Nissan 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

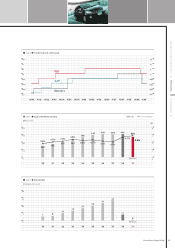

chart 08

<

<

IMPACT ON OPERATING PROFIT

chart 06

<

<

OPERATING PROFIT

<

chart 05

<

<

NET SALES

<

chart 07

<

<

NET INCOME

<

(Forecast)

(Forecast)

(Forecast)

<

10,824.2

8,437.0

6,950.0

9,428.3

10,468.6

(Billions of yen)

-134.2 -91.8 -40.2 -26.6 -13.8

+134.6 +8.2 -525.2

-223.0

790.8

-137.9

+5.6

-9.3 -8.7 -4.3

,05 ,06 ,07 ,08 ,09 ,05 ,06 ,07 ,08 ,09 ,05 ,06 ,07 ,08 ,09

-150

-300

1,200

0

900

600

300

-300

(Billions of yen)(Billions of yen)(Billions of yen)

600

0

450

300

150

482.3

-233.7

-170.0

790.8

-137.9 -100.0

871.8

776.9

12,000

0

9,000

6,000

3,000

518.1

460.8

FOREX Raw

material

/energy

costs

Provision for

residual risk

on leased

vehicles

Sales

finance

Purch.

cost

reduction

Mfg.

expenses

Warranty

expenses

Price/

volume mix

FY07

O.P.

Others Product

enrich./

regulatory

costs

Scope

change

R&D

expenses

Selling

expenses

FY08

O.P.

liabilities increased16.8 percent to ¥3,324.8 billion, primarily

because of a ¥649.1 billion increase in long-term borrowing.

Net assets decreased 24.0 percent to ¥2,926.1 billion,

compared to ¥3,849.4 billion in fiscal 2007. This was

mainly due to ¥233.7 billion in net losses and a ¥464.3

billion change in foreign currency translation adjustments.

Free cash flow and net debt (auto business)

In the fourth quarter of fiscal 2008,there was a significant

improvement in free cash flow of ¥363.5 billion. This

was due mainly to the improvement in working capital by

the reduction

in inventory. At the end of the third quarter,

net automotive

debt totaled ¥783.5 billion.The company’s

ability to generate free cash in the fourth quarter led to

a halving of its net debt position to ¥387.9 billion.

On a full-year basis, free cash flow deteriorated primarily

because of

a smaller net cash inflow from P&L items of

¥356.6 billion, as well as a negative impact on working

capital. Accounts payable decreased by ¥479.7 billion

due to dramatic production cuts. This was partially offset

by a reduction in receivables. Total accounts payable

and receivable resulted in a negative ¥286.2 billion. Due

to tight production control, total inventory was reduced by

¥88.3 billion. Including other factors, such as tax payments,

total cash flow for operating activities was positive by

¥39.9 billion. After ¥291.6 billion in investing activities,

which included ¥376.6 billion in capital expenditures, the

total net of free cash flow was negative by ¥251.7 billion.

Nissan Annual Report 2009 23

Managing Through the Global Crisis Performance Corporate Data