Nissan 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2009 49

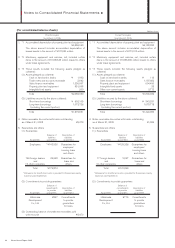

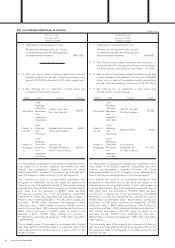

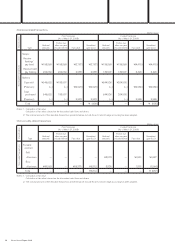

Prior fiscal year Current fiscal year

From April 1, 2007 From April 1, 2008

[

To March 31, 2008

][

To March 31, 2009

]

1.*1 Cash and cash equivalents as of the year end are reconciled

to the accounts reported in the consolidated balance sheet as

follows:

As of March 31, 2008:

Cash on hand and in banks ¥570,225

Time deposits with maturities of

more than three months (10,394)

Cash equivalents included

in securities (*) 24,271

Cash and cash equivalents ¥584,102

* This represents short-term, highly liquid investments readily

convertible into cash held by foreign subsidiaries.

2.*2 Major components of the assets and liabilities of the

companies that have been consolidated by acquiring their

shares

The following assets and liabilities have been consolidated

as a result of consolidating Atlet AB and its 16 subsidiaries

through the acquisition of their shares. The relation between

the acquisition value of these shares and the net

disbursement due to the acquisition is as follows.

Current assets ¥26,596

Fixed assets 14,158

Goodwill 5,063

Current liabilities (12,186)

Long-term liabilities (17,634)

Minority interests 0

Acquisition value of shares 15,997

Cash and cash equivalents (1,642)

Net disbursement due to the acquisition ¥14,355

1.*1 Cash and cash equivalents as of the year end are reconciled

to the accounts reported in the consolidated balance sheet as

follows:

As of March 31, 2009:

Cash on hand and in banks ¥632,714

Time deposits with maturities of

more than three months (12,699)

Cash equivalents included

in securities (*) 126,897

Cash and cash equivalents ¥746,912

* This represents short-term, highly liquid investments readily

convertible into cash held by foreign subsidiaries.

(Millions of yen)

(For consolidated statements of cash flows)