Nissan 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

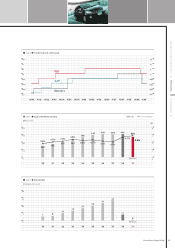

Credit rating Refer to chart 09

R&I downgraded Nissan’s long-term credit rating from A

to A- with a stable outlook on January 27, 2009. S&P

downgraded Nissan’s long-term credit rating from BBB+

to BBB with a stable outlook on February23, 2009.Moody’s

downgraded Nissan’s rating from A3 to Baa2 witha stable

outlook on February 25, 2009. (All ratings, as of March 31, 2009)

Sales finance

In conjunction with the decrease in retail sales, total

financial assets of the sales finance segment decreased

by 13.1 percent to ¥4,638.9 billion from ¥5,338.0 billion

in fiscal 2007. The sales finance segment generated

¥33.2 billion in operating profits.

The deterioration of the economy put pressure on credit

losses and led the company to make conservative pro

visions.

Credit quality control remains one of the company’s

priorities. Despite this, the company maintained the level of

penetration for loans and leases at around 45 percent on

a global basis, while providing support to the sales division.

Investment policy Refer to chart 10

Capital expenditures totaled ¥383.6 billion, which was

4.5 percent of net revenue. The company elected to

postpone, reduce or cancel specific capital investments

until there is better visibility regarding the duration of

the economic crisis. However, 50 percent of total

investments will be dedicated to new vehicles in fiscal

2009 in order to maintain Nissan’s future competitiveness.

R&D expenditures totaled ¥455.5 billion. These funds

were used to develop new technologies and products.

The company’s strength is the extensive collaborative

and development structure they enjoy with Renault’s

R&D team through the Alliance.

Dividend Refer to chart 11

An attractive dividend policy continues to be one of the

most important policies for management. And adherence

to a globally competitive dividend standard is key to its

shareholder relations.

The previously proposed dividend plan had been based

on a forecast for the period of fiscal 2008 through fiscal

2010, which was part of the NISSAN GT 2012 medium-

term business plan. However, in response to the current

environment, the company suspended the dividend plan.

The company will revisit the dividend policy once

conditions improve and free cash flow returns to a positive

level. The company remains committed to its R&D

activities, as they are indispensable for the development

of future technology, which in turn supports and ensures

long-term growth.

The company paid ¥11 per share as an interim

dividend in fiscal 2008. However, the company decided not

to pay a year-end dividend

to its shareholders, due to the

decline in profitability and negative free cash flow. As a

result, the full-year dividend is ¥11 per share.

Fiscal 2009 Outlook

In fiscal 2009, risks involve foreign exchange, distressed

suppliers, raw material price rebounds and further

deterioration in TIV. Nissan considers that opportunities

lie in exchange rates and in the hard synergies they will

develop with its Alliance partner, Renault.

In light of the outlook for fiscal 2009, the company filed

its forecast with the TokyoStock Exchange. Assumptions

included retail unit sales of 3,080,000 units, which is a

decrease of 9.7 percent from the prior year, and foreign-

exchange rates of ¥95 to the dollar and ¥125 to the euro.

●Net revenues are expected to be ¥6,950 billion

●Operating losses are expected to be ¥100 billion

●Net losses are expected to be ¥170 billion

●R&D expenses will amount to ¥400 billion

●Capital expenditures are expected to be ¥350 billion

The evolution in operating profit, compared to the fiscal

2008 results, is mainly linked to four key factors:

●Foreign exchange, which is expected to be a

negative ¥170 billion

●Deterioration in volume and mix is estimated to have

a negative impact of ¥200 billion

●Purchasing cost reduction, combined with the

decrease in raw material prices from last year, is

expected to be a positive ¥150 billion

●Others, mainly driven by fixed cost reductions, are

expected to be a positive ¥257.9 billion

The company strives to achieve a positive free cash

flow based on the assumptions above. The company

believes that this is an achievable target, as they will

continue with their efforts to improve working capital and

control capital expenditures.

(All figures for fiscal 2009 are forecasts, as of May 12, 2009)

24 Nissan Annual Report 2009