Nissan 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

corresponding amounts which would have been recorded if the

previous method had been followed. In addition, this change had no

effect on segment information.

(e) Until the year ended March 31, 2005, the Company and its

domestic consolidated subsidiaries applied special treatment to

forward foreign exchange contracts entered into to hedge forecasted

sales denominated in foreign currencies. These contracts qualified for

deferral hedge accounting as these sales and accounts receivable

were translated and reflected in the consolidated financial statements

at their corresponding contracted rates.

Effective April 1, 2005, the Company and its domestic subsidiaries

changed their method of accounting for such sales, accounts

receivable and forward foreign exchange contracts and began

applying the benchmark method. Under this method, sales

denominated in foreign currencies are translated into Japanese yen

at the exchange rates in effect at each transaction date and the

related accounts receivable are translated at the exchange rates in

effect at the balance sheet dates, with the related exchange

differences charged or credited to income, whereas the forward

foreign exchange contracts are carried at fair value. This change was

made as a result of the implementation of a newly modified internal

operating system with respect to forward foreign exchange contracts

in order to achieve a better presentation of gain or loss related to

open derivatives positions. The effect of this change on the

consolidated financial statements was immaterial for the year ended

March 31, 2006.

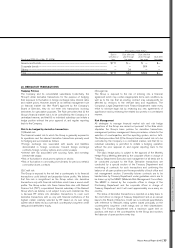

(f) Effective April 1, 2005, the Company and its domestic

consolidated subsidiaries adopted a new accounting standard for the

impairment of fixed assets. The Group bases its grouping for assessing

impairment losses on fixed assets on its business segments

(automobiles and sales finance) and geographical segments.

However, the Group determines whether or not an asset is impaired

on an individual asset basis depending on whether the asset is

deemed idle or if it is scheduled to be disposed of.

As a result of the adoption of this new standard, the Company and

its domestic consolidated subsidiaries have recognized an impairment

loss in the amount of ¥26,827 million ($229,291 thousand) on idle

assets and assets to be disposed of due to a significant decline in

their market value by reducing their book value to the respective net

realizable value of each asset. Accordingly, income before income

taxes and minority interests decreased by the same amount for the

year ended March 31, 2006 from the corresponding amount which

would have been recorded under the previous method. The effect of

this change on segment information is explained in Note 21.

Nissan Annual Report 2005 67

FINANCIAL SECTION

3. U.S. DOLLAR AMOUNTS

Amounts in U.S. dollars are included solely for the convenience of the reader. The rate of ¥117 = U.S.$1.00, the approximate rate of exchange in

effect on March 31, 2006, has been used. The inclusion of such amounts is not intended to imply that yen amounts have been or could be readily

converted, realized or settled in U.S. dollars at that or any other rate.

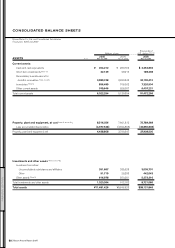

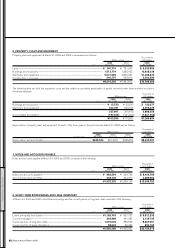

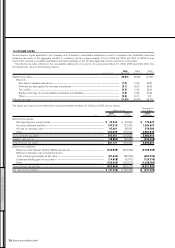

4. RECEIVABLES

Receivables at March 31, 2006 and 2005 consisted of the following:

Thousands of

Millions of yen U.S. dollars

2005 2004 2005

As of Mar. 31, 2006 Mar. 31, 2005 Mar. 31, 2006

Notes and accounts receivable......................................................................................................................................... ¥ 488,600 ¥ 538,029 $ 4,176,068

Finance receivables.................................................................................................................................................................... 3,589,127 3,026,788 30,676,299

Less allowance for doubtful receivables................................................................................................................... (87,979) (75,272) (751,957)

..................................................................................................................................................................................................................... ¥3,989,748 ¥3,489,545 $34,100,410

Finance receivables principally represent receivables from customers on loans made by financing subsidiaries in connection with sales of

automobiles.

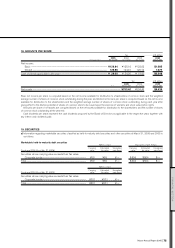

5. INVENTORIES

Inventories at March 31, 2006 and 2005 were as follows:

Thousands of

Millions of yen U.S. dollars

2005 2004 2005

As of Mar. 31, 2006 Mar. 31, 2005 Mar. 31, 2006

Finished products................................................................................................................................................................................... ¥607,149 ¥502,032 $5,189,308

Work in process and other.............................................................................................................................................................. 249,350 206,030 2,131,196

............................................................................................................................................................................................................................... ¥856,499 ¥708,062 $7,320,504