Nissan 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 Nissan Annual Report 2009

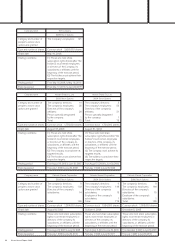

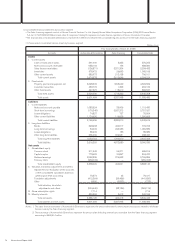

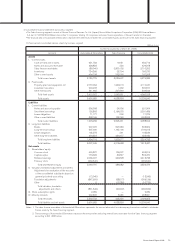

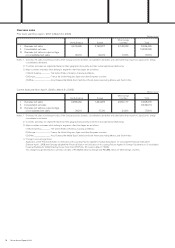

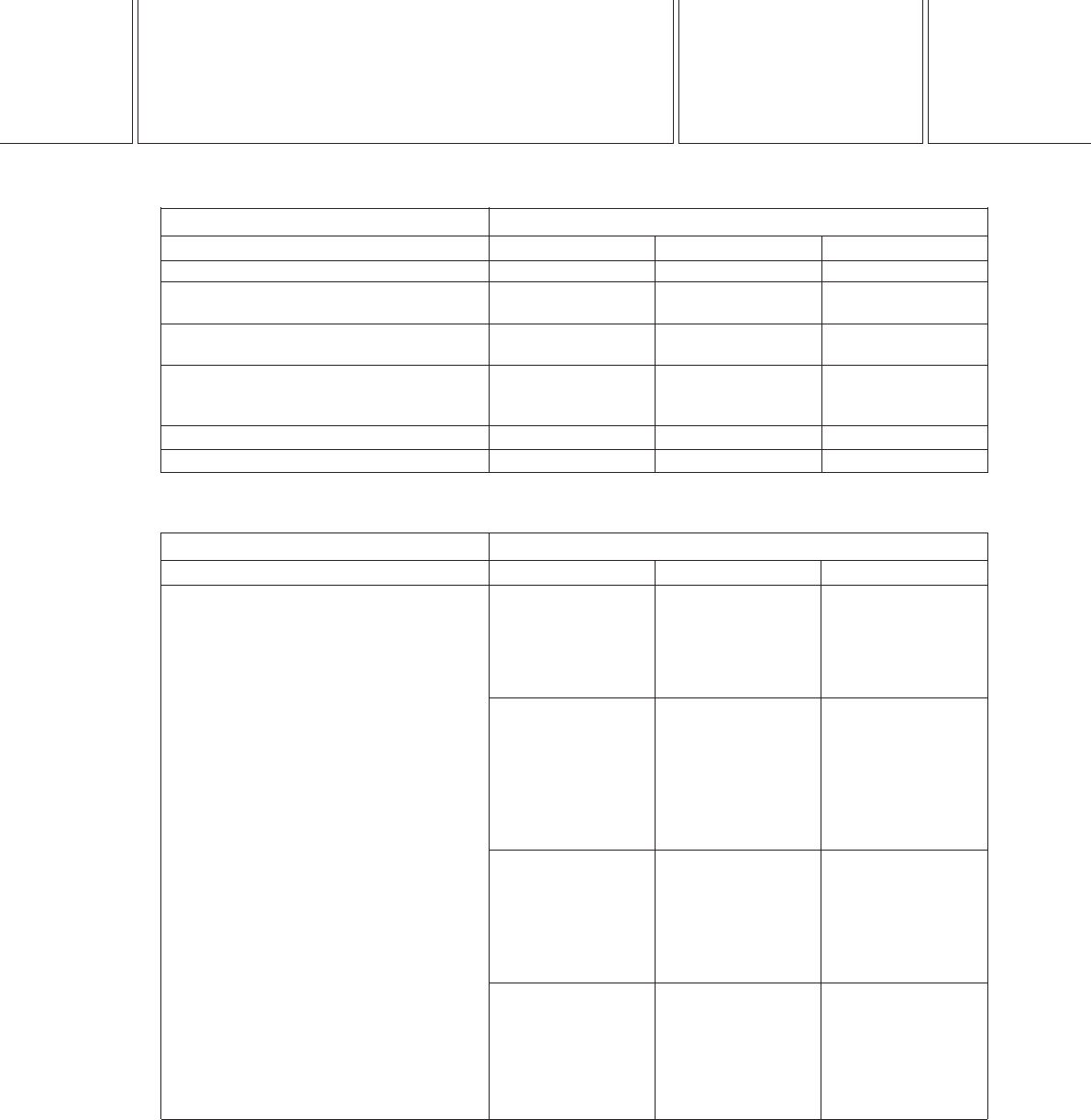

(2) Summarized consolidated statements of income by business segment

(Millions of yen)

Current fiscal year (From April 1, 2008 to March 31, 2009)

Accounts Automobile & Eliminations Sales financing Consolidated total

Net sales 7,760,173 676,801 8,436,974

Cost of sales 6,613,295 505,567 7,118,862

Gross profit 1,146,878 171,234 1,318,112

Operating income as a percentage of net sales (2.2%) 4.9% (1.6%)

Operating income (loss) (171,089) 33,168 (137,921)

Net financial cost (11,288) 201 (11,087)

Others (21,696) (2,036) (23,732)

Ordinary income (loss) (204,073) 31,333 (172,740)

Income (loss) before income taxes and minority interests

(248,604) 29,833 (218,771)

Net income (loss) (251,648) 17,939 (233,709)

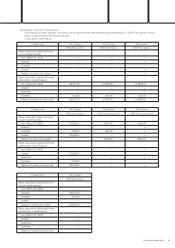

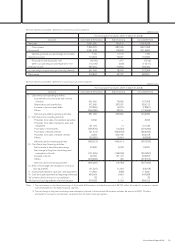

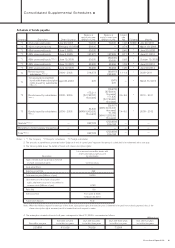

(3) Summarized consolidated statements of cash flows by business segment

(Millions of yen)

Current fiscal year (From April 1, 2008 to March 31, 2009)

Accounts Automobile & Eliminations Sales financing Consolidated total

I. Cash flows from operating activities

Income (loss) before income taxes and minority

interests (248,604) 29,833 (218,771)

Depreciation and amortization 450,391 315,971 766,362

Decrease (increase) in finance receivables (46,000) 423,422 377,422

Others (115,828) 81,541 (34,287)

