Nissan 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

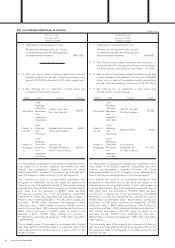

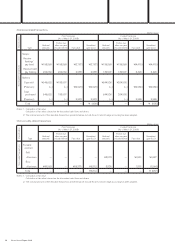

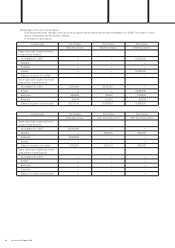

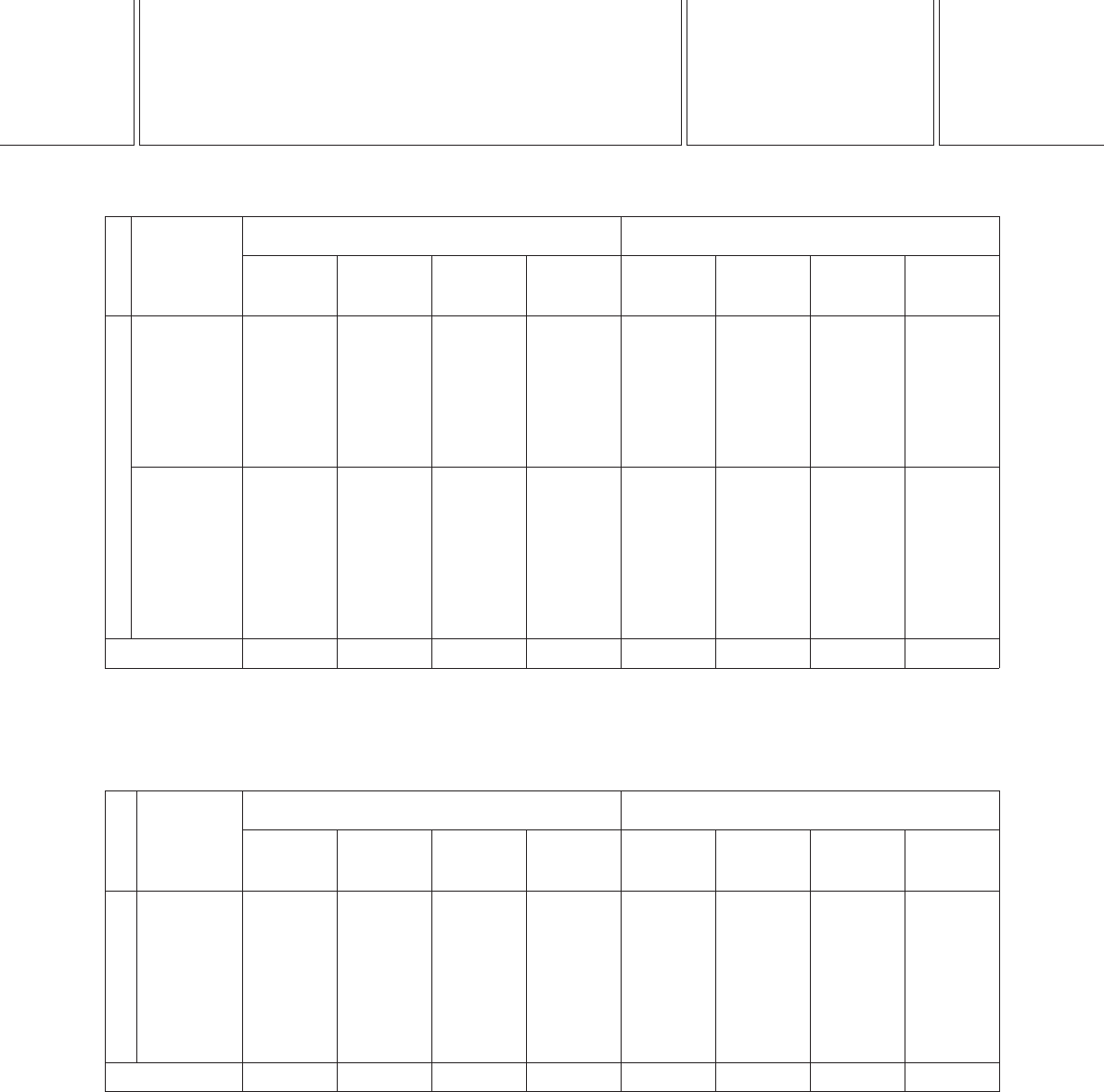

(2) Interest-related transactions

(Millions of yen)

Prior fiscal year Current fiscal year

(As of March 31, 2008) (As of March 31, 2009)

Swaps:

Receive

floating/

pay fixed ¥198,869 ¥198,869 ¥(2,787) ¥(2,787) ¥135,869 ¥135,869 ¥(4,418) ¥(4,418)

Receive fixed/

pay floating 202,060 202,060 2,288 2,288 139,597 139,597 3,420 3,420

Options

Caps sold ¥546,622 ¥183,007 ¥644,936 ¥324,992

(Premium) (—) (—) ¥(2,923) ¥(2,923) (—) (—) ¥(2,986) ¥(2,986)

Caps

purchased 546,622 183,007 644,936 324,992

(Premium) (—) (—) 2,923 2,923 (—) (—) 2,986 2,986

Total — — — ¥ (499) — — — ¥ (998)

Notes: 1. Calculation of fair value

Calculation of fair value is based on the discounted cash flows and others.

2. The notional amounts of the derivative transactions presented above exclude those for which hedge accounting has been adopted.

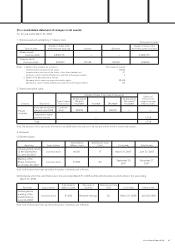

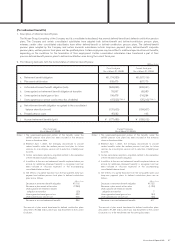

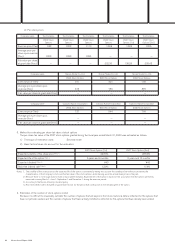

(3) Commodity-related transactions

(Millions of yen)

Prior fiscal year Current fiscal year

(As of March 31, 2008) (As of March 31, 2009)

Forward

contract

Sell:

Aluminum — — — — ¥3,578 — ¥1,891 ¥1,687

Buy:

Aluminum ¥49,563 — ¥55,375 ¥5,812 3,835 — 1,891 (1,944)

Total — — — ¥5,812 — — — ¥ (257)

Notes: 1. Calculation of fair value

Calculation of fair value is based on the discounted cash flows and others.

2. The notional amounts of the derivative transactions presented above exclude those for which hedge accounting has been adopted.

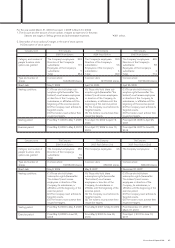

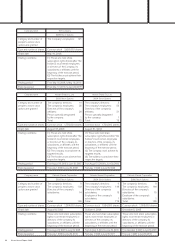

Classification

Type

Notional

amounts

Portion due

after one year

included herein Fair value

Unrealized

gain (loss)

Notional

amounts

Portion due

after one year

included herein Fair value

Unrealized

gain (loss)

Classification

Type

Notional

amounts

Portion due

after one year

included herein Fair value

Unrealized

gain (loss)

Notional

amounts

Portion due

after one year

included herein Fair value

Unrealized

gain (loss)

Non-market transactions

Non-market transactions

56 Nissan Annual Report 2009