Nissan 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

relationship between The Bank of Yokohama and the Company

during the current fiscal year.

Haruo Murakami, the Company’s external corporate auditor,

currently serves as Part-time Counselor of Japan Telecom after

retiring as chairman of the Executive Committee of Japan Telecom

in June 2006. Japan Telecom provided the Company with various

services and facilities such as network maintenance and telephone

lines during the fiscal year under review.

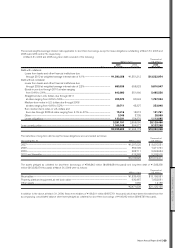

(2) Status of risk management system

The Company defines the risk as “factors which interrupt the

achievement of business objects,” and tries to identify and evaluate

such risk as soon as possible and to take necessary measures

against the risk so that the Company can minimize the probabilities

that risk arises and damages caused by the risk.

Risk management system

The Company has been evaluating risk of the Company and the

Group from various points of view and has been considering the

appropriate control system and methodology. A risk management

team established in the Financial Department has worked with sev-

eral global sections since 2004, sorted out the business risks, and

prioritized them based on the probabilities, impacts, and relevant

control level. Directors in charge were appointed and they have

been taking concrete measures against the risks for which actions

are required.

Furthermore, since April 2004, the Company has established

Intellectual Property Rights Management Department for the pur-

pose of protecting intellectual property rights in specific areas,

strengthening activities to protect Nissan’s intellectual property

rights, and abstracting new intellectual property rights. And the

department has been performing various activities to protect and

create Nissan Brand.

Since the fiscal year beginning April 1, 2005, the scope of risk

management has been expanded to address risks which are more

strategic or those relate to business processes in addition to the

original hazard risks. Functions or Departments, which operate risk

control, report the status through the normal reporting lines and EC

(Executive Committee) directly monitors the risk that must be con-

trolled on corporate level.

Compliance of corporate ethics and compliance system

In 2001, the Company established “Nissan Global Code of

Conduct” and distributed it to employees of domestic and foreign

Group companies. Moreover, the Company established “Nissan

Code of Conduct (Japanese Edition) ~Our Promises~” in 2004

and publicized it, which should be applied to employees of domes-

tic Group companies. This has been gradually implemented by the

Group companies.

The Company emphasizes education of employees based on

the idea that written conduct code must be understood by all

employees and reflected to their actions. All employees must take

learning programs by E-learning or VTR, and sign confirmations

regarding code of conduct after finishing the programs. The confir-

mations have already been received from almost every employee,

and compliance of corporate ethics has been penetrated into the

Nissan Group.

Furthermore, the Global Compliance Committee was estab-

lished in order to review the status of compliance with the code of

conduct and ensure that the code is fully complied. Managing

Director in charge of Human Resource is appointed as Global

Compliance Officer (GCO) and the chairman of regional compli-

ance committees established in each area such as Japan, North

America, Europe and Global Overseas Market. Those committees

promote the improvement of code of conduct, resolution of issues

and enlightenment activities. The “Easy Voice System,” which was

deployed in 2002 as a system that employees can freely commu-

nicate their opinions and demands to the companies, can acquaint

violation of compliance and behaviors possibly resulting in violation

and also contribute to improve business operations and to develop

corporate culture emphasizing to comply corporate ethics.

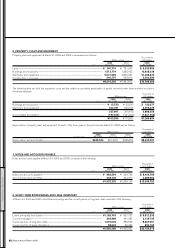

(3) Compensation paid to directors and corporate auditors

Compensation paid to Nissan’s directors consists of a fixed

amount of remuneration in cash and shares appreciation rights as

resolved at the 104th shareholders’ meeting held on June 19,

2003. The cash remuneration is limited to a maximum of ¥2.6 bil-

lion per annum as resolved at the 106th shareholders’ meeting

held on June 21, 2005 and the amount to be paid to each director

determined based on the business results and reflecting the firm’s

global competitiveness.

On the other hand, the shares appreciation rights are given as

motivation to the directors to stimulate continuous business devel-

opment and an increase in the profitability of the Group. This

incentive is linked to Nissan’s medium- or long-term business

results and is limited to the equivalent of 6 million shares of the

Company’s common stock per annum.

The remuneration paid to the corporate auditors is limited to a

yearly amount of ¥120 million as resolved at the 106th sharehold-

ers’ meeting held on June 21, 2005. This compensation is

designed to promote stable and transparent auditing.

For the current fiscal year, the aggregate amount disbursed to

the directors and corporate auditors was ¥2,527 million to eleven

directors and ¥86 million to six corporate auditors. In addition,

¥390 million was paid through an appropriation of retained earn-

ings as compensation to four directors, ¥624 million as retirement

allowances to two directors and ¥88 million to two corporate audi-

tors. In addition, shares appreciation rights equivalent to 4.8 million

shares were granted to seven directors.

(4) Remuneration to independent auditors

Remuneration paid to the independent auditors is summarized as

follows:

• Remuneration for services stipulated by the Certified Public

Accountant Law, Article 2, Paragraph 1 (Law No. 103, 1948)

for the current fiscal year: ¥510 million

• Remuneration for other services for the current fiscal year:

¥14 million

Nissan Annual Report 2005 59

FINANCIAL SECTION