Nissan 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

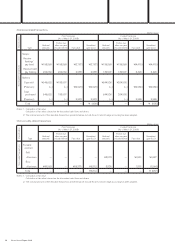

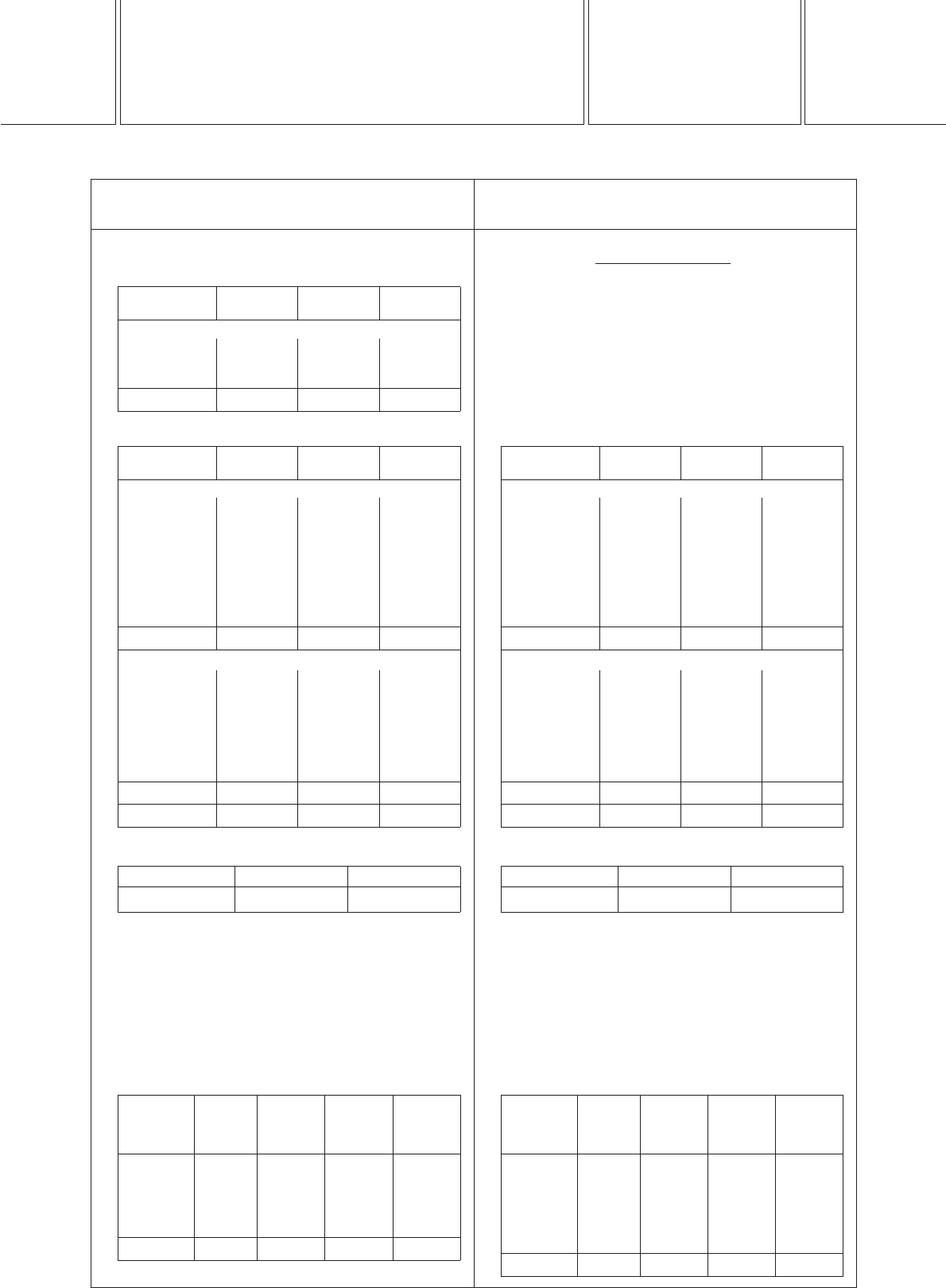

Prior fiscal year Current fiscal year

From April 1, 2007 From April 1, 2008

[

To March 31, 2008

][

To March 31, 2009

]

(Millions of yen)

