Nordstrom 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 24 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

Notes to Consolidated Financial Statements

24 NORDSTROM INC. AND SUBSIDIARIES

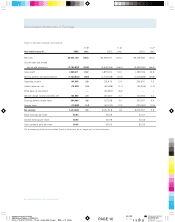

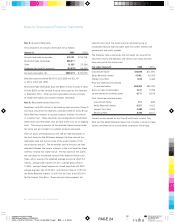

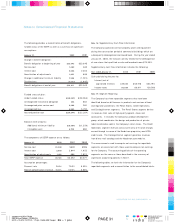

Note 8: Accounts Receivable

The components of accounts receivable are as follows:

January 31, 2002 2001

Unrestricted trade receivables $73,157 $716,218

Restricted trade receivables 628,271 —

Other 21,325 22,266

Allowance for doubtful accounts (24,278) (16,531)

Accounts receivable, net $698,475 $721,953

Bad debt expense totaled $34,750, $20,368 and $11,707

in 2001, 2000 and 1999.

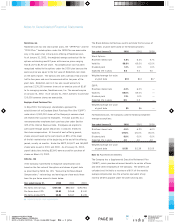

Restricted trade receivables back the $300 million of Class A notes

and the $200 million variable funding note issued by the Company

in November 2001. Other accounts receivable consists primarily

of vendor receivables and cosmetic rebates receivable.

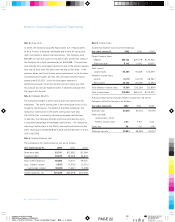

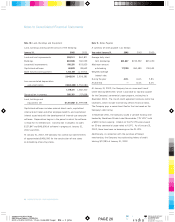

Note 9: Receivable-backed Securities

Nordstrom has $200 million in outstanding debt securities (Class A)

and holds securities that represent undivided interests (Class B and

Seller Retained Interest) or residual interests (Interest Only Strip)

in a master trust. These securities are collateralized by Nordstrom

VISA credit card receivables that are sold to the trust on an ongoing

basis. The carrying amounts of the retained interests approximate

fair value and are included in customer accounts receivable.

Gains or losses are recognized on the sale of VISA receivables to

the trust based on the difference between the face value of the

receivables sold and the fair value of the assets created in the

securitization process. The receivables sold to the trust are then

allocated between the various interests in the trust based on those

interests’ relative fair market value. The fair values of the assets

are calculated as the present value of their expected future cash

flows, which assumes the weighted average remaining life of 2.4

months, average credit losses of 7.41%, average gross yield of

17.48%, average interest expense on issued securities of 2.38%,

average payment rate of 22.04%, and discount rates of 7.75% for

the Seller Retained Interest, 13.62% for the Class B and 25.35%

for the Interest Only Strip. These discount rates represent the

volatility and risk of the assets and are calculated using an

established formula that considers both the current interest rate

environment and credit spreads.

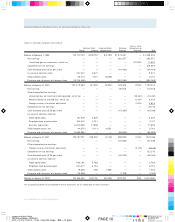

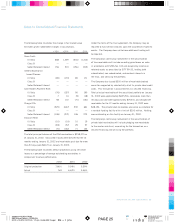

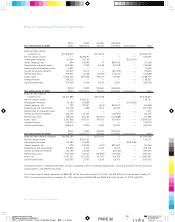

The following table summarizes the estimated fair value of the

securities held by the Company and certain cash flows received

from and paid to the master trust.

Year ended January 31, 2002 2001

Class B Certificate $10,849 $11,000

Seller Retained Interest 47,102 42,052

Interest Only Strip 1,335 3,464

Principal collections reinvested

in new receivables 669,582 485,422

Gains on sales of receivables 3,147 5,356

Income earned on retained assets 6,711 9,035

Cash flows from retained assets:

Class B Certificate 715 684

Seller Retained Interest 6,217 4,411

Interest Only Strip 4,984 4,955

Servicing Fees 8,440 8,121

Interest income earned on the Class B certificate, Interest Only

Strip and the Seller Retained Interest are included in service charge

income and other on the consolidated statements of earnings.