Nissan 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

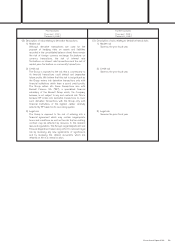

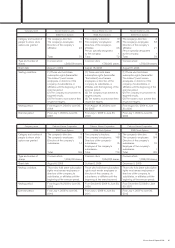

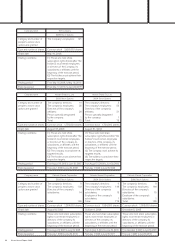

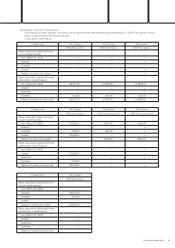

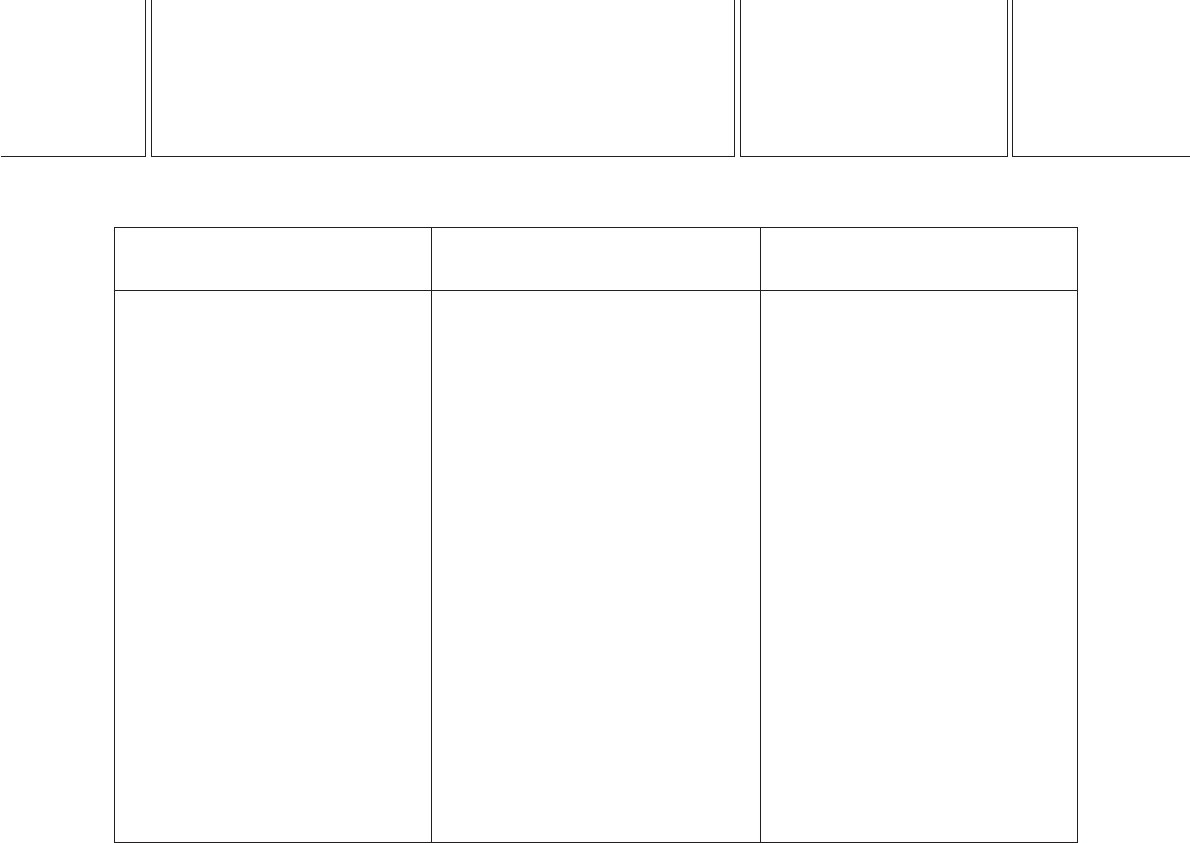

4. Assumptions used in accounting for the retirement benefit obligation

Prior fiscal year Current fiscal year

From April 1, 2007 From April 1, 2008

[

To March 31, 2008

][

To March 31, 2009

]

a. Attribution of retirement benefit obligation

b. Discount rates

c. Expected rate of return on plan assets

d. Amortization period of prior service cost

e. Amortization period of actuarial gain or

loss

f. Amortization period of net retirement

benefit obligation at transition

The straight-line method over the estimated

years of service of the eligible employees

Domestic companies: 2.1% – 2.3%

Foreign companies: 2.8% – 6.2%

Domestic companies: mainly 3.0%

Foreign companies: 2.8% – 9.0%

Prior service cost is being amortized as

incurred by the straight-line method over

periods (principally 9 years through 15 years)

which are shorter than the average remaining

years of service of the eligible employees.

Actuarial gain or loss is amortized in the year

following the year in which the gain or loss is

recognized primarily by the straight-line

method over periods (principally 9 years

through 18 years) which are shorter than the

average remaining years of service of the

eligible employees.

Certain foreign consolidated subsidiaries have

adopted the corridor approach for the

amortization of actuarial gain and loss.

Mainly 15 years

Same as the prior fiscal year.

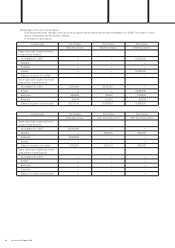

Domestic companies: 2.1% – 2.3%

Foreign companies: 2.3% – 8.4%

Domestic companies: mainly 3.0%

Foreign companies: 2.5% – 9.0%

Prior service cost is being amortized as

incurred by the straight-line method over

periods (principally 7 years through 15 years)

which are shorter than the average remaining

years of service of the eligible employees.

Actuarial gain or loss is amortized in the year

following the year in which the gain or loss is

recognized primarily by the straight-line

method over periods (principally 8 years

through 18 years) which are shorter than the

average remaining years of service of the

eligible employees.

Certain foreign consolidated subsidiaries have

adopted the corridor approach for the

amortization of actuarial gain and loss.

Same as the prior fiscal year.

Nissan Annual Report 2009 59