Nordstrom 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Blk + 1 pms PAGE 22 pms

550

Cyan Mag Yelo Blk

20200324 NORDSTROM

2001 Annual Report • VERSION

8.375 x 10.875 • SCITEX • 175 lpi • Kodak 80# Cougar

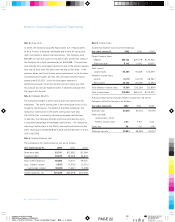

Notes to Consolidated Financial Statements

22 NORDSTROM INC. AND SUBSIDIARIES

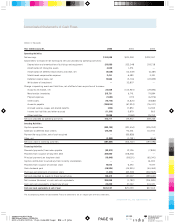

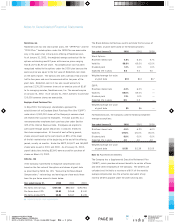

Note 2: Acquisition

In 2000, the Company acquired Façonnable, S.A. ("Façonnable"),

of Nice, France, a designer, wholesaler and retailer of high quality

men’s and women’s apparel and accessories. The Company paid

$87,685 in cash and issued 5,074,000 shares of common stock of

the Company for a total consideration of $168,868. The purchase

also provides for a contingent payment to one of the previous owners

that may be paid after five years from the acquisition date. If the

previous owner continues to have active involvement in the business

and performance targets are met, the contingent payment would

approximate $10,000. Since the contingent payment is

performance based, the actual amount paid will likely vary from

this amount and will be expensed when it becomes probable that

the targets will be met.

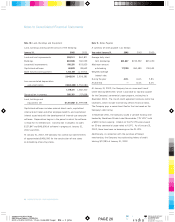

Note 3: Employee Benefits

The Company provides a profit sharing plan and 401(k) plan for

employees. The profit sharing plan is non-contributory and is fully

funded by the Company. The Board of Directors establishes the

Company’s contribution to the profit sharing plan each year.

The 401(k) plan is funded by voluntary employee contributions.

In addition, the Company provides matching contributions up to

a stipulated percentage of employee contributions. The Company’s

matching contributions to the 401(k) plan and contributions to the

profit sharing plan totaled $28,525, $29,113 and $47,500 in 2001,

2000 and 1999.

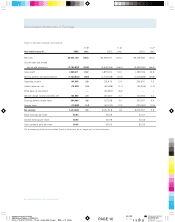

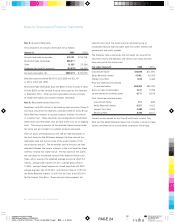

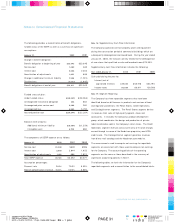

Note 4: Interest Expense, Net

The components of interest expense, net are as follows:

Year ended January 31, 2002 2001 2000

Short-term debt $3,741 $12,682 $2,584

Long-term debt 83,225 58,988 56,831

Total interest expense 86,966 71,670 59,415

Less: Interest income (1,545) (1,330) (3,521)

Capitalized interest (10,383) (7,642) (5,498)

Interest expense, net $75,038 $62,698 $50,396

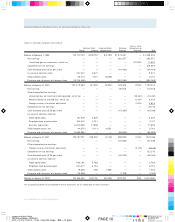

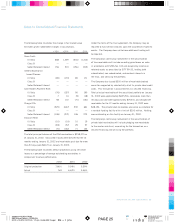

Note 5: Income Taxes

Income tax expense consists of the following:

Year ended January 31, 2002 2001 2000

Current income taxes:

Federal $58,122 $79,778 $130,524

State and local 6,142 11,591 21,835

Total current

income taxes 64,264 91,369 152,359

Deferred income taxes:

Current (7,217) (11,215) (18,367)

Non-current 22,753 (15,054) (4,492)

Total deferred income taxes 15,536 (26,269) (22,859)

Total income taxes $79,800 $65,100 $129,500

A reconciliation of the statutory Federal income tax rate to the

Company’s effective tax rate is as follows:

Year ended January 31, 2002 2001 2000

Statutory rate 35.00% 35.00% 35.00%

State and local

income taxes, net of

Federal income taxes 3.93 3.93 4.06

Other, net .09 .05 (.06)

Effective tax rate 39.02% 38.98% 39.00%