Nissan 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2009 75

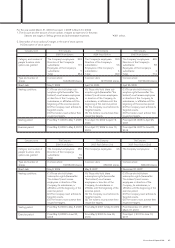

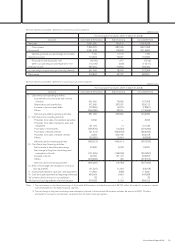

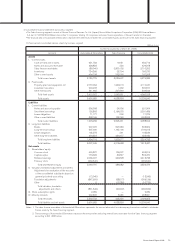

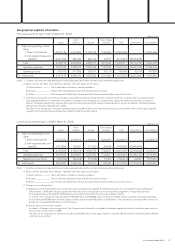

4. Consolidated financial statements by business segment

• The Sales financing segment consists of Nissan Financial Services Co., Ltd. (Japan), Nissan Motor Acceptance Corporation (USA), NR Finance Mexico

S.A. de C.V. SOFOM E.N.R (Mexico) and other 7 companies, totaling 10 companies, and sales finance operations of Nissan Canada Inc. (Canada).

•The financial data on Automobile & Eliminations represent the differences between the consolidated figures and those for the Sales financing segment.

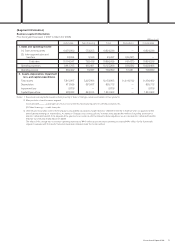

(1) Summarized consolidated balance sheets by business segment

(Millions of yen)

Current fiscal year (As of March 31, 2009)

Accounts Automobile & Eliminations Sales financing Consolidated total

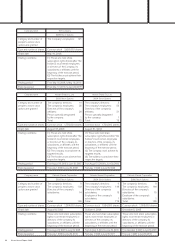

Assets

I. Current assets

Cash on hand and in banks 621,783 10,931 632,714

Notes and accounts receivable 428,858 220 429,078

Sales finance receivables (89,940) 2,800,192 2,710,252

Inventories 734,366 25,704 760,070

Other current assets 494,708 252,560 747,268

Total current assets 2,189,775 3,089,607 5,279,382

II. Fixed assets

Property, plant and equipment, net 2,770,034 1,340,013 4,110,047

Investment securities 299,208 1,369 300,577

Other fixed assets 341,665 207,869 549,534

Total fixed assets 3,410,907 1,549,251 4,960,158

Total assets 5,600,682 4,638,858 10,239,540

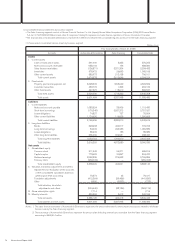

Liabilities

I. Current liabilities

Notes and accounts payable 596,998 24,906 621,904

Short-term borrowings 126,893 2,164,593 2,291,486

Lease obligations 71,177 202 71,379

Other current liabilities 898,165 105,760 1,003,925

Total current liabilities 1,693,233 2,295,461 3,988,694

II. Long-term liabilities

Bonds 297,976 297,333 595,309

Long-term borrowings 507,909 1,192,106 1,700,015

Lease obligations 105,278 261 105,539

Other long-term liabilities 493,553 430,377 923,930

Total long-term liabilities 1,404,716 1,920,077 3,324,793

Total liabilities 3,097,949 4,215,538 7,313,487

Net assets

I. Shareholders’ equity

Common stock 499,807 106,007 605,814

Capital surplus 773,623 30,847 804,470

Retained earnings 2,065,907 349,828 2,415,735

Treasury stock (269,540) — (269,540)

Total shareholders’ equity 3,069,797 486,682 3,556,479

II. Valuation, translation adjustments and others

Adjustments for revaluation of the accounts

of the consolidated subsidiaries based on

general price level accounting (13,945) — (13,945)

Translation adjustments (847,609) (58,517) (906,126)

Other 5 (10,780) (10,775)

Total valuation, translation

adjustments and others (861,549) (69,297) (930,846)

III. Share subscription rights 2,089 — 2,089

IV. Minority interests 292,396 5,935 298,331

Total net assets 2,502,733 423,320 2,926,053

Total liabilities and net assets 5,600,682 4,638,858 10,239,540

Notes: 1. The sales finance receivables of Automobile & Eliminations represents the amount eliminated for intercompany transactions related to wholesale

finance made by the Sales financing segment.

2. The borrowings of Automobile & Eliminations represent the amount after deducting internal loans receivable from the Sales financing segment

amounting to ¥611,588 million.