Nissan 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005 29

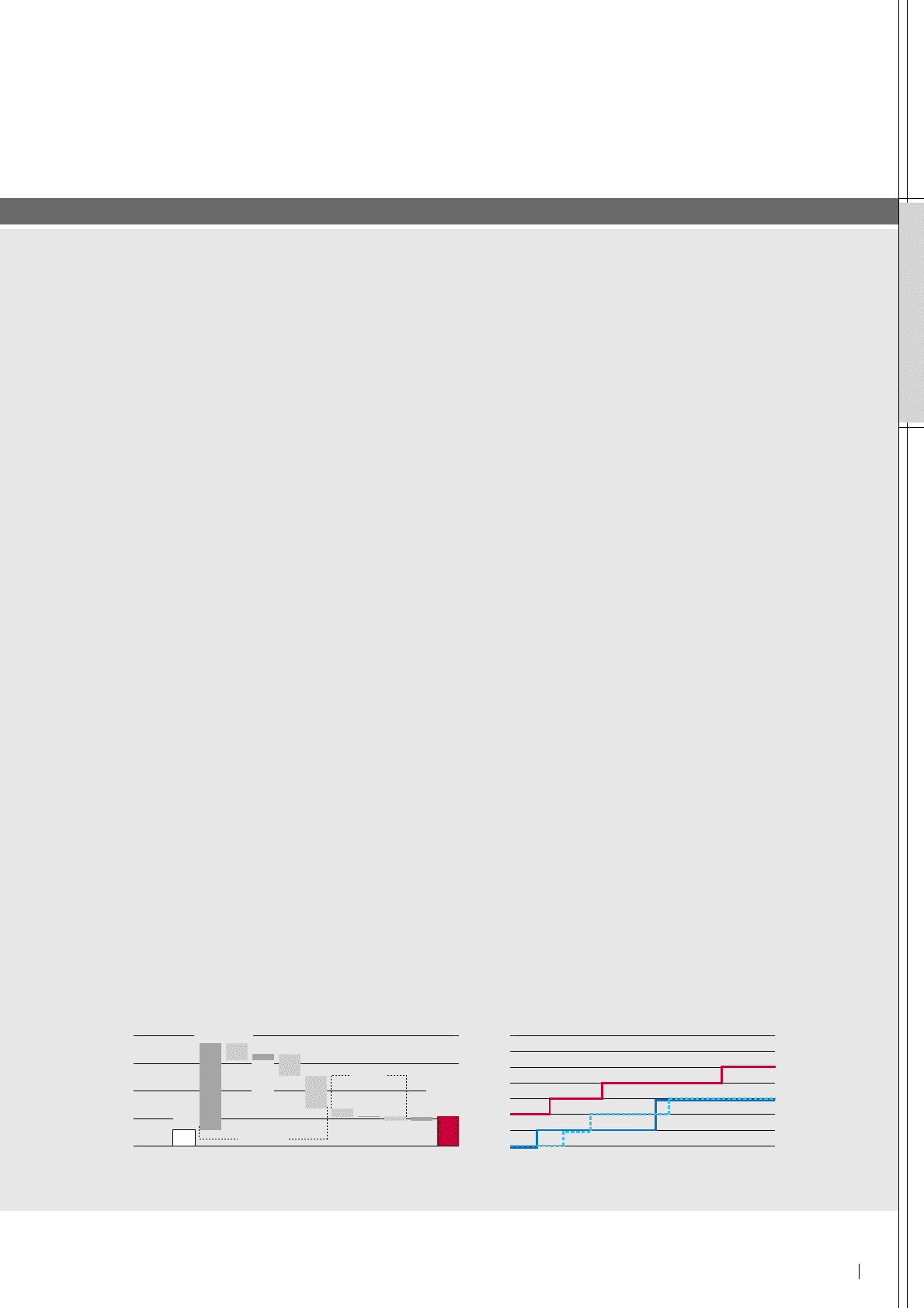

1,400

1,050

700

350

0

Free cash flow

¥271.3 billion

Financing

activities

¥154.2 billion

Net

automotive

cash at

the end

of FY04

Net

automotive

cash at the

end of

FY05

Operating

activities

Working

capital

and

others Investing

activities

Dividend

paid

Other

financial

activities

FX rate

impact

+1,106.3

+76.8

Pension

fund

–222.2

–419.8

Tax

paid

–269.8

+4.2

–105.7 –52.7 +50.0

372.9

205.8

Treasury

stock

Net Cash Flow (automotive)

(Billion Yen)

Regional profits were modified by a global

change of inter-company payments that favored

Japan, which bears most of the company’s

engineering and global development costs.

Operating profits in Japan amounted to ¥390.4

billion, compared to ¥341.1 billion yen in the

previous fiscal year. Profitability in the U.S. and

Canada totaled ¥345.4 billion, a slight drop

compared to the ¥379.7 billion in fiscal 2004.

Operating profit in Europe rose from ¥56 billion to

¥67.2 billion. In the General Overseas Markets,

which includes Mexico, operating profits came to

¥101.2 billion, up from ¥84.8 billion last year. Inter-

regional eliminations resulted in a loss of ¥32.4

billion, mostly from unrealized profit on inventory.

Net Income

Net non-operating expenses totaled ¥25.9 billion,

¥20.4 billion higher than last year, largely the result

of foreign exchange losses. Net extraordinary items

totaled negative ¥36.9 billion, which actually

represented an improvement of ¥25.5 billion from

last year. The losses are mainly due to one-time

changes resulting from a revision in Japanese

accounting standards relating to the impairment of

fixed assets. These losses were offset by a gain from

the sale of Nissan Diesel shares to Volvo.

Pre-tax income was ¥809 billion. Taxes totaled

¥254.4 billion, representing an effective consolidated

tax rate of 31.4 percent. Minority interests, which are

profits from fully consolidated companies that Nissan

does not own outright, such as Calsonic Kansei, Aichi

Kikai and Nissan Shatai, amounted to ¥36.5 billion.

Net income totaled ¥518.1 billion, an increase of

¥5.8 billion over last year.

FINANCIAL POSITION

Balance Sheet

In 2005, Nissan’s total consolidated assets went up

by 16.6 percent to ¥11,481.4 billion.

Current assets increased by 17.2 percent from

¥5,139.4 billion to ¥6,022.3 billion. The main reason

was a ¥562.3 billion increase in sales finance

receivables. Fixed assets increased by ¥750.6 billion

to ¥5,458.7 billion, a 15.9 percent rise. There was a

¥641.9 billion increase in property, plant and

equipment asset value thanks to capital expenditures

of ¥475 billion and foreign exchange gains of

¥228.6 billion.

Current liabilities went up by ¥877 billion, or 22.1

percent, to ¥4,851.7 billion. This included an

increase in short-term borrowings of ¥664.5 billion

for sales financing and foreign exchange activity of

¥198.5 billion.

In fiscal 2005, total shareholder equity increased

from ¥2,465.8 billion to ¥3,088 billion. This rise was

primarily due to net income of ¥518.1 billion, offset

by ¥105.7 billion in dividends paid. Consolidated

shareholder equity represented 32.8 percent of total

revenues and 26.9 percent of total assets.

Moody’s

S&P

R&I

A+

AA–

A

A–

BBB+

BBB

BBB–

BB+

Aa3

A1

A2

A3

Baa1

Baa2

Baa3

Ba1

9/01 4/02 9/02 4/03 9/03 4/04 9/04 4/05 9/05 4/06

Corporate Rating

PERFORMANCE