Net cash provided by operating activities 39,959 850,767 890,726

II. Cash flows from investing activities

Proceeds from sales of investment securities 1,468 150 1,618

Proceeds from sales of fixed assets 154,750 1,511 156,261

Purchases of fixed assets (376,634) (9,488) (386,122)

Purchases of leased vehicles (27,441) (636,636) (664,077)

Proceeds from sales of leased vehicles 1,683 371,269 372,952

Others (45,497) (8,719) (54,216)

Net cash used in investing activities (291,671) (281,913) (573,584)

III. Cash flows from financing activities

Net increase (decrease) in short-term borrowings

225,602 (847,833) (622,231)

Net change in long-term borrowings and

redemption of bonds 378,046 251,372 629,418

Increase in bonds — 73,336 73,336

Others (179,780) (35,756) (215,536)

Net cash provided by (used in) financing activities

423,868 (558,881) (135,013)

IV. Effect of exchange rate changes on cash and

cash equivalents (23,848) (3,912) (27,760)

V. Increase in cash and cash equivalents 148,308 6,061 154,369

VI. Cash and cash equivalents at beginning of the year 574,963 9,139 584,102

VII. Increase due to inclusion in consolidation 2,387 6,054 8,441

VIII.Cash and cash equivalents at end of the year 725,658 21,254 746,912

Notes 1. The net increase in short-term borrowings of Automobile & Eliminations includes the amount of ¥343,504 million eliminated for decrease in

internal loans receivable from the Sales financing segment.

2. The net change in long-term borrowings and redemption of bonds of Automobile & Eliminations includes the amount of ¥112,109 million

eliminated for increase in internal loans receivable from the Sales financing segment.