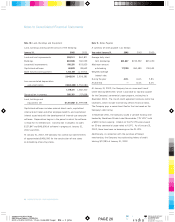

Capitalized software includes external direct costs, capitalized

internal direct labor and other employee benefits, and capitalized

interest associated with the development of internal-use computer

software. Depreciation begins in the period in which the software

is ready for its intended use. Construction in progress includes

$127,847 and $46,696 of software in progress at January 31,

2002 and 2001.

At January 31, 2002, the Company has contractual commitments

of approximately $456,090 for the construction of new stores

or remodeling of existing stores.

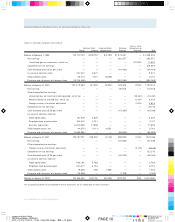

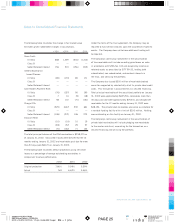

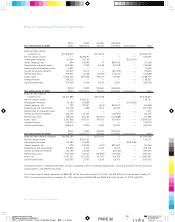

Note 11: Notes Payable

A summary of notes payable is as follows:

Year ended January 31, 2002 2001 2000

Average daily short-

term borrowings $81,647 $192,392 $45,030

Maximum amount

outstanding 177,100 360,480 178,533

Weighted average

interest rate:

During the year 4.6% 6.6% 5.8%

At year-end —6.4% 6.0%

At January 31, 2002, the Company has an unsecured line of

credit totaling $300,000, which is available as liquidity support

for the Company’s commercial paper program, and expires in

November 2004. The line of credit agreement contains restrictive

covenants, which include maintaining certain financial ratios.

The Company pays a commitment fee for the line based on the

Company’s debt rating.

In November 2001, the Company issued a variable funding note

backed by Nordstrom Private Label Receivables (“PL VFN”) with

a $200 million capacity. Interest on the PL VFN varies based

on 30-day commercial paper rated at A1/P1. As of January 31,

2002, there have been no borrowings on the PL VFN.

Additionally, in connection with the purchase of foreign

merchandise, the Company has outstanding letters of credit

totaling $77,085 at January 31, 2002.