Nissan 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

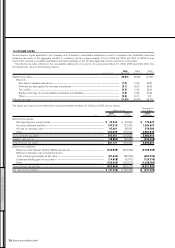

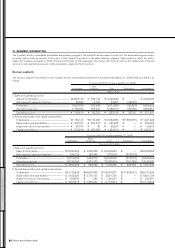

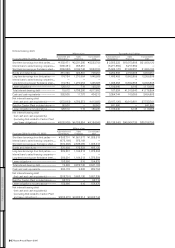

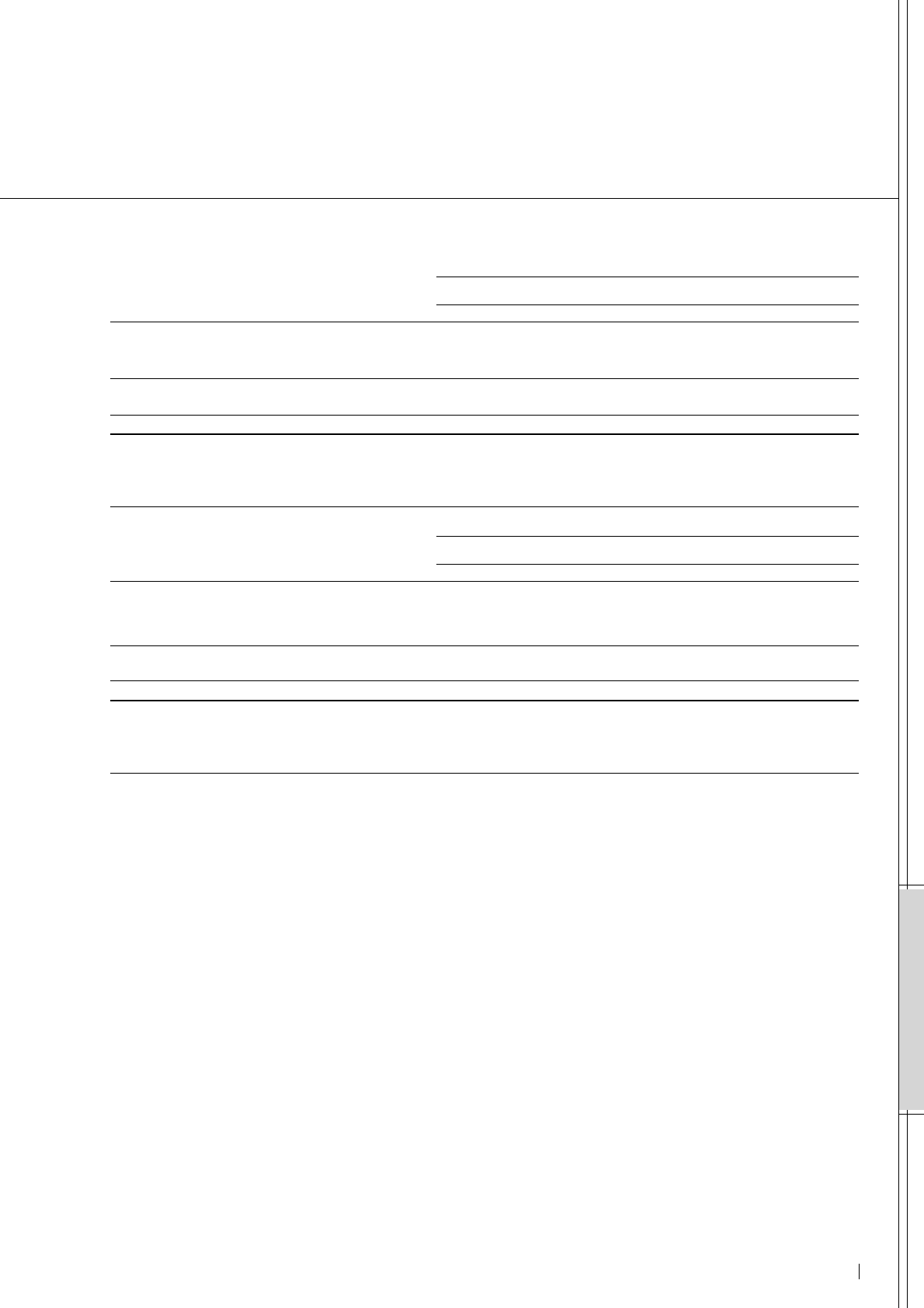

Fiscal year 2004 (For the year ended Mar. 31, 2005)

Sales

Automobile Financing Total Eliminations Consolidated

Millions of yen

I. Sales and operating income

Sales to third parties................................................................................... ¥8,177,841 ¥398,436 ¥8,576,277 ¥ — ¥8,576,277

Inter-segment sales and transfers................................................... 23,742 13,509 37,251 (37,251) —

Total sales............................................................................................................ 8,201,583 411,945 8,613,528 (37,251) 8,576,277

