Nordstrom 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 14 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

Management’s Discussion and Analysis

1 4 NORDSTROM INC. AND SUBSIDIARIES

The remainder of the Company’s outstanding debt is not subject

to termination or interest rate adjustments based on changes in

credit ratings.

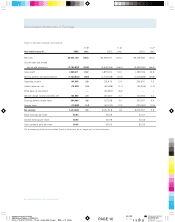

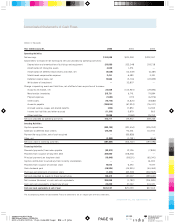

The following table summarizes the Company’s contractual

obligations and the expected effect on liquidity and cash f lows

excluding the $93 million construction loan and any potential

liability related to the Nordstrom.com Put Agreement.

Less

than 1 - 3 4 – 5 Over

Fiscal Year Total 1 Year Years Years 5 Years

Long-term

Debt $1,330.6 $77.7 $3.0 $700.6 $549.3

Capital Leases 17.2 1.3 2.2 2.2 11.5

Operating

Leases 674.1 66.9 125.2 108.5 373.5

Construction

Commitments 456.1 195.9 151.2 — 10 9.0

Total $2,478.0 $341.8 $281.6 $811.3 $1,043.3

Construction commitments include $109 million shown in the

Over 5 Years category for new stores construction. These contracts

do not have specific due dates and may become due sooner than

five years.

CRITICAL ACCOUNTING POLICIES

The preparation of the Company’s financial statements require

that management make estimates and judgments that affect the

reported amounts of assets, liabilities, revenues and expenses,

and disclosure of contingent assets and liabilities. On an on-

going basis, the Company evaluates its estimates including

those related to doubtful accounts, inventory valuation, intangible

assets, income taxes, self-insurance liabilities, pensions, contingent

liabilities and litigation. The Company bases its estimates on

historical experience and on other assumptions that management

believes to be reasonable under the circumstances. Actual results

may differ from these estimates under dif ferent assumptions

or conditions.

Put Agreement

The holders of the minority interest of Nordstrom.com LLC, through

their ownership interests in its managing member, Nordstrom.com,

Inc., have the right to sell their shares of Nordstrom.com, Inc. to the

Company for effectively $80 million in the event that certain events

do not occur. This right would terminate if the Company provides at

least $100 million in additional funding to Nordstrom.com, Inc.

prior to July 1, 2002 or if Nordstrom.com, Inc. completes an initial

public offering of its common stock prior to September 1, 2002.

It is possible that the Company will choose not to provide the $100

million in additional funding and that Nordstrom.com, Inc. will not

complete an initial public offering on or before September 1, 2002.

If and when the Company determines that neither of those events is

likely to occur and that the purchase of the minority interest shares

is probable, the Company will begin to accrete, over the period

remaining prior to the purchase, the difference between that $80

million and the fair value of the shares. Based on current values

for similar businesses, management of the Company believes that

the amount of that difference could range from $55 million to

$65 million.

Valuation of Intangible Assets

The Company is in the process of performing a valuation to

determine if there has been an impairment of the $138 million

intangible asset resulting from the purchase of Façonnable. This is

the Company’s only intangible asset. The valuation is dependent

on many factors including future performance and market

conditions. Should this asset be impaired, a charge will be

recorded in the first quarter of 2002.

Realization of Deferred Tax Assets

As of January 31, 2002, the Company has $34 million of capital

loss carryforwards. The utilization of this deferred tax asset is

contingent upon the ability to generate capital gains within the

next four years. No valuation allowance has been provided

because management believes it is probable that the full benefit

of the carryforwards will be realized.