Nissan 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 Nissan Annual Report 2009

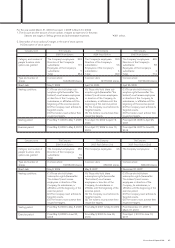

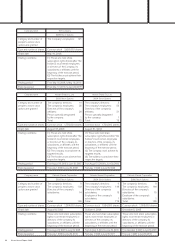

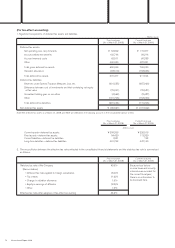

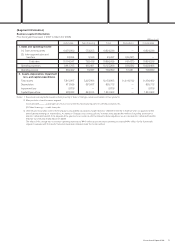

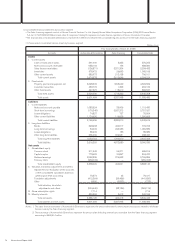

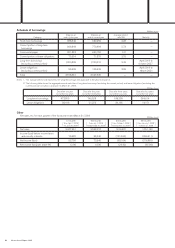

4. Consolidated financial statements by business segment

• The Sales financing segment consists of Nissan Financial Services Co., Ltd. (Japan), Nissan Motor Acceptance Corporation (USA), NR Finance Mexico

S.A. de C.V. SOFOM E.N.R (Mexico) and other 5 companies, totaling 8 companies, and sales finance operations of Nissan Canada Inc. (Canada).

•The financial data on Automobile & Eliminations represent the differences between the consolidated figures and those for the Sales financing segment.

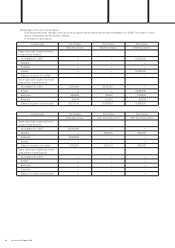

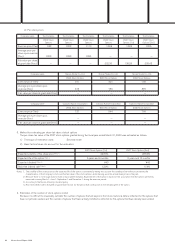

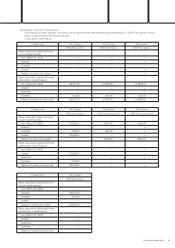

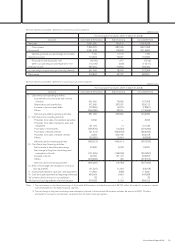

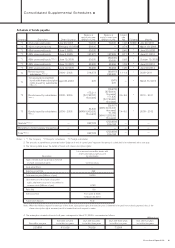

(1) Summarized consolidated balance sheets by business segment

(Millions of yen)

Prior fiscal year (As of March 31, 2008)

Accounts Automobile & Eliminations Sales financing Consolidated total

Assets

I. Current assets

Cash on hand and in banks 561,900 8,325 570,225

Notes and accounts receivable 688,104 196 688,300

Sales finance receivables (136,871) 3,371,304 3,234,433

Inventories 978,472 26,693 1,005,165

Other current assets 582,973 213,128 796,101

Total current assets 2,674,578 3,619,646 6,294,224

II. Fixed assets

Property, plant and equipment, net 3,028,503 1,598,049 4,626,552

Investment securities 450,776 1,393 452,169

Other fixed assets 447,627 118,910 566,537

Total fixed assets 3,926,906 1,718,352 5,645,258

Total assets 6,601,484 5,337,998 11,939,482

Liabilities

I. Current liabilities

Notes and accounts payable 1,083,524 35,906 1,119,430

Short-term borrowings (170,345) 2,927,372 2,757,027

Lease obligations 74,827 727 75,554

Other current liabilities 1,174,600 116,005 1,290,605

Total current liabilities 2,162,606 3,080,010 5,242,616

II. Long-term liabilities

Bonds 348,208 424,517 772,725

Long-term borrowings 54,903 995,986 1,050,889

Lease obligations 85,203 186 85,389

Other long-term liabilities 565,439 372,981 938,420

Total long-term liabilities 1,053,753 1,793,670 2,847,423

Total liabilities 3,216,359 4,873,680 8,090,039

Net assets

I. Shareholders’ equity

Common stock 511,543 94,271 605,814

Capital surplus 773,623 30,847 804,470

Retained earnings 2,352,336 374,523 2,726,859

Treasury stock (269,003) — (269,003)

Total shareholders’ equity 3,368,499 499,641 3,868,140

II. Valuation, translation adjustments and others

Adjustments for revaluation of the accounts

of the consolidated subsidiaries based on

general price level accounting 79,374 43 79,417

Translation adjustments (412,364) (29,456) (441,820)

Other 8,550 (9,323) (773)

Total valuation, translation

adjustments and others (324,440) (38,736) (363,176)

III. Share subscription rights 1,714 — 1,714

IV. Minority interests 339,352 3,413 342,765

Total net assets 3,385,125 464,318 3,849,443

Total liabilities and net assets 6,601,484 5,337,998 11,939,482

Notes: 1. The sales finance receivables of Automobile & Eliminations represents the amount eliminated for intercompany transactions related to wholesale

finance made by the Sales financing segment.

2. The borrowings of Automobile & Eliminations represent the amount after deducting internal loans receivable from the Sales financing segment

amounting to ¥900,614 million.