Operating expenses.................................................................................... 7,429,760 338,388 7,768,148 (53,031) 7,715,117

Operating income.......................................................................................... ¥ 771,823 ¥ 73,557 ¥ 845,380 ¥ 15,780 ¥ 861,160

II. Assets, depreciation and capital expenditures

Total assets ........................................................................................................ ¥6,646,594 ¥4,596,322 ¥11,242,916 ¥(1,394,393) ¥9,848,523

Depreciation and amortization............................................................ ¥ 349,163 ¥ 176,763 ¥ 525,926 ¥ — ¥ 525,926

Capital expenditures................................................................................... ¥ 469,283 ¥ 582,468 ¥ 1,051,751 ¥ — ¥1,051,751

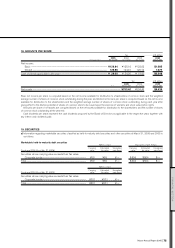

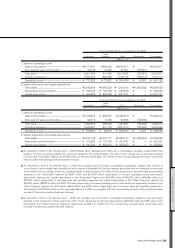

Fiscal year 2003 (For the year ended Mar. 31, 2004)

Sales

Automobile Financing Total Eliminations Consolidated

Millions of yen

I. Sales and operating income

Sales to third parties................................................................................... ¥7,072,982 ¥ 356,237 ¥7,429,219 ¥ — ¥7,429,219

Inter-segment sales and transfers................................................... 22,916 9,752 32,668 (32,668) —

Total sales............................................................................................................ 7,095,898 365,989 7,461,887 (32,668) 7,429,219

Operating expenses.................................................................................... 6,340,631 301,179 6,641,810 (37,446) 6,604,364

Operating income.......................................................................................... ¥ 755,267 ¥ 64,810 ¥ 820,077 ¥ 4,778 ¥ 824,855

II. Assets, depreciation and capital expenditures

Total assets ........................................................................................................ ¥5,847,139 ¥3,479,171 ¥9,326,310 ¥(1,466,454) ¥7,859,856

Depreciation and amortization............................................................ ¥ 313,289 ¥ 147,748 ¥ 461,037 ¥ — ¥ 461,037

Capital expenditures................................................................................... ¥ 441,384 ¥ 463,616 ¥ 905,000 ¥ — ¥ 905,000

Nissan Annual Report 2005 81

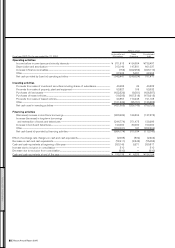

FINANCIAL SECTION

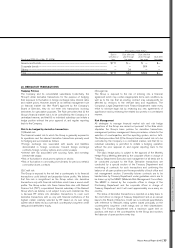

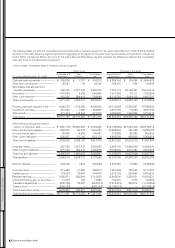

a) As described in Note 2 (b), effective April 1, 2003, Nissan Motor Manufacturing (UK) Ltd., a consolidated subsidiary, implemented early

adoption of a new accounting standard for retirement benefits in the United Kingdom. The effect of this change was to decrease operating

income in the “Automobile” segment by ¥1,686 million for the year ended March 31, 2004 from the corresponding amount which would have

been recorded if the previous method had been followed.

b) As described in Note 2 (c), effective April 1, 2003, the Company and its domestic consolidated subsidiaries changed their method of

accounting for noncancelable lease transactions which transfer substantially all risks and rewards associated with the ownership of the assets

to the lessee, from accounting for them as operating leases, to finance leases. The effect of this change was to decrease sales and operating

expenses in the “Automobile” segment by ¥237 million and ¥21,805 million respectively, to increase operating income, total assets,

depreciation expense and capital expenditures in the “Automobile” segment by ¥21,568 million ¥136,522 million, ¥46,986 million and

¥55,581 million, respectively, to decrease sales and operating expenses and capital expenditures in the “Sales Financing” segment by

¥33,351 million, ¥33,374 million and ¥29,716 million, respectively, to increase operating income, total assets and depreciation expense in the

“Sales Financing” segment by ¥23 million, ¥662 million and ¥292 million, respectively, and to increase sales and operating expenses in

“Eliminations” by ¥15,645 million for the year ended March 31, 2004 as compared with the corresponding amounts which would have been

recorded if the previous method had been followed.

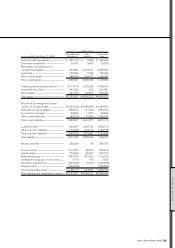

c) As described in Note 2 (f), effective April 1, 2005, the Company and its domestic consolidated subsidiaries adopted a new accounting

standard for the impairment of fixed assets. The effect of this change was to decrease total assets by ¥26,794 million and ¥33 million in the

“Automobile” and “Sales Financing” segments, respectively, at March 31, 2006 from the corresponding amounts which would have been

recorded if the previous method had been followed.