Nissan 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2009 81

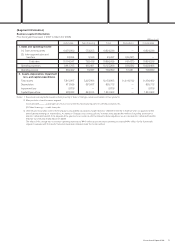

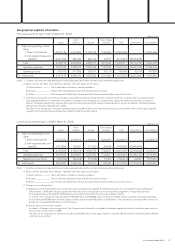

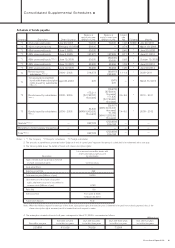

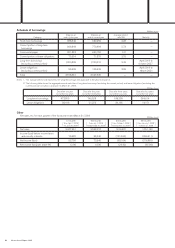

Consolidated Supplemental Schedules >

Balance at Balance at Interest

end of prior year end of current year rate

Company Description Date of Issuance (Millions of yen) (Millions of yen) (%) Collateral Maturity

*1 41st unsecured bonds July 29, 2003 70,000 70,000 1.00 NONE July 29, 2010

*1 42nd unsecured bonds February 19, 2004 50,000 — 0.74 " March 19, 2009

*1 43rd unsecured bonds June 2, 2005 50,000 — 0.40 " June 20, 2008

*1 44th unsecured bonds June 2, 2005 127,977 127,988 0.71 " June 21, 2010

*1 45th unsecured bonds (Note 2) June 15, 2005 50,000 (50,000) 0.62 " October 15, 2009

50,000

*1 46th unsecured bonds June 19, 2007 64,995 64,996 1.76 " June 20, 2012

*1 47th unsecured bonds June 19, 2007 34,990 34,993 1.95 " June 20, 2014

*2 Bonds issued by (69,997)

subsidiaries (Note 2) 2006 - 2008 214,973 224,980 1.1-1.4 " 2009–2011

*2

1st unsecured convertible

bonds with share subscription (247)

rights issued by subsidiaries 247

(Note 2, 3)

April 30, 2003 247 — " March 31, 2010

(73,673)

[$750,000

175,211 thousand]

*3 Bonds issued by subsidiaries 2005 - 2006 [$1,748,787 171,830 4.6–5.6 " 2010 - 2011

(Note 2) thousand] [$1,749,262

thousand]

(26,967)

[MXN 3,914,000

84,330 thousand]

*3 Bonds issued by subsidiaries 2006 - 2008 [MXN 9,000,000 71,159 7.4–9.0 " 2009 - 2012

(Note 2) thousand] [

MXN 10,328,000

thousand]

Subtotal (Note 2) —922,723 (220,884) ——

816,193

Elimination of intercompany transactions — — — — —

Total (Note 2) —922,723 (220,884)

816,193 ——

Notes: 1. *1 The Company *2 Domestic subsidiaries *3 Foreign subsidiaries

2. The amounts in parentheses presented under “Balance at end of current year” represent the amounts scheduled to be redeemed within one year.

Schedule of bonds payable

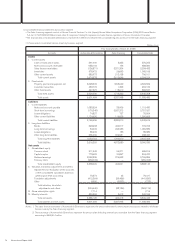

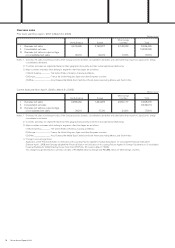

3. The following table shows the details of bonds with share subscription rights:

1st unsecured convertible bonds with

share subscription rights issued

Description by subsidiaries

Type of shares to be issued upon exercise

of share subscription rights Common stock

Issue price (Yen) —

Exercise price (Yen) 499

Total exercise price (Millions of yen) 10,000

Upon exercise of the share subscription

rights, total exercise price to be credited to

common stock (Millions of yen) 9,753

Ratio (%) 100

Exercise period From June 2, 2003

To March 30, 2010

Substitutive deposits Note

Note: When the Holders request for exercise of the share subscription rights, the exercise price is deemed to be paid from maturity payment. Also, if the

share subscription rights are exercised, it is treated that such request is made.

4. The redemption schedule of bonds for 5 years subsequent to March 31, 2009 is summarized as follows:

(Millions of yen)

Due after one year Due after two years Due after three years Due after four years

Due within one year but within two years but within three years but within four years but within five years

220,884 410,426 76,626 73,264 —