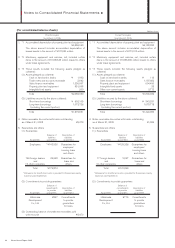

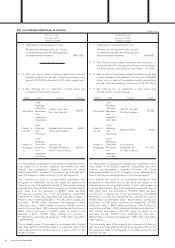

Securities

1. Marketable held-to-maturity debt securities

(As of March 31, 2008)

Types of Carrying Estimated Unrealized

securities value fair value gain (loss)

(Securities whose fair value does not exceed their carrying value)

Government

bonds

¥77 ¥77

—

Corporate bonds — — —

Total

¥77 ¥77 —

2. Marketable other securities

(As of March 31, 2008)

Types of Acquisition Carrying Unrealized

securities cost value gain (loss)

(Securities whose carrying value exceed their acquisition cost)

Stock ¥4,464 ¥16,226 ¥11,762

Bonds:

Government

bonds — — —

Corporate

bonds — — —

Others bonds — — —

Others — — —

Subtotal 4,464 16,226 11,762

(Securities whose carrying value does not exceed their acquisition cost)

Stock 1,834 1,049 (785)

Government

bonds — — —

Corporate

bonds — — —

Others bonds — — —

Others 4,902 4,846 (56)

Subtotal 6,736 5,895 (841)

Total ¥11,200 ¥22,121 ¥10,921

3. Other securities sold during the current fiscal year

(From April 1, 2007 to March 31, 2008)

Sales proceeds Total gain Total loss

4,823 801 (2)

4. Carrying value of major securities whose fair value is not

available is as follows: (As of March 31, 2008)

Other securities:

Unlisted domestic stocks (excluding those

traded on the over-the-counter market) ¥3,915

Unlisted foreign stocks 1,209

Unlisted foreign investment trusts 19,425

5. The redemption schedule for securities with maturity dates which

are classified as other securities and held-to-maturity debt securities

(As of March 31, 2008)

Due after Due after

one year five years

Types of Due within but within but within Due after

securities one year five years ten years ten years

Bonds:

Government

bonds ¥77 — — —

Corporate

bonds — 179 4 —

Total ¥77 ¥179 ¥4 —

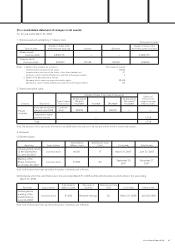

Securities

1. Marketable other securities

(As of March 31, 2009)

Types of Acquisition Carrying Unrealized

securities cost value gain (loss)

(Securities whose carrying value exceed their acquisition cost)

Stock ¥1,319 ¥7,468 ¥6,149

Bonds:

Government

bonds 81 86 5

Corporate

bonds — — —

Others bonds — — —

Others — — —

Subtotal 1,400 7,554 6,154

(Securities whose carrying value does not exceed their acquisition cost)

Stock 3,226 1,560 (1,666)

Government

bonds — — —

Corporate

bonds 225 214 (11)

Others bonds 37 32 (5)

Others 221 130 (91)

Subtotal 3,709 1,936 (1,773)

Total ¥5,109 ¥9,490 ¥4,381

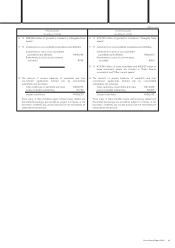

2. Other securities sold during the current fiscal year

(From April 1, 2008 to March 31, 2009)

Sales proceeds Total gain Total loss

557 381 (29)

3. Carrying value of major securities whose fair value is not

available is as follows: (As of March 31, 2009)

Other securities:

Unlisted domestic stocks (excluding those

traded on the over-the-counter market) ¥3,693

Unlisted foreign stocks 858

Unlisted foreign investment trusts 126,897

4. The redemption schedule for securities with maturity dates which

are classified as other securities and held-to-maturity debt securities

(As of March 31, 2009)

Due after Due after

one year five years

Types of Due within but within but within Due after

securities one year five years ten years ten years

Bonds:

Government

bonds 7 — 17 57

Corporate

bonds — 203 4 8

Other bonds

—21319

Total 7 205 34 84

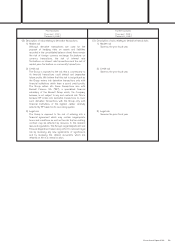

(For securities)

Nissan Annual Report 2009 51