Nissan 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL SECTION

Nissan Annual Report 2005 73

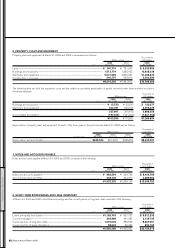

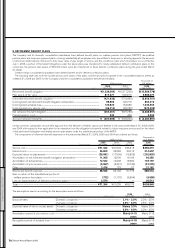

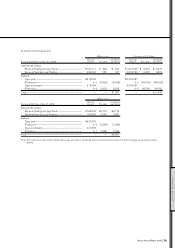

14. RETAINED EARNINGS

Other changes in retained earnings for each of the three years in the period ended March 31, 2006 were as follows:

Thousands of

Millions of yen U.S. dollars

2005 2004 2003 2005

For the years ended Mar. 31, 2006 Mar. 31, 2005 Mar. 31, 2004 Mar. 31, 2006

Adjustments for revaluation of accounts

of consolidated subsidiaries based on

general price-level accounting (Note 1 (b))................................................................................................... ¥ 9,331 ¥12,942 ¥ 9,460 $ 79,752

Loss on disposition of treasury stock.......................................................................................................... (11,507) (4,700) (8,171) (98,350)

Effect of adoption of accounting standard

for retirement benefits by overseas subsidiaries (Note 2 (b)) ........................................................ —— (18,132) —

Decrease due to increase in unfunded retirement benefit

obligation of overseas subsidiaries............................................................................................................. (884) (369) — (7,556)

Adjustments to retained earnings at beginning of

the year for inclusion in or exclusion from consolidation

or the equity method of accounting for subsidiaries

and affiliates, and certain other adjustments...................................................................................... (2,672) 1,104 (4,176) (22,838)

Changes in land revaluation of overseas subsidiaries................................................................... 1,646 2,182 — 14,068

Decrease due to one affiliate’s transition to International

Financial Reporting Standards.......................................................................................................................... (6,004) ——(51,317)

..................................................................................................................................................................................................... ¥(10,090) ¥11,159 ¥(21,019) $(86,241)

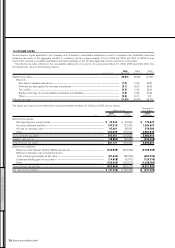

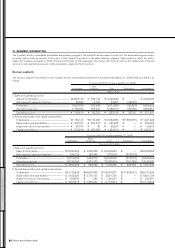

15. SUPPLEMENTARY CASH FLOW INFORMATION

The following is a summary of the assets and liabilities of Calsonic Kansei Corporation and its 11 subsidiaries, which were newly consolidated

following the acquisition of their shares through a private placement during the year ended March 31, 2005:

Millions of yen

2004

For the year ended Mar. 31, 2005

Current assets............................................................................................................................................................................................................................................................................. ¥ 69,926

Fixed assets.................................................................................................................................................................................................................................................................................. 126,242

Total assets................................................................................................................................................................................................................................................................................... ¥196,168

Current liabilities ....................................................................................................................................................................................................................................................................... ¥ (21,146)

Long-term liabilities................................................................................................................................................................................................................................................................ (55,714)

Total liabilities.............................................................................................................................................................................................................................................................................. ¥ (76,860)

The following is a summary of the assets and liabilities of Dongfeng Motor Co., Ltd., which was newly consolidated as a result of the transfer of all

its shares to the Company’s consolidated subsidiary, Nissan China Investment Co., Ltd., during the year ended March 31, 2005:

Millions of yen

2004

For the year ended Mar. 31, 2005

Current assets............................................................................................................................................................................................................................................................................. ¥ 106,744

Fixed assets.................................................................................................................................................................................................................................................................................. 44,094

Total assets................................................................................................................................................................................................................................................................................... ¥ 150,838

Current liabilities ....................................................................................................................................................................................................................................................................... ¥(109,922)

Long-term liabilities................................................................................................................................................................................................................................................................ (22,218)

Total liabilities.............................................................................................................................................................................................................................................................................. ¥(132,140)