Nordstrom 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 2 pms PAGE 09 pms

8002

pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

NORDSTROM INC. AND SUBSIDIARIES 9

Management’s Discussion and Analysis

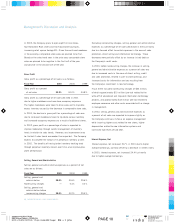

Overview

Earnings for 2001 (the fiscal year ended January 31, 2002) for

Nordstrom, Inc. and its subsidiaries (collectively, the “ Company” )

increased by 22% as compared to 2000. This increase was

primarily attributable to nonrecurring charges experienced in

the prior year. Excluding nonrecurring charges, earnings for

2001 declined by 8.4% due in large part to the slowing economy.

The Company experienced a modest increase in net sales due to

the opening of new stores but comparable store sales (sales from

stores open at least one full fiscal year) declined. Gross profit as

a percent of sales also declined primarily due to higher markdowns

taken to increase sales and liquidate excess inventories. Selling,

general and administrative expenses as a percent of sales declined

as a result of focused efforts in 2001 to reduce costs.

In 2002 (the fiscal year ending January 31, 2003), the Company

plans to focus on sales growth, managing merchandise inventory

levels, controlling expenses, and making disciplined capital

investment decisions. The Company will also strive to build on

its core values of customer service and delivering the right mix

of quality merchandise at the right price.

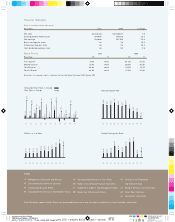

RESULTS OF OPERATIONS

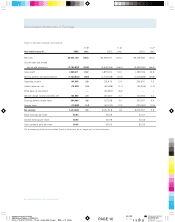

Net Sales (in millions)

Year over year net sales percentage increases and comparable store

sales percentages are as follows:

Fiscal Year 2 0 01 2000 1999

Net sales increase 1.9 % 7. 4 % 2 . 0 %

Comparable store sales (2 .9 % ) 0.3 % (1.1%)

The net sales increase of 1.9% in 2001 was due to new store

openings. During 2001, the Company opened four Nordstrom

full-line stores, eight Nordstrom Rack stores and three Façonnable

boutiques. The increases in net sales were offset by negative

comparable store sales and a decline in sales at Nordstrom.com.

Comparable store sales in the first half of the year were lower

by 1.3% and in the second half of the year were lower by 4.4%.

The decline in the second half of 2001 was largely due to the

overall slowdown in the economy. The most significant sales

declines were in men’s apparel and shoes while women’s apparel

was essentially f lat.

Net sales increased 7.4% in 2000 due to new store openings.

During 2000, the Company opened six Nordstrom full-line stores

and ten Nordstrom Rack stores. Comparable store sales were

essentially flat in 2000, with increases in shoes, cosmetics

and accessories of fset by decreases in women’s apparel.

The decrease in women’s apparel was primarily attributable

to a change in product mix.

Percentage of 2001 Sales by Merchandise Category

Women’s Accessories 21%

Shoes 1 9 %

Men’s Apparel and

Furnishings 1 8 %

Children’s Apparel

and Accessories 4 %

Women’s Apparel 3 5 %

Other 3 %

1997 1998 1999 2000 2001

$6,000

$5,500

$5,000

$4,500

$4,000

$ 4 ,8 6 5

$ 5 ,0 4 9

$ 5 ,14 9

$ 5 ,5 2 9

$ 5 ,6 3 4