Nissan 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Changes in Accounting Policies >

42 Nissan Annual Report 2009

Prior fiscal year Current fiscal year

From April 1, 2007 From April 1, 2008

[

To March 31, 2008

][

To March 31, 2009

]

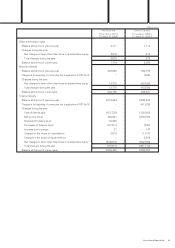

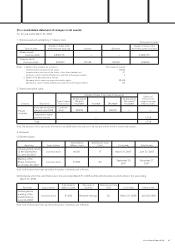

Accounting for Directors’ Retirement Benefits

Until the year ended March 31, 2008, certain subsidiaries expensed

retirement benefits for directors and statutory auditors to income when

general shareholders’ meetings approved resolutions for the payment of

those benefits. In April 2007, a new position paper was issued by the

Japanese Institute of Certified Public Accountants to clarify the

accounting treatment for retirement benefits for directors and statutory

auditors. In this connection, certain subsidiaries began to record an

accrual for the retirement benefits for the directors and statutory auditors

at the amount which would have been required to be paid in accordance

with their respective internal rules if those directors and statutory auditors

had resigned their offices as of the balance sheet date in order to

establish a sound financial position.

The effect of this change was to increase selling, general and

administrative expenses by ¥441 million, to decrease operating income

and ordinary income each by ¥441 million, and to decrease income

before income taxes and minority interests by ¥1,569 million for the year

ended March 31, 2008, compared with the corresponding amounts that

would have been recorded under the previous method.

The effect of this change on Segment Information is explained in the

applicable notes.

“Accrued directors’ retirement benefits” recognized on balance sheets by

some of the Company’s consolidated subsidiaries were previously

included in “Accrued retirement benefits.” Following the aforementioned

change, however, they are separately reported effective from the fiscal

year ended March 31, 2008.

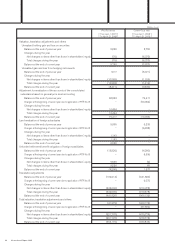

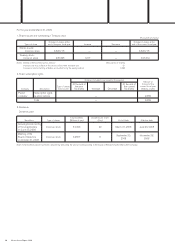

Application of the “Practical Solution on Unification of

Accounting Policies Applied to Foreign Subsidiaries for

Consolidated Financial Statements”

Effective April 1, 2008, the Company adopted the “Practical Solution on

Unification of Accounting Policies Applied to Foreign Subsidiaries for

Consolidated Financial Statements” (ASBJ Practical Issues Task Force

(PITF) No. 18 issued on May 17, 2006). The effect of this change was to

decrease net sales by ¥160,145 million and gross profit by ¥147,683

million and increase the operating loss by ¥2,649 million but to decrease

the ordinary loss by ¥4,258 million, the loss before income taxes and

minority interests by ¥3,667 million and the net loss by ¥2,349 million for

the year ended March 31, 2009.

As a result of this change, as of April 1, 2008, total shareholders’ equity

increased ¥47,114 million, total valuation translation adjustments and

others decreased ¥87,892 million, minority interests decreased ¥898

million and total net assets decreased ¥41,676 million.

The effect of this change on Segment Information is explained in the

applicable notes.

Classification to record sales incentive

Until the year ended March 31, 2008, “sales incentive” was deducted

from net sales for the consolidated subsidiaries in the United States of

America and Mexico, whereas it was included in “Selling, general and

administrative expenses” for the Company and the other consolidated

subsidiaries. Pursuant to the “Practical Solution on Unification of

Accounting Policies Applied to Foreign Subsidiaries for Consolidated

Financial Statements” (PITF No. 18 issued on May 17, 2006), however,

the treatment of sales incentive for all overseas consolidated subsidiaries

was unified to the effect that the sales incentive is deducted from net

sales. In response, the Company and its domestic consolidated

subsidiaries applied the method of deducting sales incentive from net

sales, effective April 1, 2008, to unify the accounting principle among the

consolidated subsidiaries and present net sales more appropriately.

This change decreased net sales and gross profit by ¥15,938 million

each and decreased selling, general and administrative expenses by the

same amount compared with the corresponding amounts that would have

been recorded if the previous method had been followed. Therefore,

there was no effect on the operating loss, the ordinary loss, the loss

before income taxes and minority interests and the net loss.

The effect of this change on Segment Information is explained in the

applicable notes.