Nissan 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2009 69

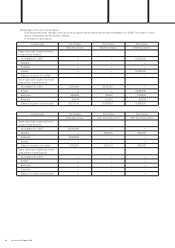

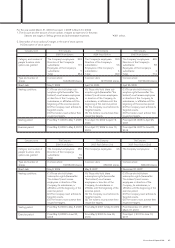

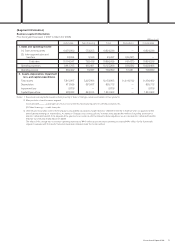

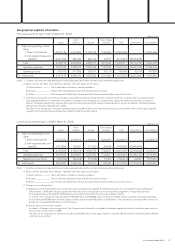

2) Per share prices

Company name The Company The Company The Company The Company The Company The Company The Company

2003 Stock 2004 Stock 2005 Stock 2006 Stock 2007 Stock 2007 Stock 2008 Stock

Options Options Options Options Options [1st] Options [2nd] Options

Exercise price (Yen) 932 1,202 1,119 1,526 1,333 1,205 975

Average price per

share upon exercise

(Yen) — — — — — — —

Fair value per share

at grant date (Yen) — — — 222.30 136.29 205.43 168.99

Company name Nissan Shatai Co., Ltd. Nissan Shatai Co., Ltd.

2003 Stock Options 2004 Stock Options

Exercise price (Yen) 421 759

Average price per share upon

exercise (Yen) — 829

Fair value per share at grant date (Yen) — —

Company name Calsonic Kansei Corporation Calsonic Kansei Corporation Calsonic Kansei Corporation

2003 Stock Options 2004 Stock Options 2005 Stock Options

Exercise price (Yen) 737 844 759

Average price per share upon

exercise (Yen) — — —

Fair value per share at grant date (Yen) — — —

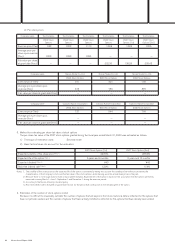

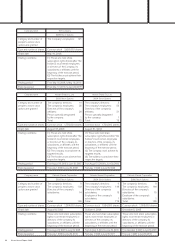

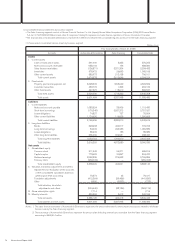

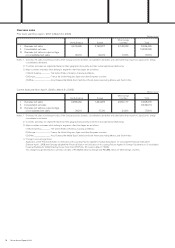

3. Method for estimating the per share fair value of stock options

The per share fair value of the 2008 stock options granted during the fiscal year ended March 31, 2009, was estimated as follows.

1) Technique of estimation used: Binomial model

2) Basic factors taken into account for the estimation:

2008 Stock Options

Expected volatility of the share price (Note 1) 30.00%

Expected life of the option (Note 2) 6 years

Expected dividend (Note 3) ¥42

Risk-free interest rate (Note 4) 1.35%

Notes: 1. The volatility of the share price for the expected life of the option is estimated by taking into account the volatility of the entire stock market, the

characteristics of the Company’s stock and the fair value of the stock options, while drawing upon the actual share prices in the past.

2. Because there is not enough data to make a reasonable estimation, the expected life of the option is based on the assumption that the options are evenly

exercised on every June 1, September 1, December 1 and March 1 during the exercise period.

3. According to the Nissan GT 2012 dividend policy at grant date.

4. The risk-free interest rate is the yield on government bonds for the period that corresponds to the remaining life of the option.

4. Estimation of the number of stock options vested

Because it is difficult to reasonably estimate the number of options that will expire in the future, historical data is reflected for the options that

have not yet been vested, and the number of options that have actually forfeited is reflected for the options that have already been vested.