Nissan 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2009 43

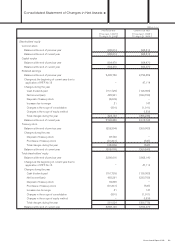

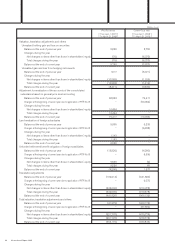

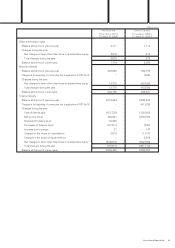

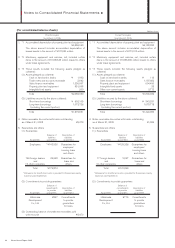

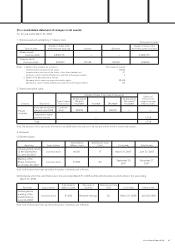

Prior fiscal year Current fiscal year

From April 1, 2007 From April 1, 2008

[

To March 31, 2008

][

To March 31, 2009

]

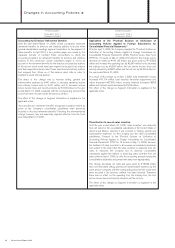

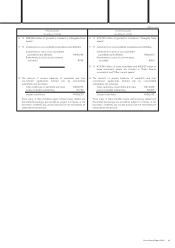

Consolidated statements of income

(1) A gain on prior period adjustments was presented as a separate

account until the prior fiscal year. Due to its minor importance,

however, this account, in the amount of ¥1,383 million for the

current fiscal year, has been included in “Other” under “Special

gains.”

(2) A loss on prior period adjustments was presented as a separate

account until the prior fiscal year. Due to its minor importance,

however, this account, in the amount of ¥1,637 million for the

current fiscal year, has been included in “Other” under “Special

losses.”

Consolidated balance sheet

Upon the adoption of the Cabinet Office Ordinance No. 50 for

Partical Amendment to the Regulation for Terminology, Forms and

Preparation of Financial Statements (August 7, 2008), the accounts

presented as “Finished goods” and “Other inventories” until the prior

fiscal year have been reclassified into “Merchandise and finished

goods,” “Work in process” and “Raw materials and supplies,”

effective from the current fiscal year.

“Work in process” and “Raw materials and supplies” included in

“Other inventories” for the prior fiscal year amounted to ¥130,406

million and ¥164,961 million, respectively.

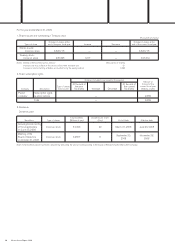

Consolidated statement of income

(1) The “Gain on implementation of defined contribution plans” was

presented as a separate account until the prior fiscal year. Due

to its decreased materiality, however, this account, in the amount

of ¥332 million for the current fiscal year, has been included in

“Other” under “Special gains.”

(2) The “Loss on sales of investment securities” (which amounts to

¥41 million for the current fiscal year) and the “Loss on

implementation of defined contribution plans” (which amounts to

¥60 million for the current fiscal year) were presented as

separate accounts until the prior fiscal year. Due to their

decreased materiality, however, these accounts have been

included in “Other” under “Special losses.”

Consolidated statement of cash flows

(1)

Beginning with the current fiscal year, the “Provision for residual

value risk of leased vehicles” is separately presented due to its

increased materiality. The “Provision for residual value risk of leased

vehicles” in the amount of ¥25,738 million was included in “Other”

under “Cash flows from operating activities” for the prior fiscal year.

(2)

Beginning with the current fiscal year, the “Loss (gain) on sales of

property, plant and equipment” and the “Loss (gain) on sales of

intangible fixed assets” have been combined into the “Loss (gain) on

sales of fixed assets” under “Cash flows from operating activities.”

The “Loss (gain) on sales of fixed assets” for the current fiscal

year includes the “Loss (gain) on sales of intangible fixed

assets” in the amount of ( ¥41,038 ) million.

(3)

Beginning with the current fiscal year, the “Proceeds from sales of

property, plant and equipment” and the “Proceeds from sales of

intangible fixed assets” have been combined into the “Proceeds from

sales of fixed assets” under “Cash flows from investing activities.”

The “Proceeds from sales of fixed assets” for the current fiscal

year includes the “Proceeds from sales of intangible fixed

assets” in the amount of ¥41,362 million.

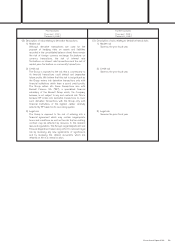

Changes in Presentation >

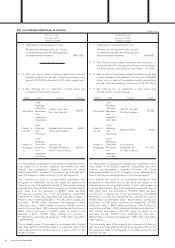

Additional information

Prior fiscal year Current fiscal year

From April 1, 2007 From April 1, 2008

[

To March 31, 2008

][

To March 31, 2009

]

Accrued Retirement Benefits for Directors and Statutory auditors

Until the year ended March 31, 2007, the Company expensed

retirement benefits for directors and statutory auditors to income

when general shareholders’ meetings approved resolutions for the

payments of those benefits. However, a resolution was approved at

the general shareholders’ meeting held on June 20, 2007 that

retirement benefits for directors and statutory auditors in response to

the discontinuation of such system to be paid to the relevant

directors and statutory auditors when they retire. Accordingly, the

Company recognized the amount of expected payments for this

purpose as a special loss and included the outstanding balance in

“Other long-term liabilities” for the fiscal year ended March 31, 2008.