Nissan 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2005

20

less globally, although needs vary from country

to country.

That’s why we developed our LCV Pro Shop

concept for Japan, to provide that superior service as

well as custom conversions. We opened two pro

shop hubs in fiscal 2005, in Kanagawa and Tokyo,

and recently another in Miyagi Prefecture. The hub

shops have basically all the services, and support

several satellite or spoke shops. We’ve done the

trials, checked the performance and the problems.

Now we’re ready to deploy the concept elsewhere in

Japan. Later we will export this concept to other

markets: Europe, for instance, will develop a similar

concept by adapting the Pro Shop model to specific

European customer needs. We see two slightly

different customer profiles in Europe, truck buyers

and van/pickup buyers. We’re working on adapting

the Pro Shop model appropriately.

LCV customers are big on conversions, rarely

wanting what comes out of the factory gate. They

want a box and shelving here, or a door there. We’re

having an organization in North America look at

extreme customer usage, such as ambulances and

SWAT team vehicles, to see how we can innovate

based on that—aspects like super-efficient storage,

and getting in and out of the vehicle quickly and

smoothly with lots of equipment.

Did we have this mentality two years ago?

No. We thought like a car company, and car

companies wait for customers to walk through the

door and sell them a product that is standard in

principle. The Pro Shops turn that around,

establishing an infrastructure that supplies exactly

the services the customer needs.

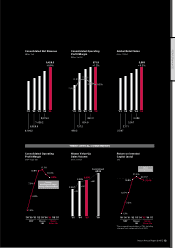

In an overall sense, we follow six strategies, all

linked to that 40 percent increase in volume and

doubling profit. First, renewing our portfolio. Second,

reducing cost and enhancing value for the customer.

Third, entering new territories. Fourth, enhancing the

value chain, because you need the marketing, after-

sales and conversion. Fifth, original equipment

manufacturing or OEM deals. And sixth, taking all the

lessons we’ve learned through this breakthrough and

passing that knowledge on to later generations of

LCV managers.

There are a couple of issues related to OEM

deals. In 2002, we found ourselves in a kind of limbo,

with a portfolio full of products produced by other

makers with our badge on them. Obviously we make

more profit from vehicles we sell, like AD Van and

Civilian, than on vehicles we buy.

Even our most aggressive rollout plans wouldn’t

supply enough volume to sustain the 8 percent

profitability that we want. So we looked for strategic

partners that would provide us additional volumes.

We’ve completed a deal with Renault Trucks in

Europe, cross-badging a new truck with them. They

enter a new segment; we enjoy the added volume.

We’ve signed a similar deal with Mazda for AD Van in

Japan and we are working on other deals.

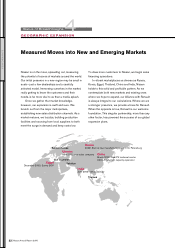

Nissan has advantages in the LCV space. No

LCV competitor can play in every market in every

segment. And fleet managers, some of our key

customers, are taking a global perspective on

sourcing their vehicles. We don’t have global

coverage in every segment yet, but we’ve spent two

years on a plan that is getting us there.

We have an aggressive product-launching plan

for fiscal 2006 and 2007. Fiscal 2006 will benefit

from what we began two years ago as products

come out of the pipeline. We launch one all-new

product in Europe, the Cabstar, and three

significantly changed models. We will also launch

an all-new product in Japan. In fiscal 2007, the

network starts to hum, and we come in with new

products and start with a regional rollout. By fiscal

2007, we plan to cover almost 70 percent of the

world markets.

PERFORMANCE